- UK 10-year government bond yield surges to a 15-year high

- US 10-year real yields approach 14-year high

- Dollar was also lower on rebounding yen and yuan

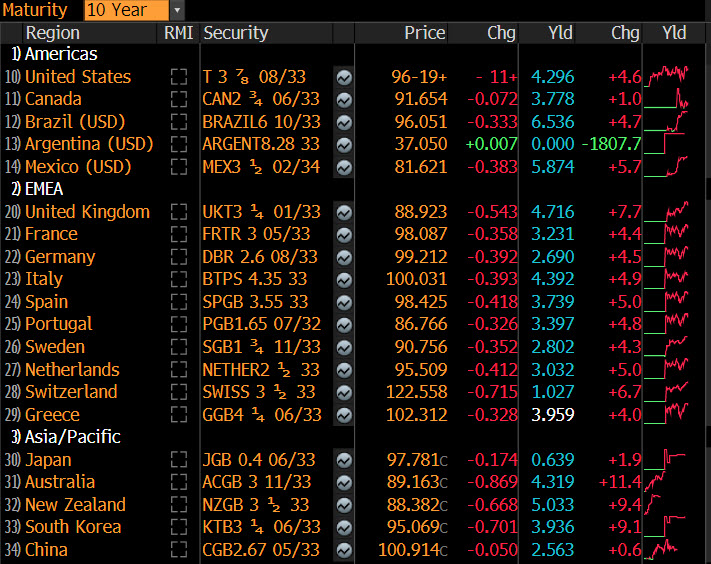

The British pound is still rallying from the latest inflation that suggests sticky core inflation will keep the BOE in tightening mode. With the global bond market selloff being the dominant theme on Wall Street, traders are noticing Gilt yields are standing out. With FX traders pricing in three more rate hikes by the BOE, it seems that could be the trigger to allow the pound to continue its rebound. Today’s benchmark United Kingdom 10-Year bond yield rose 7.7 bps to 4.716%, the highest levels since August 2008. If we see a further vicious cycle here with Gilt yields, this will suggest BOE rate hike wagers are not cooling.

Source: Bloomberg

The GBP/USD daily chart is displaying a Dragonfly doji pattern has identified a bullish reversal that is currently respecting the 50-day SMA. Price action is also tentatively breaking above the downward sloping trendline that has been in place since mid-July. If bullishness remains intact, further upside could target the 1.2825 level, followed by the 1.2920 region. The psychological 1.30 level could remain an elusive target as expectations remain for the US economy to outperform most advanced economies.