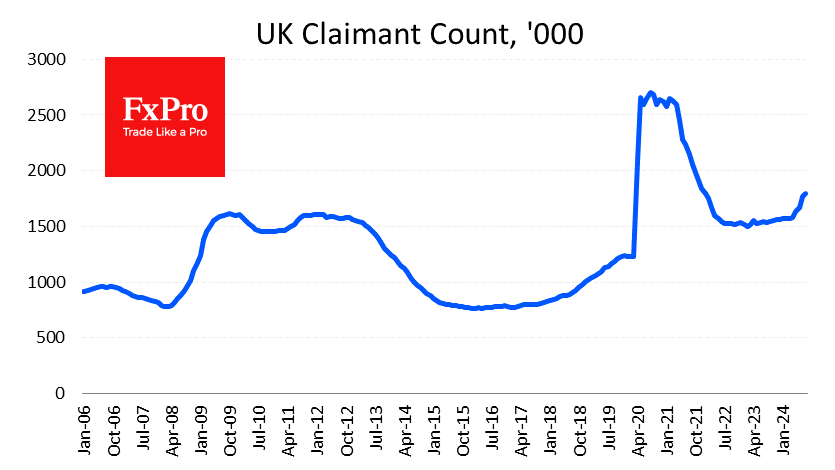

In the UK, jobless claims rose by 23.7K in August, much better than the 95.5K expected and the 102.3K rise in the previous month. This is relatively positive data as it suggests that the rate of deterioration in the UK labor market is slowing.

However, this is still the fastest claims growth since the unemployment spike in 2020 and the 2008 financial crisis.

At the same time, wage growth continues to slow, rising by 4% year on year in the three months to July. This is a sharp slowdown from 4.6% in the previous month and 5.7% two months ago, although wage growth is still above inflation at 2.2% year-on-year.

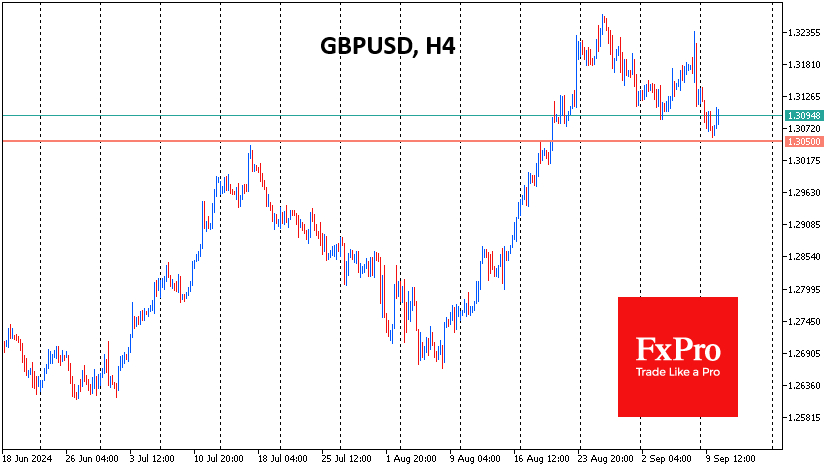

The data did not change the expectations of market analysts, who still do not expect a rate change next week but are forecasting a rate cut in November. The employment data temporarily supported the Pound as speculators played up the positive gap between expectations and reality. GBP/USD found support on Tuesday on the drop to the 1.3050 level, which looks like a bullish attempt to end the corrective pullback and take the Pound into a new round of growth.

While it is wise to wait for tomorrow's UK CPI figures, which will be released on Wednesday morning, the main movement may be delayed until similar statistics are released from the US. For now, we can only compare labor market figures, and the US figures look stronger. This gives the Bank of England a greater degree of urgency to ease policy than the US, creating bearish risks for GBP/USD.

The FxPro Analyst Team