- GBP/USD hovers within critical zone

- Stochastics and RSI lose momentum

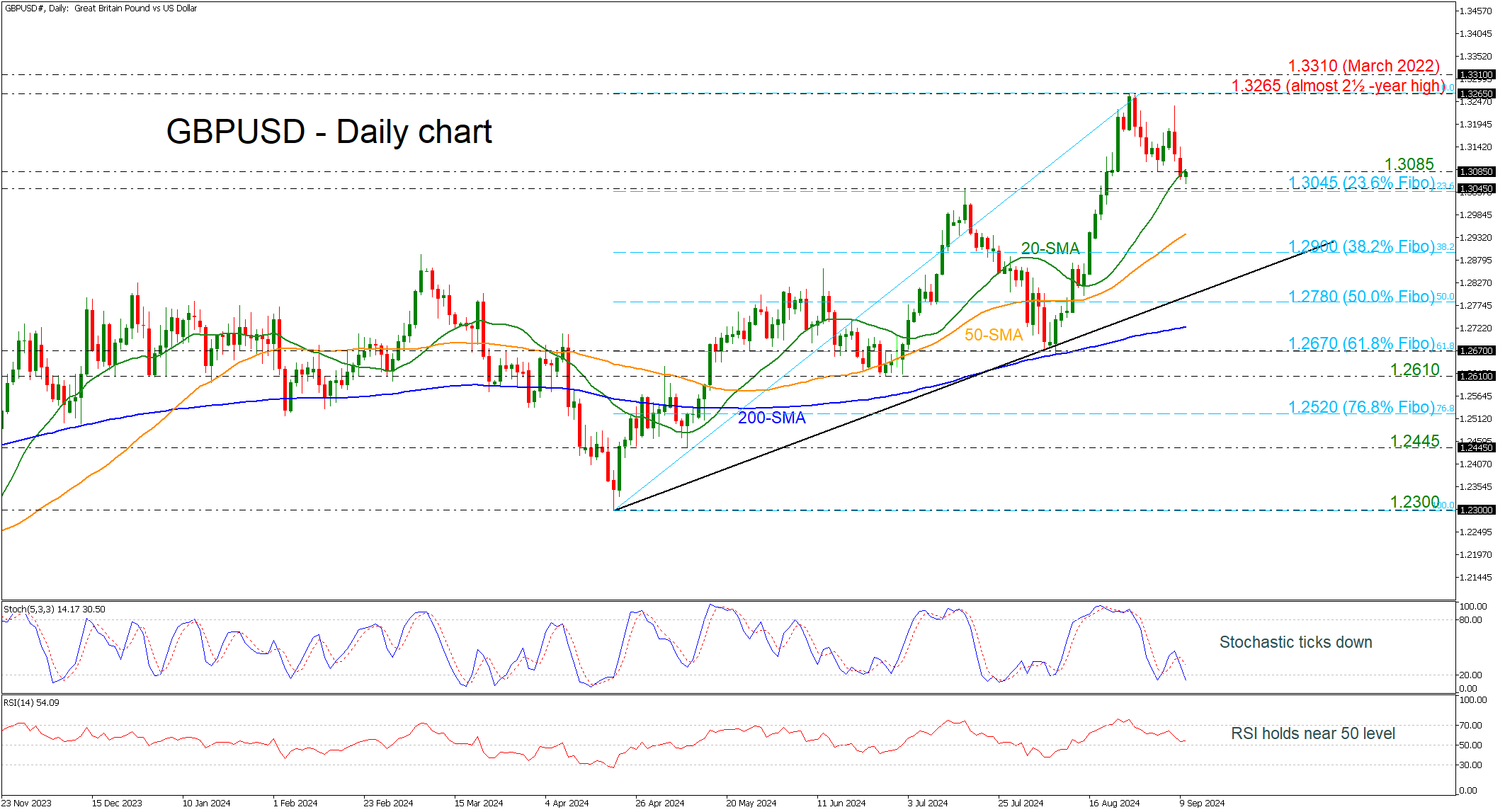

GBP/USD has lost its positive momentum after the pullback on the almost two-and-a-half-year high of 1.3265, trading within the restrictive support area of 1.3045-1.3085, which encapsulates the 23.6% Fibonacci retracement level of the upward wave from 1.2300 to 1.3265.

In the short term, the market could maintain downside risks if the RSI keeps moving around the neutral threshold of 50 and the stochastic continues to move in the oversold territory.

If the pair weakens further, the 50-day simple moving average (SMA) at 1.2940 could provide immediate support ahead of the 38.2% Fibonacci at 1.2900. Even lower, the 50.0% Fibonacci at 1.2780 may attract more attention, as any leg lower could worsen the market’s outlook, opening the way for a bearish bias.

On the other hand, an extension to the upside could meet the area within the 1.3265 peak and the March 2022 top at 1.3310.

To summarize, GBP/USD looks neutral to bearish in the very short-term window; however, the broader picture is strongly positive as long as the market remains well above the medium-term ascending trend line.