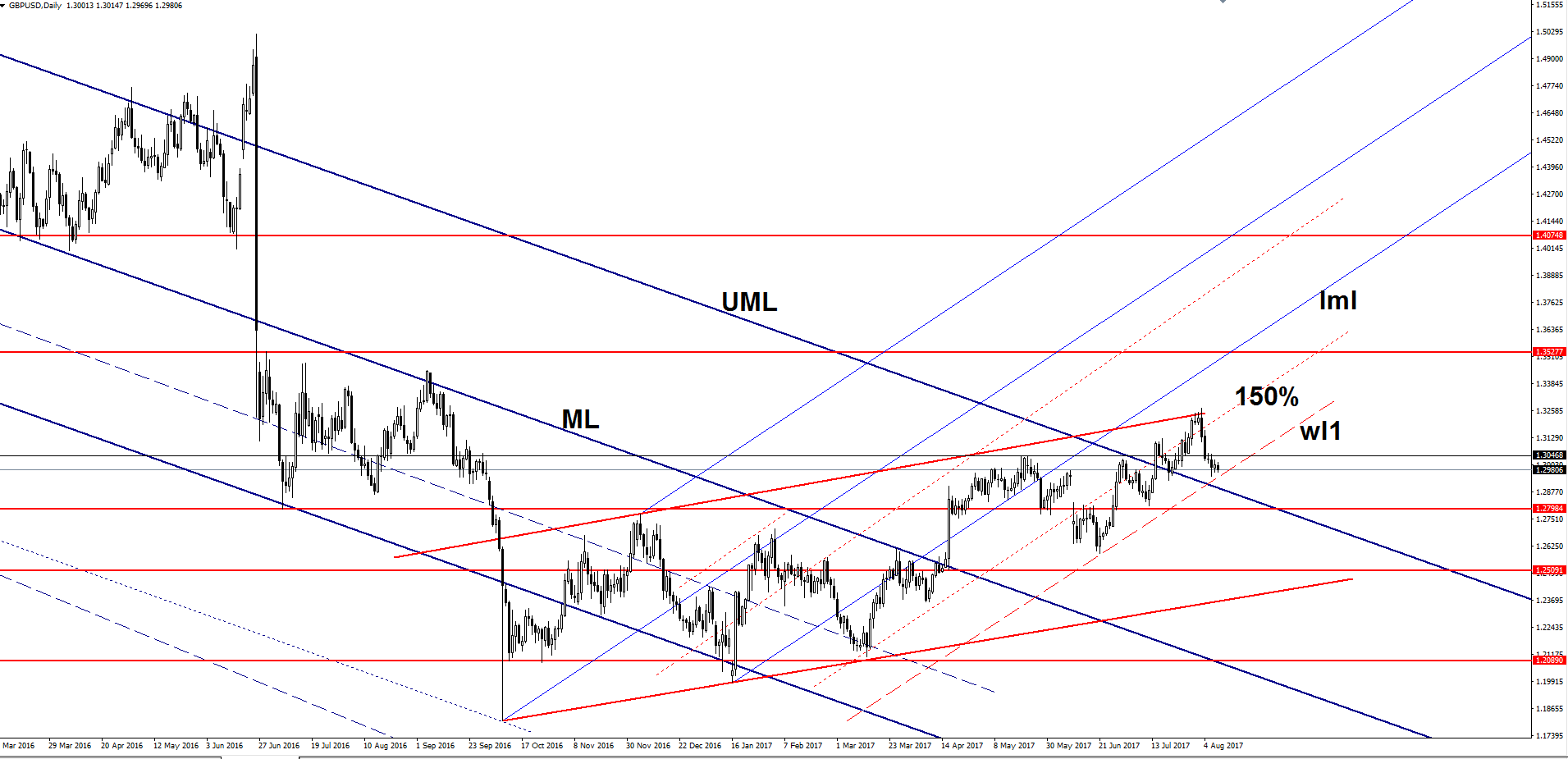

GBP/USD Bounce Or Break?

GBP/USD slides further on the daily chart and is almost to hit another downside target. Is trading in the red as the USD is still supported by the USDX’s increase. The dollar index increased again in the last hours and maybe will try again to take out the 93.81 static resistance. The greenback could dominate the currency market if the USDX will have enough energy to jump and to stabilize above the 94.00 psychological level.

You should pay attention at the fundamental events today because most likely will bring a high volatility, the UK’s Manufacturing Production may increase by 0.0% versus the 0.2% drop in May, the Goods Trade Balance may decrease from -11.9B to -11.0B. Moreover, the Construction Output could increase by 1.4% in June after the 1.2% drop in the previous reading period, the Industrial Production is expected to increase by 0.1%, so the Cable could be saved by the economic figures.

The United States could bring a high volatility in the afternoon, only some good data will boost the greenback.

Price is very close to reach and retest the first warning line (wl1) of the minor ascending pitchfork. Personally, I believe that a will breakdown if will touch it, but we have to be patient to see what will happen because we may have a false breakout as well.

The perspective remains bullish as long as the warning line (wl1) is unharmed. I want to remind you that the minor decrease was expected after the false breakout above the up sloping red line and after the failure to approach and reach the lower median line of the minor ascending pitchfork and the 1.3527 major static resistance.

We may have a Rising Wedge pattern on the Daily chart, a breakdown below the warning line and below the UML will confirm it.

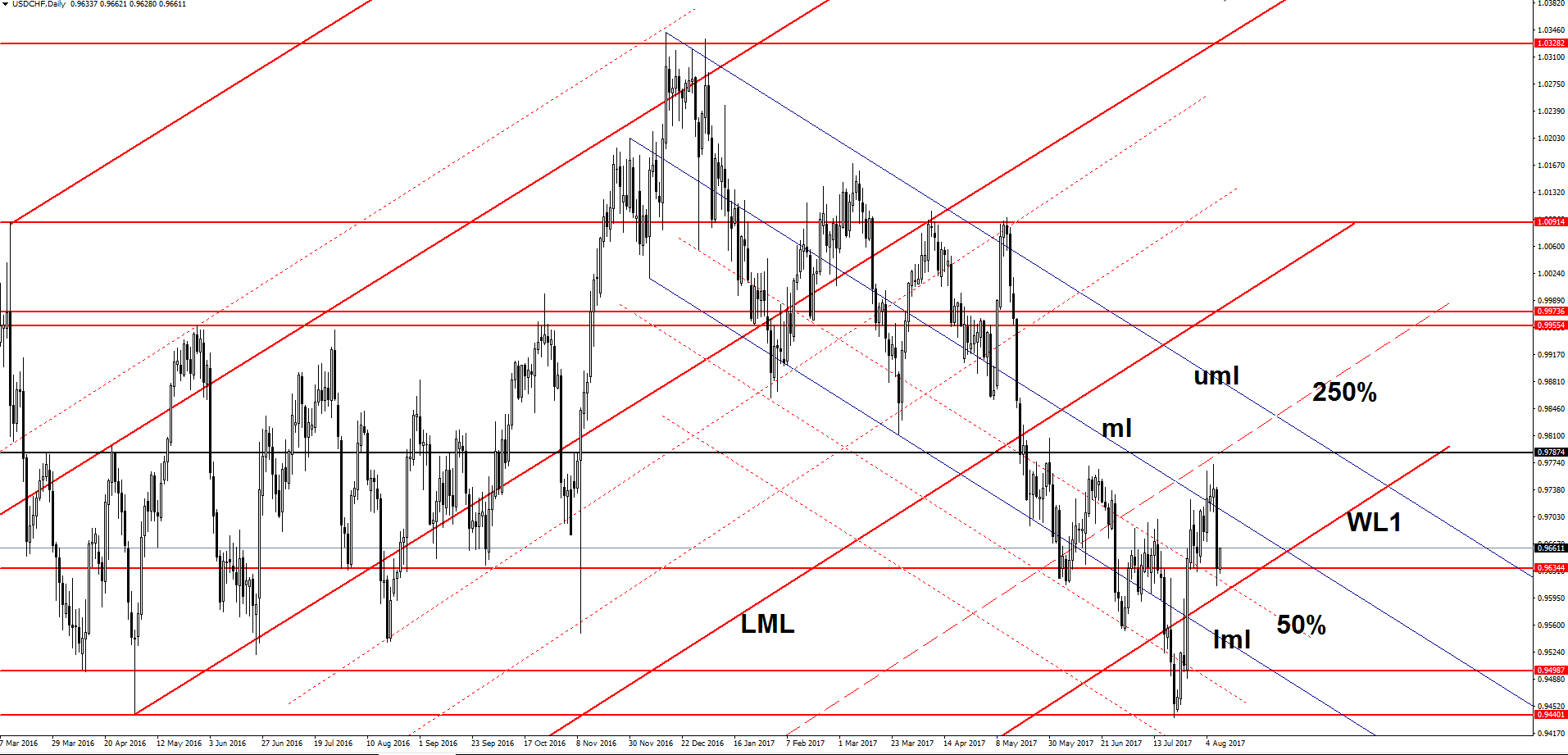

USD/CHF Downside Paused

USD/CHF rebounded from the 0.9634 static support, a minor consolidation above this level will bring another bullish momentum. Could come to retest the first warning line (WL1) before will climb higher again. You should know that only a valid breakout above the median line (ml) of the minor descending pitchfork will confirm a larger rebound.

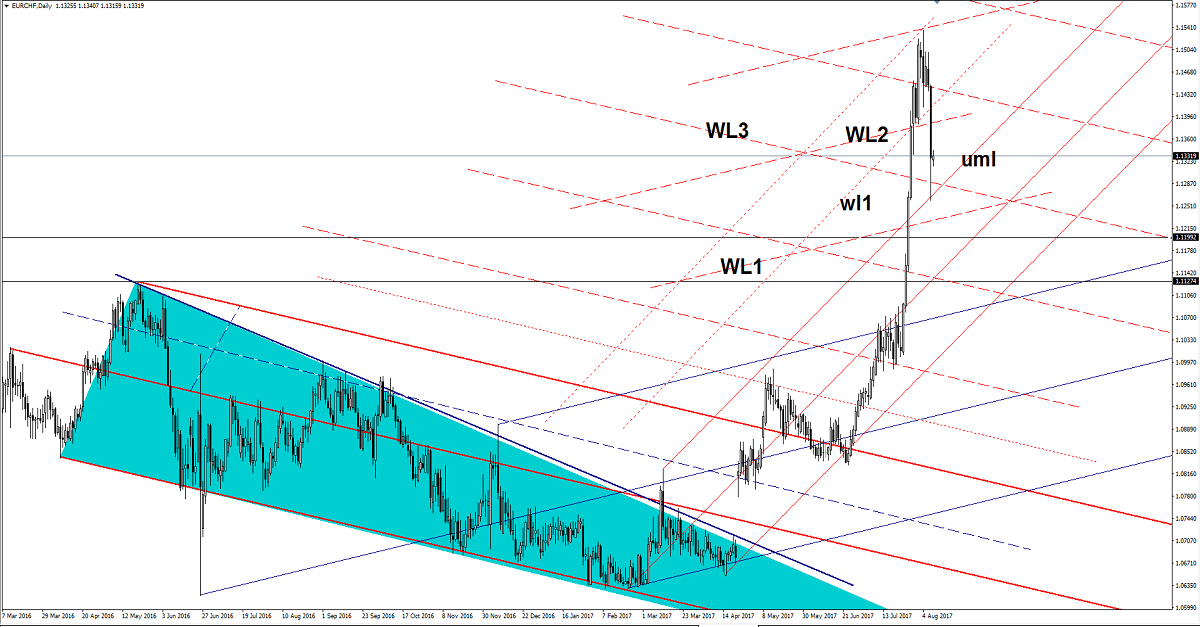

EUR/CHF Is The Retreat Completed?

EUR/CHF plunged in the yesterday’s session and touched the upper median line (uml) of the minor ascending pitchfork. Has closed much above the mentioned support level and above the third warning line (WL3) of the former descending pitchfork. Personally, I still believe that will come down to test and retest the confluence area formed at the intersection between the WL3 with the upper median line (wl1), only a rejection will signal a rebound.

Risk Disclaimer: Trading in general is very risky and is not suited for everyone. There is always a chance of losing some or all of your initial investment/deposit, so do not invest money you can’t afford to lose. You are strongly advised to carry out your independent research before making any trading decisions. All the analysis, market reports posted on this site are only educational and do not constitute an investment advice or recommendation to open or close positions on international financial markets. The author is not responsible for any loss of profit or damage which may arise from transactions made based on any information on this web site.