Only concerns about mass GBP/USD sales can force the Bank of England to increase its Official Bank Rate

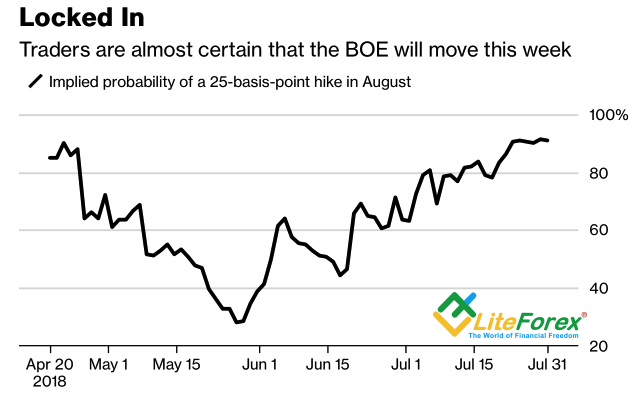

Ahead perhaps the historical meeting of Bank of England, there is quite interesting situation in the market. The financial regulator can afford to avoid increasing its interest rate, but the market is entirely convinced that it is going to continue monetary normalization. The derivatives suggest 90% probability that the BoE will hike its official bank rate up to o.75% from 0.5%. 83% of the respondents, interviewed by Bloomberg, agree with it. The matter is that neither foreign environment nor domestic statistics provide strong arguments for the further monetary restriction. BoE can do it only because of its fears of GBP price drop.

Dynamics of the probability of BoE interest rate increase in August

Source: Bloomberg.

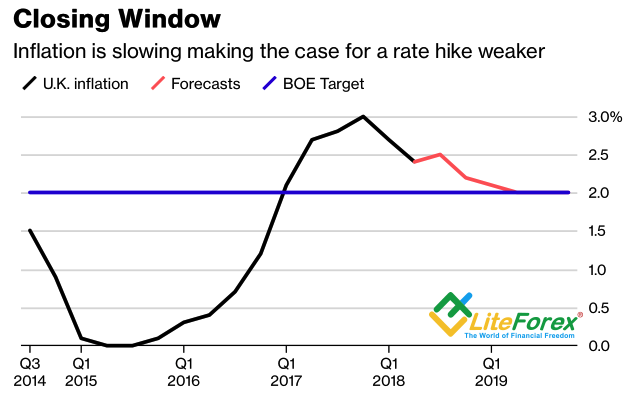

The consensus forecast suggests that the Monetary Policy Committee will decide on 25-basis-point hike by seven votes against two. BBVA and Mizuho Bank expect a split (5 to 4), which can trigger GPB/USD crash. What are the MPC hawks based on? The lowest unemployment rate for over four decades? It has been low for a long time. Increase in average wages growth by 2.7%? But the last polls prove that for the most employees, it is about 2%; while those, who often change employers, get +10%. The BoE’s hopes for the UK GDP recovery from +0.2% Q-o-Q up to +0.4% Q-o-Q in the second quarter? But the ECB was expecting the same, and had to actually hide the head in the sand. Concerns about uncontrollable inflation growth? But the CPI, on the contrary, slows down.

Dynamics of U.K. inflation

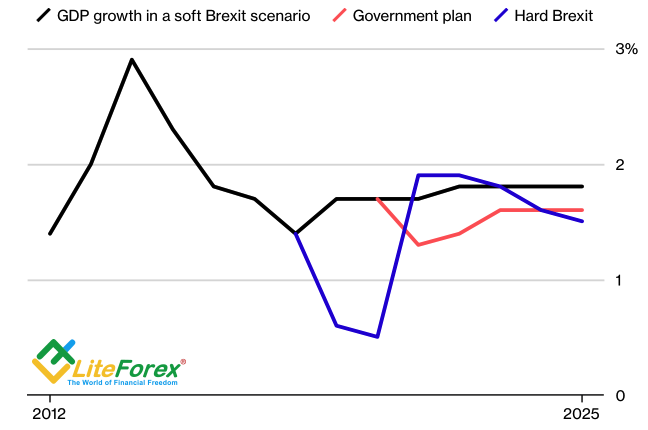

Yes, there are certain risks of insufficient means to manage the global economic recession, led by the USA. The current BoE interest rate will hardly be of any help in this case. Ahead the crisis of 2008, the Official Bank Rate was 5%, it could be lowered. Now, the situation is different. London is under the pressure of Brexit, and The National Institute of Economic and Social Research strongly suggests the BoE should use the terms, which imply both restricting and normalizing its monetary policy. It needs to link the U.K. economy’s expansion to the BoE interest rate decision.

Scenarios for U.K. economic development

So, the Bank of England doesn’t need to hurry. The British media, referring to Mark Carney's hopes to see normal interest rate during his life, note ironically that the BoE governor is just 53. Is there any point in restricting the monetary policy too soon?

Nevertheless, you must understand that, if the U.K. central bank leaves the rate the same, it will face mass GPB sales towards $1.27-1.28, followed by higher risks of inflation growth. Maybe, it is better to increase the rate and feature dovish rhetoric? Especially since the derivative market doesn’t expect another monetary restriction before September, 2019. If so, I expect GBP/USD quotes to go down towards 1.292-1.297; and the GBPUSD future depends on the U.S. employment report.