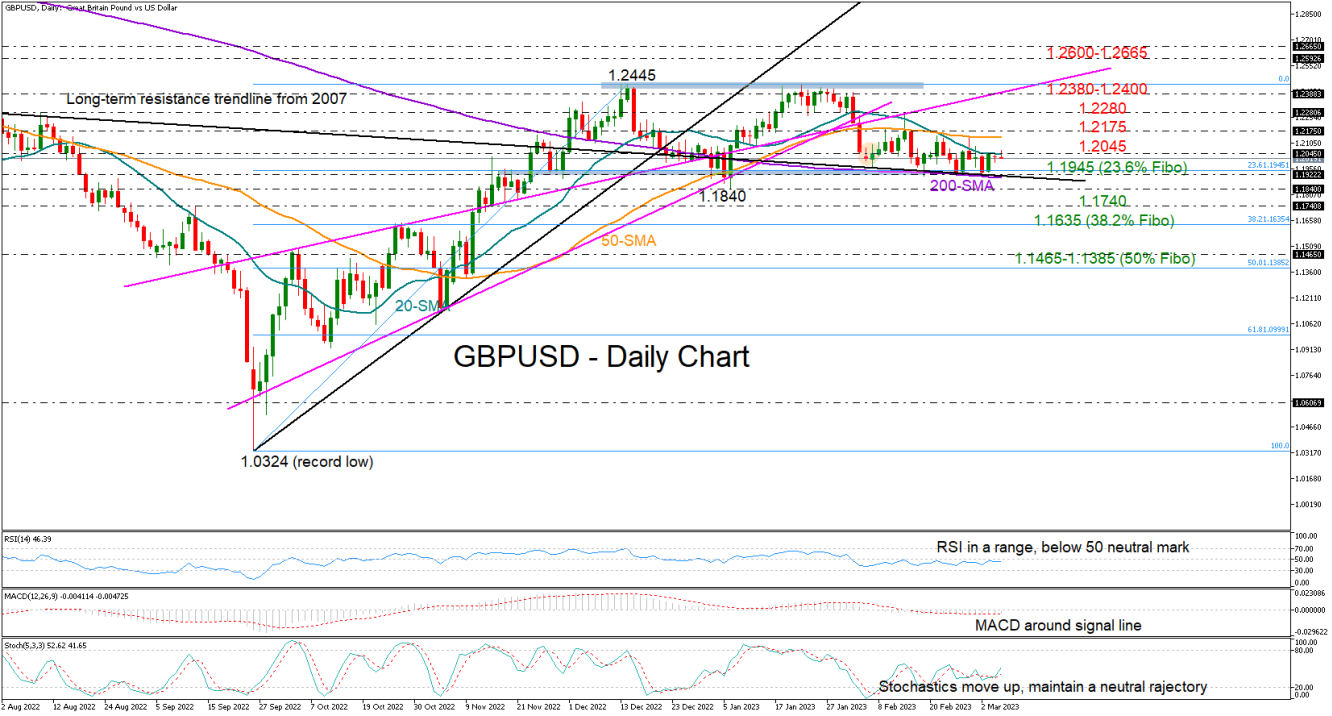

GBPUSD is making another attempt to climb the constraining 20-day simple moving average (SMA) at 1.2045, which has been capping bullish actions over the past week.

Although the pair seems to have secured a strong footing near January’s support area, where the 200-day SMA and the 23.6% Fibonacci retracement of the 1.0324-1.2445 upleg are positioned, the technical indicators have yet to show meaningful improvement. The RSI is sloping upwards, but it has yet to breach its neutral trajectory above its 50 neutral mark, while the MACD keeps fluctuating within the negative area and near its red signal line, both displaying a neutral-to-bearish bias.

Above the 20-day SMA, the 50-day SMA and the nearby 1.2175 resistance region could immediately cool upside pressures. If not, the pair could speed up to test the 1.2280 handle ahead of the key 1.2380-1.2400 barrier. Yet, only a sustainable move above the 1.2445 ceiling would activate new buying orders, likely boosting the price towards the 1.2600-1.2665 zone.

On the downside, a close below the 1.1945 floor may shift the spotlight to January’s trough of 1.1840. A step lower could face some congestion around 1.1740 before the door opens for the 38.2% Fibonacci zone of 1.1635. Should the bears persist, the pair could experience a freefall towards the 1.1465 level and the 50% Fibonacci of 1.1385.

In a nutshell, the technical picture in GBPUSD does not look bright despite the strong support developed around 1.1945. A close above 1.2045 could strengthen market sentiment, though only a rally above 1.2445 would violate the three-month-old range area.