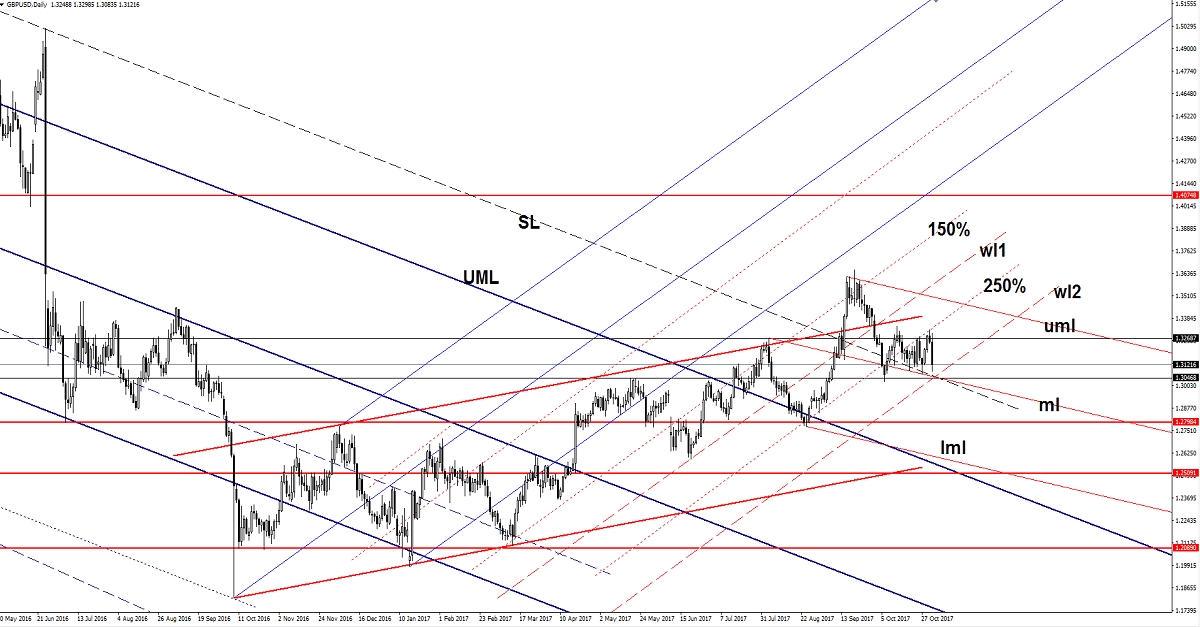

GBP/USD dropped sharply on the BoE rate hike and has resumed Wednesday's bearish candle. The pair is eyeing a strong confluence area. Price moves are in range on the short term. Cable plunged even as Bank of England decided to hike the interest rate from 0.25% to 0.50%. The Official Bank Rate was finally increased, the MPC members have voted by a majority of 7 to 2 for this decision, more versus the 6 to 3 estimate. The Asset Purchase Facility remained steady at 435B, matching expectations. The pair dropped also because the USD received support from the United States unemployment claims, the indicator was reported at 229K jobs in the previous week, much below the 235K in the former week.

The rate has found resistance at the 250% Fibonacci line and failed to stay above the 1.3268 static resistance. Right now is almost to reach the major confluence formed between the second warning line (wl2) with the sliding line (SL) and with the median line (ml) of the minor descending pitchfork. We'll see how will react when will hit this level, a valid breakdown will accelerate the sell-off, this is the most anticipated scenario.

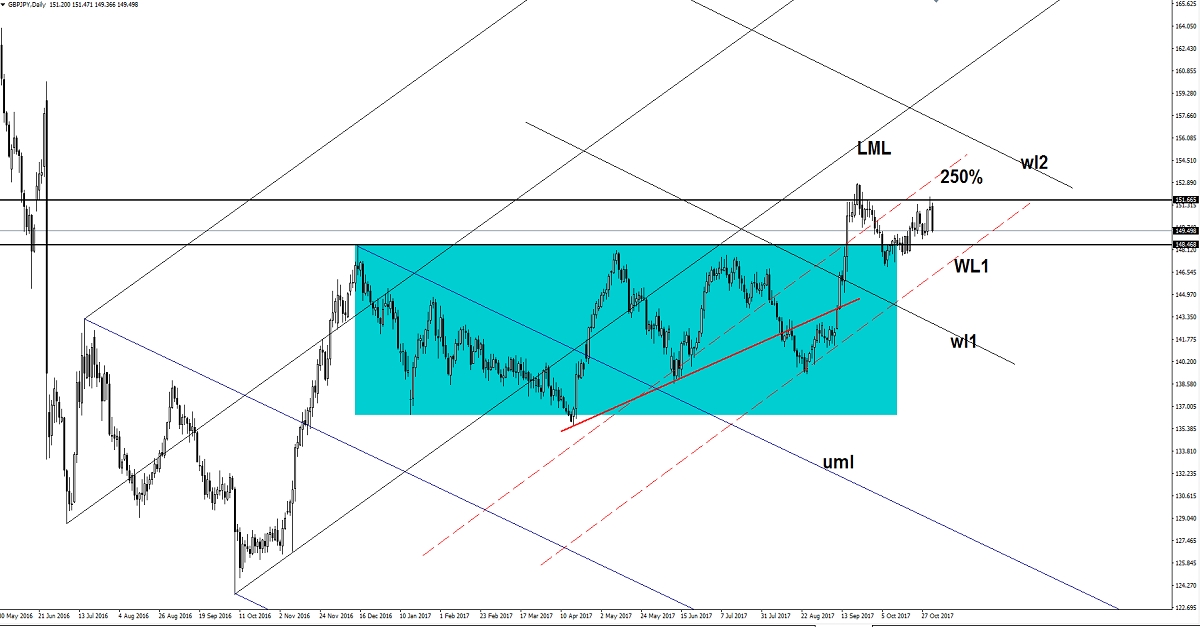

GBP/JPY Slides Again

The GBP/JPY plunged and could retest the 148.46 level very soon after the false breakout above the 151.66 and after the failure to close near this level. Price dropped even if the BOE has finally decided to hike the interest rate. The perspective remains bullish as long as the rate is trading above the first warning line (WL1) of the ascending pitchfork.

A larger drop will be confirmed only after a breakdown below the WL1, personally I believe that will take out this if will reach it.

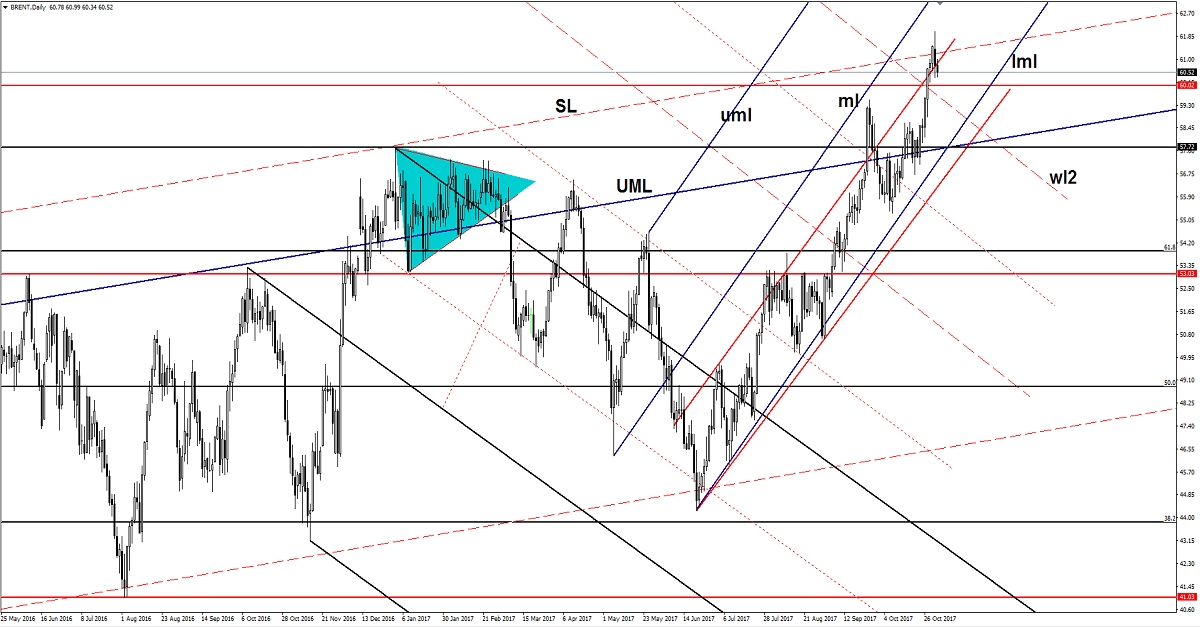

Brent Oil Too Overbought

Brent dropped today and resumed the yesterday's bearish candle. Price has shown the first exhaustion signs after the false breakout above the outside sliding line (SL) and above the upside line of the ascending channel. A retest of the mentioned resistance levels will signal a potential drop towards the lower median line (lml) of the minor blue ascending pitchfork. Has failed once again to approach and reach the median line (ml) of the ascending pitchfork, signaling that we may have a larger corrective phase.

By Olimpiu Tuns - Market Analyst