The week between Christmas and New Years Eve is not usually the best time to trade. Especially for the traders looking for high volatility, but it definitely has some advantages. The most important one for me is the fact that the macro calendar is almost empty and movements on the market are mostly technical and are not interfered by surprises from the fundamental analysis.

That being said, lets check the situation on the Cable, which from the beginning of December is very bearish. Although in that time, price already declined over 500 pips, we still have a potential for more. To be precise, we still should see at least 140 pips decline, which makes it a good mid-term opportunity. Why we say that the GBP should go down against the USD?

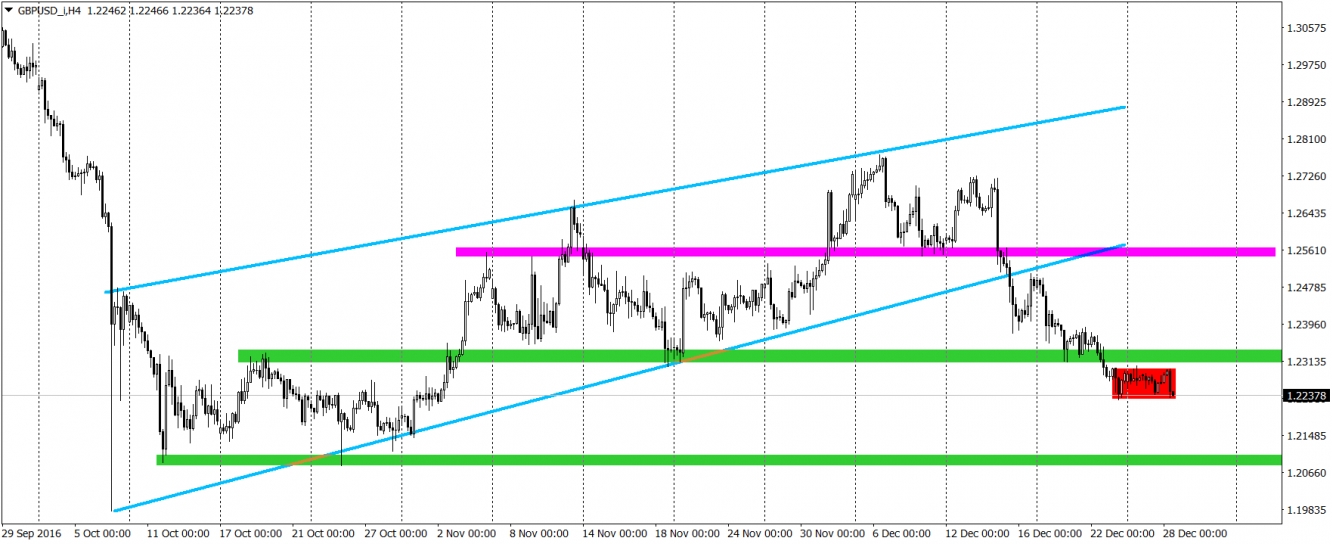

First of all – the trend. Always stick to the trend. Another thing is the bullish correction (flag-blue lines) seen lately, We broke the lower line of the flag, which ends the bullish retracement and technically forces the price to go lower. What is more, on the way here, we broke two horizontal supports 1.255 and 1.233, which shows that current demand for the sterling is weak.

Now, the price created a rectangle below 1.233 (red area). Rectangle is a trend continuation pattern, so technically we should expect a bearish breakout here and a further downswing. Fall should reach the long-term support from October around the psychological barrier on 1.21 and to this place we have those 140 pips mentioned above. Most factors are showing us that the price should decline.

Even if you do not believe in Brexit (like me) you cannot argue with the technical analysis here. Maybe in the long-term, sterling will rebound but for now, it looks like we should see it lower.