- GBP/USD eases a bit after strong rally

- Technical oscillators move slightly down

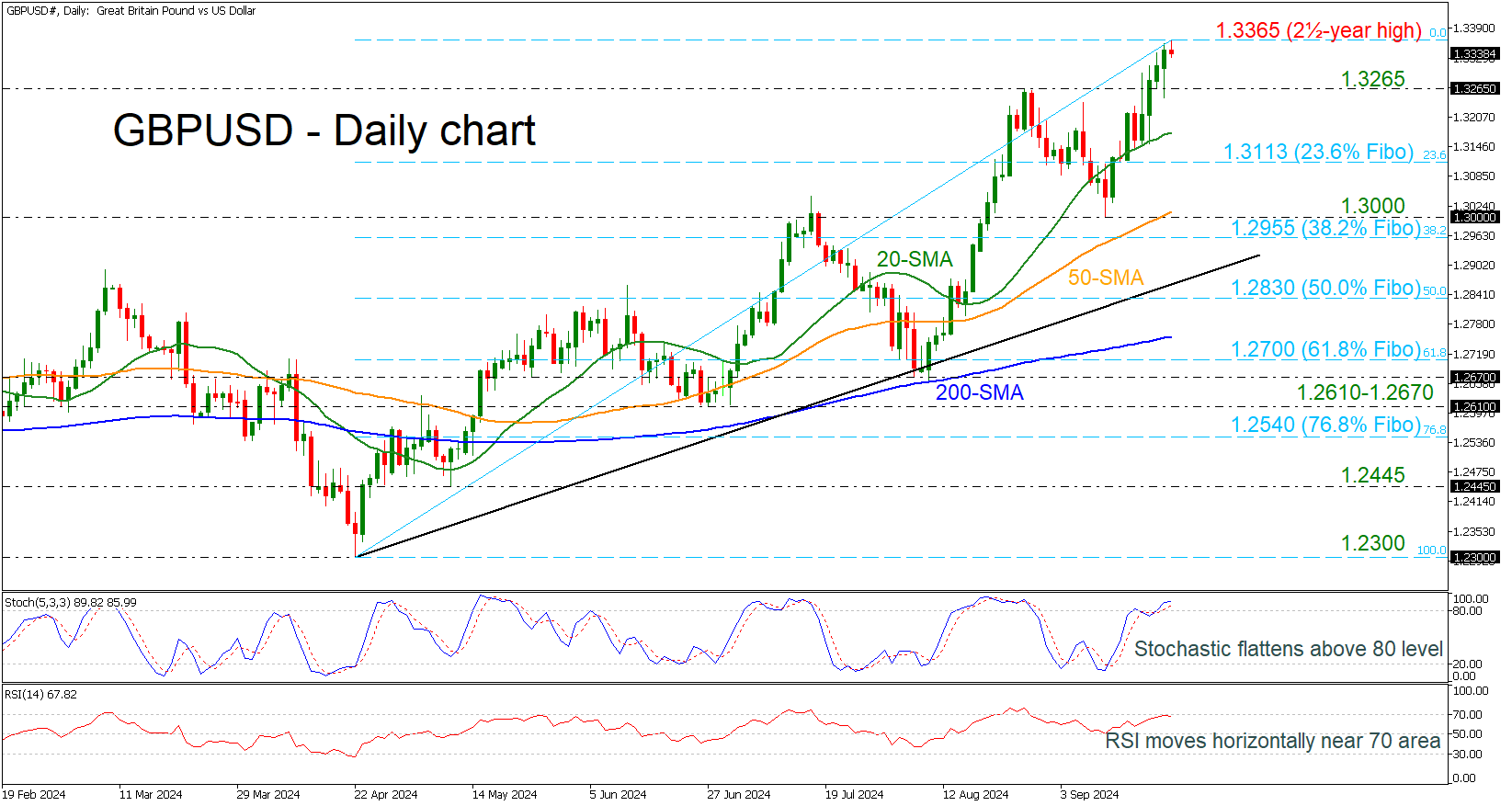

GBP/USD skyrocketed to a fresh two-and-a-half-year high of 1.3365 earlier today, adding almost 3% after the bounce off the 1.3000 round mark. The technical oscillators indicate an overstretched market. The stochastic is turning slightly lower in the overbought territory, while the RSI is pointing down following the pullback at the 70 level. Moreover, the 20-day simple moving average is losing its positive momentum, showing some downside pressure.

If the market retreats, then the pair could open the door for the immediate 1.3265 support level before meeting the 20-day SMA at 1.3170. Moving lower, the 23.6% Fibonacci retracement level of the upward wave from 1.2300 to 1.3365 at 1.3113 could come next before plunging to 1.3000, which coincides with the 50-day SMA.

On the other hand, in case of an upside pressure again, the price could enter the 1.3400 territory ahead of the 1.3640 resistance, achieved back in February 2022.

All in all, GBP/USD has been in a significant bullish tendency since April and only a dive beneath the uptrend line and more importantly below the 200-day SMA may change the current outlook.