Last week was fairly buoyant for the Cable as the pair benefitted largely from the general risk aversion surrounding the US dollar. However, despite the recent rally, the pair is now facing a reversal of its gains as today has seen price action decline back towards the long run bearish trend line. Subsequently, the question remains, will the Cable continue to gain or will the BoE’s rate decision see it bearish again.

The Cable had a strong week, finally breaching the long run bearish trend line, as the pair was buoyed by a sentiment swing against the US Dollar. In addition, the UK Manufacturing Production figures came in sharply above estimates at 0.7% m/m. This result over-rode the previously weak UK Industrial Production figures and further buoyed the pair. This confluence of factors enabled the pair to shake off the bearish binds and rise sharply to close the week well up around the 1.4381 mark.

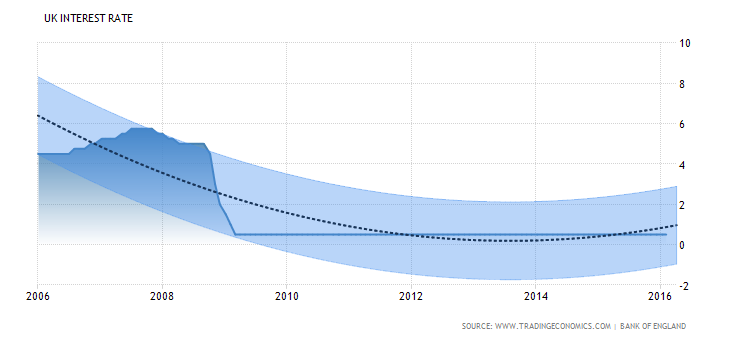

The week ahead is likely to be extremely volatile for the Cable as it faces both a slew of US economic data as well as a critical Bank of England monetary decision. The Bank of England’s decision on the official bank rate is due out on Thursday and most estimates have the central bank holding the rate steady at 0.50%. However, given the ECB’s recent rate cuts, there is added impetus on the BOE to depreciate the currency to stimulate export demand. Subsequently, the MPC meeting should be viewed as live but retains its bias as a “hold steady” event.

From a technical perspective, price action has recently broken through the long run bearish trend line in a signal that further upside moves could be likely. However, the pair now faces some stiff dynamic resistance as the 100-Day moving average starts to decline towards its current level. In addition, RSI is also nearing over-bought territory which could mean a pull back, towards the 1.4250 level, could be on the cards. Subsequently, our bias remains neutral until a retest of support around the broken trend line occurs.Support is currently in place for the pair at 1.4120, 1.3839, and 1.3514. Resistance exists on the upside at 1.4434, 1.4656, and 1.4944.

Ultimately, regardless of our neutral bias, the Cable is likely to see some sharp volatility in the days ahead. Subsequently, monitor any long positions closely as the downside is the probable trend direction in the days ahead.