Britain is ready to show its hand at the EU summit

Haste makes waste or the winner takes it all? Which motto should one follow when opening positions in the British pound? Danske Bank believes that until political risks fade, it's too early to talk about a large-scale offensive of the sterling. Despite the optimism about the outcome of the EU summit in Salzburg, Morgan Stanley (NYSE:MS) is wary of shorts in the EUR/GBP. If you buy the pound, buy it against the Australian dollar, which is vulnerable to trade wars. On the other hand, a currency grows fastest on Forex when the start of tightening of monetary policy approaches. This is exactly what is going on in the Foggy Albion.

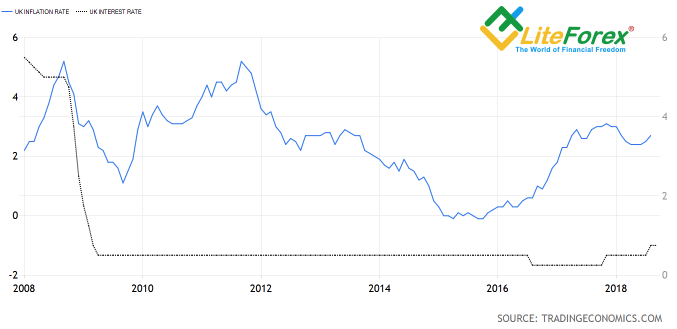

At its September meeting, the Bank of England put everything in order. Inflation is slowing down in the direction of the target at 2%, however, in the second half of 2019, due to the growing consumer demand, the normalization cycle will continue. After such comments, the market was comfortable enough with the forecast of the REPO rate raise in November of the following year and closely watched the political upheavals. However, the BoE scheme began to fail in a week (!) after the MPC meeting. In August, consumer prices jumped to a six-month high of 2.7%, and the question is in the air: if the economy feels much better than what the central bank thinks about it, maybe one should not pull the cat by the tail? The terms of the next act of monetary restriction shifted from November to August 2019, and the pair GBP/USD finally reached the mark of 1.32 announced in the previous materials.

Dynamics Of British inflation And Repurchase Rates

Source: Trading Economics.

The joy of the bulls was short-lived: the pound received a blow from The Times. The tabloid reported that Theresa May is going to reject Michel Barnier's proposal on the Irish border and address the EU directly at the summit in Austria. It seems that the British prime minister blames a certain person for the troubles of the Foggy Albion. No man - no problem? Given the fact that Brexit's secretary Dominique Raab called the meeting in Salzburg a key milestone in the relationship between London and Brussels, it can be assumed that there is no smoke without fire. His predecessor, David Davis, argues that the parties will once again face a wall of misunderstanding, which, however, will soften the EU's position.

Thus, sterling is stuck between the economy and politics. A positive effect the acceleration of GDP and average salaries in May-July was supplemented by inflation and retail sales. The latter indicator instead of deceleration by -0.2% m / m, as expected by Bloomberg experts, rose by 0.3%. It seems that consumer demand is not going to wait for the end of 2019, which increases the risks of continuing the cycle of normalizing the monetary policy by the BoE in the first half of next year. If Brexit's weights were not tied to the feet of the pound, it could become the most promising currency of the G10. For now, we need to bet on the results of the Austrian summit. A breakthrough in the negotiations will allow the GBP/USD to continue the rally in the direction of 1.34-1.35, but a failure will increase the risk of the pair returning to the base of the 30th figure.