The Cable has had a relatively positive few weeks as the pair appears to have shrugged off some of the recent BREXIT worries. However, itsprice action has now entered a key reversal point which could see it tumbling back towards the 1.42 handle.

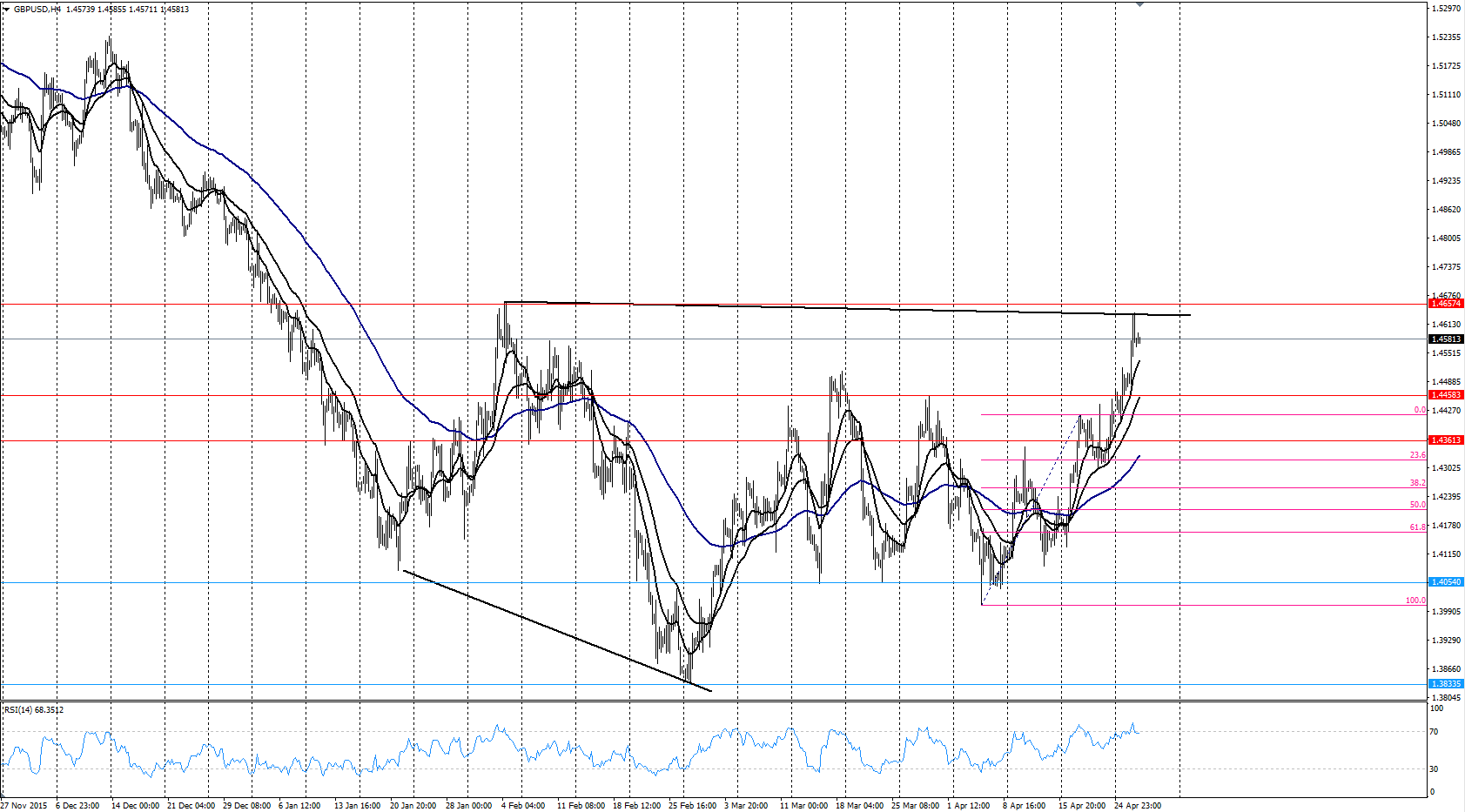

Taking a look at the Cable’s 4-hour chart shows some interesting patterns emerging over the past few days. It would appear that the pair’s recent rally has taken it perilously close to a key reversal point from early February. The failure to breach that point subsequently led to a sharp decline towards support at 1.3835 and it appears as if we are reaching a similar point within this current cycle.

In addition, the technical indicators are also indicating a significant retracement under way given the fact that the latest high at 1.4633 actually completed the ABCD pattern. Subsequently, it is likely that the pair will look to retrace back towards the 38.2% Fibonacci level at 1.4256. Further supporting the short contention is the RSI Oscillator which has now trended into overbought territory indicating that a pullback may be required.

However, there is a fundamental risk event looming on the horizon with the release of the UK Advance GDP figures. The GDP results are largely forecast to come in at 0.4% q/q but there is a unknown risk component within the release. Recent instability within markets caused by BREXIT talk, and the rapid appreciation of the pound, is likely to have impacted the result. Subsequently, watch the outcome closely as it is probable that it will sharply impact the pair.

Ultimately, the Cable can be a difficult currency to trade given the required width of stops and the general volatility of the pair. However, the currency is exhibiting some strong impending signs of a short side retracement which is likely to see it trading at significantly lower valuations. Subsequently, look for the pair to make a move within the coming New York session but watch for any fundamental news releases.