No deal between UK and EU may knock GBP/USD down to 1.2.

Bad luck never comes alone. No-deal Brexit is not a single political risk for GBP. The Labour party suggests the second referendum on the UK’s membership of the European Union. The Britain's opposition party expressed the willingness to vote against Theresa May’s Brexit plan; even if it is completely changed, the Conservative party won’t necessarily approve it. This fact worsens already tense political situation in the UK, sending GBP/USD down to the bottom of figure 29. After all, the steady rise of the U.S. dollar also makes a contribution.

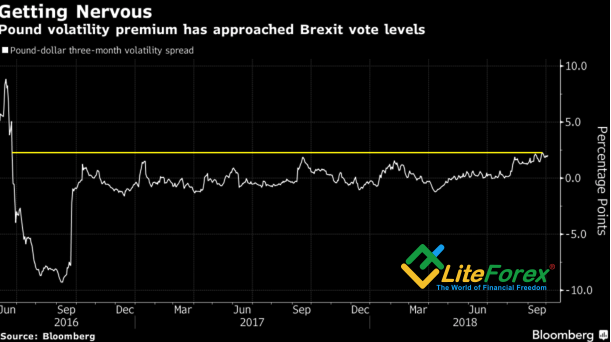

Sterling didn’t responded so much after May maintained her leadership as a result of Tory meeting. Previously, the GBP used to drop in response to the Prime Minister’s speeches about hard Brexit in 2016, towards its record low since 1985; and to its monthly low, responding to the rumours about her possible resignation in 2017. This time, the head of the government expressed her confidence that the deal would be reached, though, again repeating that a bad deal would be worse than no deal. Increasing risks of no-deal Brexit result in the widest gap between the implicit and the actual volatility since the referendum in 2016. According to Commerzbank (DE:CBKG), this fact suggests a significant drop in GBP rate if the negative scenario is implemented.

Dynamics of pound-dollar volatility spread

Source: Bloomberg

Bloomberg experts’ median forecast suggests that, if the UK and the EU fail to strike a deal, the sterling will tank as low as $1.15.The chances of it are up at 23% in the October poll, compared to 20% probability in July. In fact, it is not so much to change the experts’ bullish forecasts; especially since the second referendum will grow much more likely if the deal hasn’t been reached. Reuters respondents expect GBP/USD to hit the levels of 1.33 and 1.37 in six and twelve months respectively.

I still suggest that, if UK’s political situation improves, the GBP/USD long-term uptrend will recover, though the pound will be still under a pressure in the short-term. After a series of positive macro-economic data, the expected increase in the Bank Rate is shifted to May,2019. It can well turn out that the index will be up at 1.25% before the end of 2019. Besides, no deal between London and Brussels won’t necessarily result in the easing of the UK monetary policy. Increasing inflation rate will make the Bank of England tighten it.

It stands to reason that the strong U.S. dollar positions must be mentioned in the GBP/USD analysis. The U.S.-Canada trade conflict has been settled down, the U.S. PMI is up, Jerome Powell sounds hawkish; and so, the greenback is steadily climbing up. But you should remember about political risks ahead the U.S. midterm election. In my opinion, if the sterling bulls drive GBP above $1.3065, the uptrend be more likely to restore.