GBP/USD bulls are not encouraged by the positive.

At the time of referendum about the UK membership in the EU, Brexit supporters were calling for abandoning the slow, pressed by political problems and debts, euro-area economy. Independence would guarantee the UK prosperity in future. A year and a half later, the UK GDP is expanding slower than European and messy Brexit looks more dangerous than Italian political crisis. Based on the draft deal with the EU, suggested by Theresa May, London is going to become Brussels retainer. So, the phrase “time will tell” turns out to be right.

When the situation is determined by politics, the GBP value is no longer the index of the UK economy state. It rather outlines what could be the outlook of the British economy in future. Bloomberg experts’ consensus forecasts suggest if the British Parliament blocks the EU deal, GBP/USD may drop down to 1.2. BNY Mellon believes the pound could be falling down as low as $1.1. UBS Wealth Management, on the contrary, suggests its clients buy out the falling prices. The sterling will hardly drop deeper than $1.2, and big buyers are likely to enter at this level, as from a fundamental point of view, the GBP rate is far undervalued.

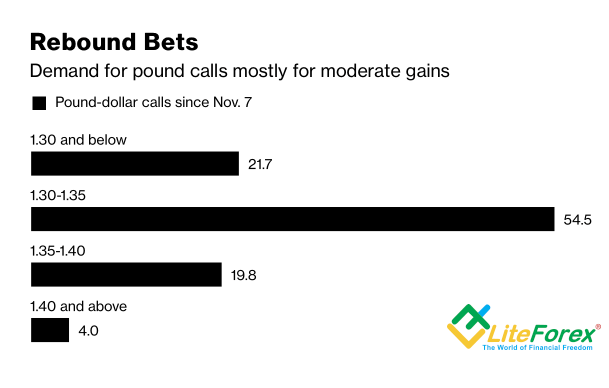

Bulls, like Mizuho Bank and Goldman Sachs (NYSE:GS), are confident in Theresa May’s victory, so that GBP/USD will be soon back at 1.3. According to Rabobank, the ratification of Brexit deal at the end of the week, ending November 23, will provide the pound with a temporary support; and next, provided the document is approved by the parliament, it should surge up to $1.4. It is remarkable that, according to the pound options trades, investor do not expect soon rise of the GBP/USD above 1.3-1.35.

Source: Bloomberg

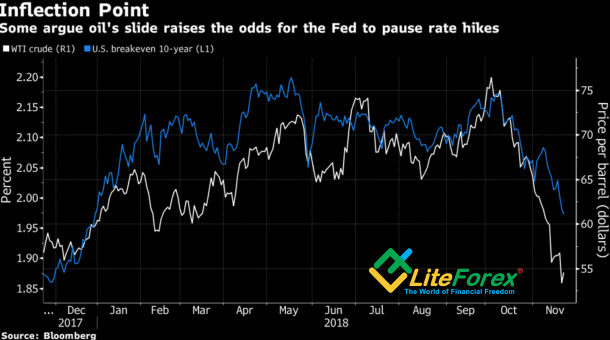

In general, the sterling hasn’t been responding to any positive throughout November. The news about striking a deal with the EU, its approval by the UK parliament, Theresa May’s opponents’ failure in collecting 48 votes, necessary for a non-confidence motion against the Prime Minister. All of this hasn’t encouraged the GBP/USD bulls. Considering the fact that the U.S. dollar is being sold off amid the concerns about slower normalizing of the Fed’s monetary policy, the pound hasn’t suffered so much. TD Securities suggests that USD rally has come to an end because of...bearish trend in the oil market. In this environment, investor are about to believe in a global economy’s decline and are buying out the U.S. Treasuries. The Treasury yield is flying down, followed by the greenback.

Source: Bloomberg

In my opinion, the ratification of the UK withdrawal agreement will support the pound a little. No ratification will press the GBP deeper. I don’t think the British Parliament to be willing to vote for softer Brexit conditions than currently. Therefore, messy Brexit is getting more real, suggesting a snap election and another referendum. If so, the GBP/USD bears will easily break through the support at 1.27, drawing the pair to new lows.