UK inflation beat expectations and accelerated markedly, but this only temporarily boosted the GBP/USD. The pair came under further selling when it broke above 1.2700.

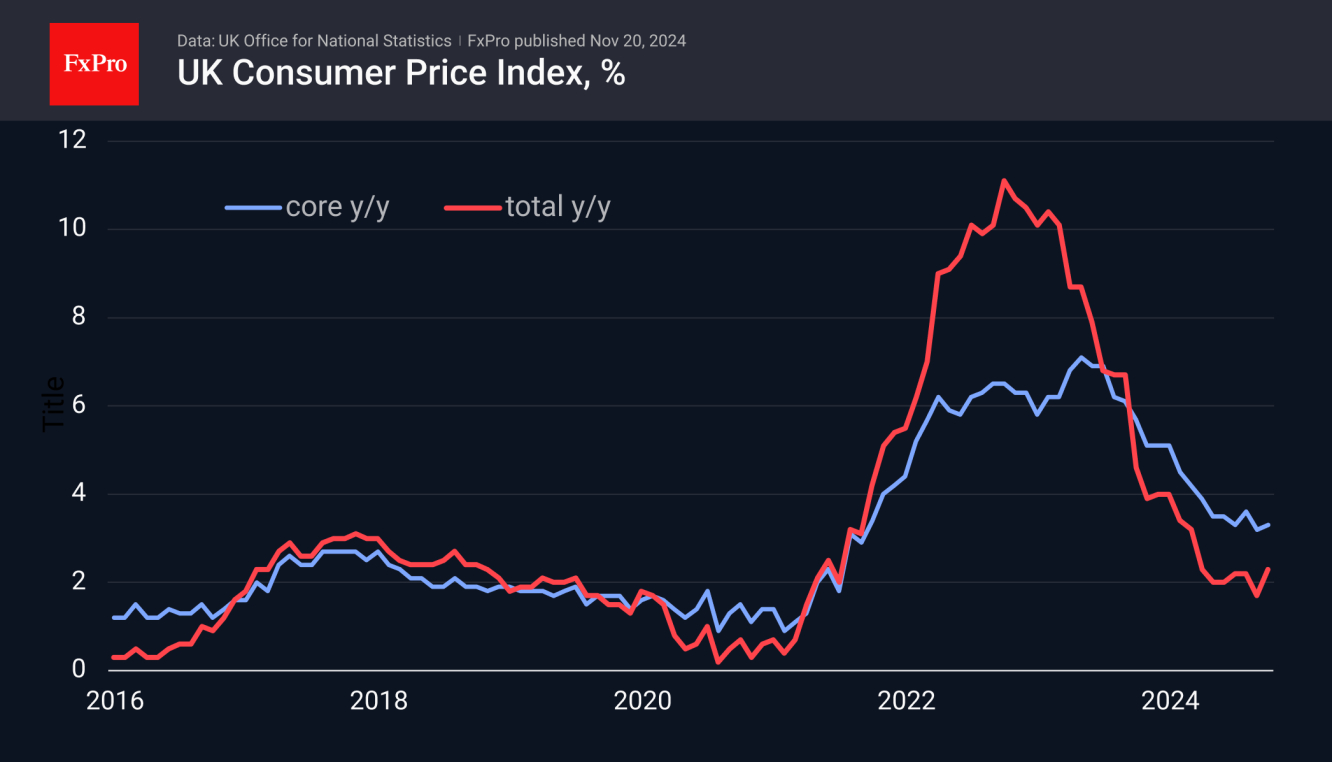

CPI rose 0.6% in October, and annual inflation accelerated from 1.7% to 2.3%, the highest since March. These fluctuations around the target do not yet look like a significant threat of a second wave of inflation. Therefore, they are unlikely to force the Bank of England to revise its monetary easing plans significantly.

The jump in the overall price is due to the largest annual rate increase in owner-occupiers' housing costs since 1992. Technically, this is not a one-off factor that promises to spread through the economy in the coming months. It is not the result of an overheating economy, so it makes no sense to talk about the formation of a sustained inflationary spiral.

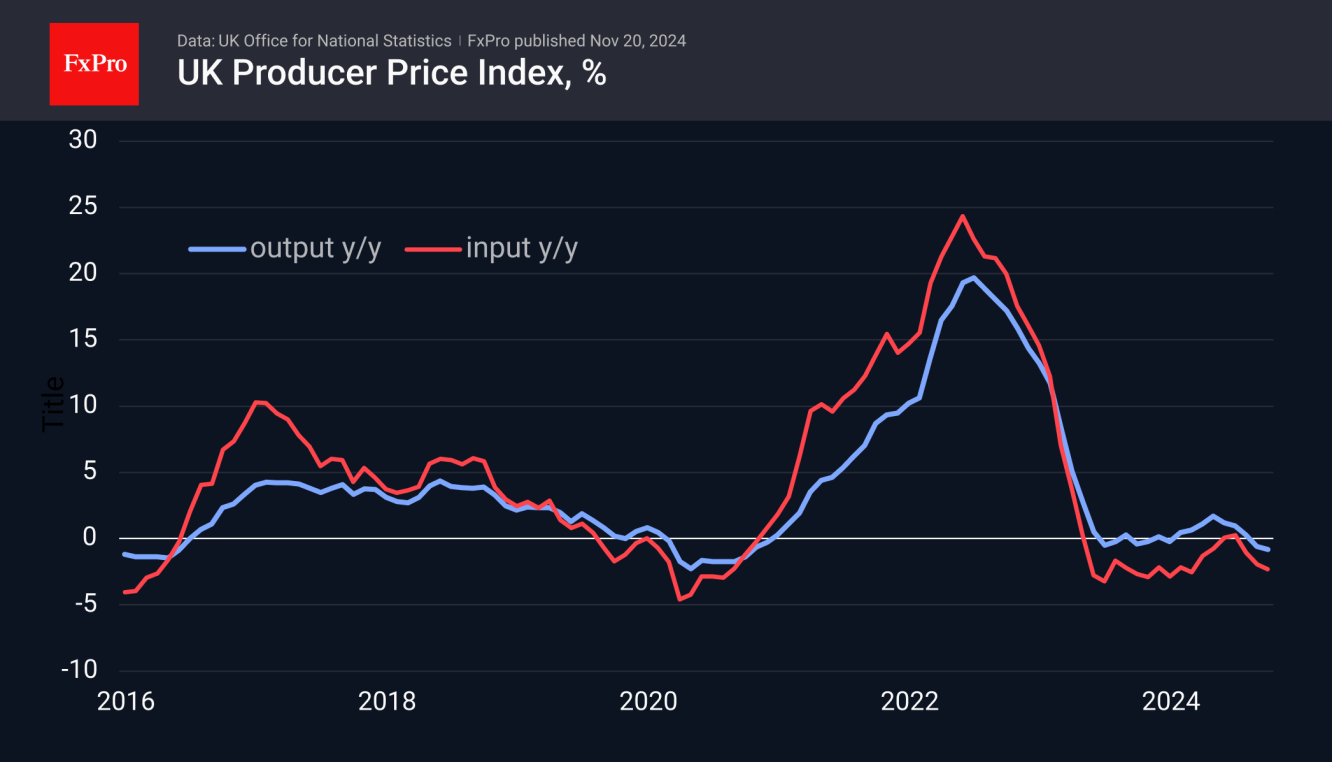

The leading indicator of inflation - producer prices - also came in above expectations. Most importantly, they stay below last year's levels. The Input Producer Price Index fell 2.3% year-on-year in October, compared with 1.9% in the previous month. The Output PPI accelerated its decline to -0.8% from -0.6%. Although both indices are well above estimates (-3.0% and -1.0% respectively), they are still disinflationary.

Technical analysis

The British Pound surged impulsively on the better-than-expected news, but the rally lost steam after touching the 1.2700 level. The pair's rally at the end of last week came to a halt at this level, making it a short-term resistance. This failure to leap forward after the positive news could signal the end of the corrective consolidation. Confirmation of this bearish outlook will come with a fresh failure below 1.26 and a potential target near 1.23, which coincides with this year's lows.

The FxPro Analyst Team