GBP/USD is trending lower on Tuesday for a 4th straight session amid dovish BoE expectations, hard Brexit fears and continued coronavirus fears.

The second half of this weeks sees the BoE monetary policy announcement and the date that the UK leaves the EU.

Hard Brexit

Following Boris Johnson’s Brexit Bill’s rapid passing through UK Parliament, the EU Parliament will vote on the bill tomorrow, no surprises are expected. The UK will leave the EU on Friday 31st January. The focus will then shift firmly onto difficult trade talks between the UK and EU. The two sides will have until the end of the year to hammer out a trade deal. Failure to reach an agreement means the UK will endure a hard, no deal Brexit.

The pound will continue to act as a fear gauge of a no deal Brexit. Today the pound is falling in part owing to comments by Chief EU negotiator Michel Barnier that a disorderly Brexit is still an option.

Dovish BoE?

Data has been mixed. Retail sales earlier in the month disappointed, whilst more recently labour market data and PMI’s surprised to the upside, making traders scale back their expectations of a rate cut. The market is pricing in a 50 / 50 probability of rates being slashed on Thursday.

With a 50% chance of a rate cut from BoE coupled with fears of a no deal Brexit the pound is under pressure.

Safe Haven Dollar Looks To Data

The safe haven dollar has found support amid growing concerns over the spread of China’s deadly coronavirus and the potential economic impact of the outbreak on global growth and trade.

With no UK macroeconomic data due today, attention will move to US durable goods orders later today. Expectations are for a rebound in durable goods, increasing 0.9% in December, up from -2.1% decline in November.

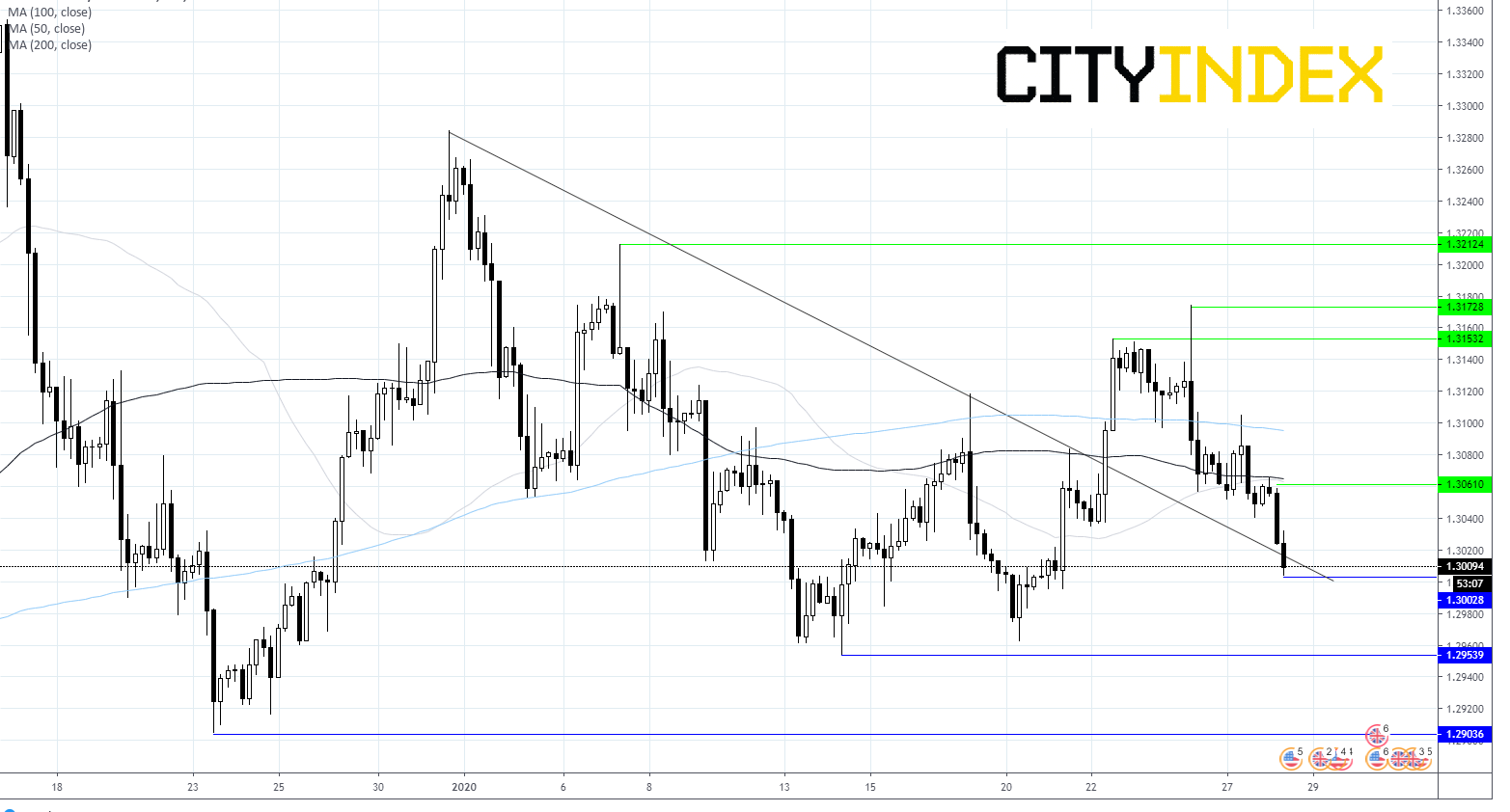

Levels to watch:

A move through the 50 sma this morning has triggered further selling. GBP/USD is testing trend line support. A meaningful break through here and through immediate support at the kept $1.30 psychological level could open the door to support at $1.2950 prior to December low of $1.29.

On the upside a move above $1.3050 could negate the current bearish bias, before an attempt on $1.3150, $1.3170 and $1.3212 (Jan 6th high)