In late July, the dynamics of the GBP/USD will be determined by the factors external for Britain.

Investors like to see historical parallels. To some, the current alignment of forces on the British pound market is reminiscent of the April events, when a portion of the disappointing macroeconomic statistics of the Foggy Albion forced the Bank of England to abandon the idea of raising the REPO rate at the May meeting that pushed the sterling from the cliff. Someone remembers the events of late 2015, when the unfavorable external background shifted the start of the monetary policy normalization by the Fed from September to December. Indeed, Britain lives in conditions of political uncertainty, which is reflected in the economy and in the monetary policy of the central bank.

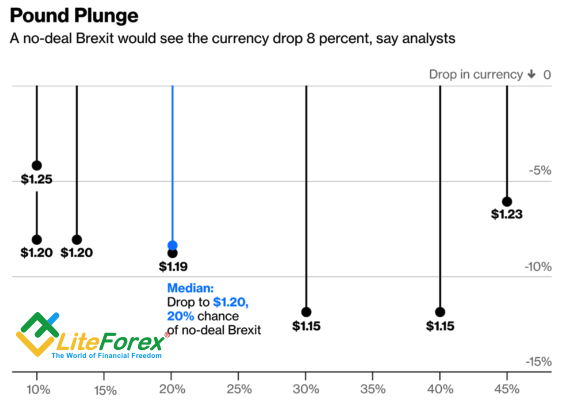

The disagreements within the conservative party on Brexit, Brussels's appeal to European companies about the need to prepare for the release of the Foggy Albion from the European Union without the agreed terms, the weakness of inflation and retail sales, as expected, pushed the GBP/USD quotes below the psychologically important 1.3 mark for the first time since September 2017. According to Commerzbank (DE:CBKG), the market was not ready for a political catastrophe, and in the case of a hard Brexit, sterling could fall to $1.12. According to the median estimate of Bloomberg experts, the refusal to strike the deal will drop the pair to 1.2. At the same time, Mizuho Bank and MUFG believe that the consequences can be much worse (1,15).

The pound's reaction to no deal between London and Brussels

Source: Bloomberg.

Investors prefer to hedge the pessimistic scenarios using options: three- and one-month reversal risks (the difference in premiums between call and put options) are traded near the lowest levels since June 2017.

Despite the political crisis and the disappointing statistics, the GBP/USD bulls found the strength to return the quotes of the pair above the base of the 31st figure. They have Donald Trump and the Bank of England to thank for this. The US president unleashed a currency war by criticizing the Fed for tightening monetary policy and China for manipulating the yuan. As a result, rumors grew on the market that the Federal Reserve could limit itself to three increases in the federal funds rate in 2018 instead of four, which makes hedge funds and other speculators close their long positions in the greenback. As for the BoE, the weakness of inflation and retail sales reduced the probability of the August monetary restriction from only 82% to 66%. The market, still believes in the repo rate raise at the next MPC meeting.

No significant statistics in the economic calendar of Britain, the readiness of the Parliament for the summer holidays and the traditional silence of the members of the BoE Monetary Policy Committee on the eve of the August meeting make the pound dependent on external factors. In this respect, the initiators of the fluctuations in the GBP/USD and EUR/GBP will be the releases of data on business activity and US GDP, as well as the results of the ECB meeting. The belief of investors in the acceleration of the American economy to 4% q / q and higher in the second quarter, most likely, negates the factor of verbal intervention. In this regard, I expect the pound to form a short-term consolidation in the range of 1.3-1.33.