- GBP/USD finds strong support in 1.2480 region

- But upside momentum struggles to take off

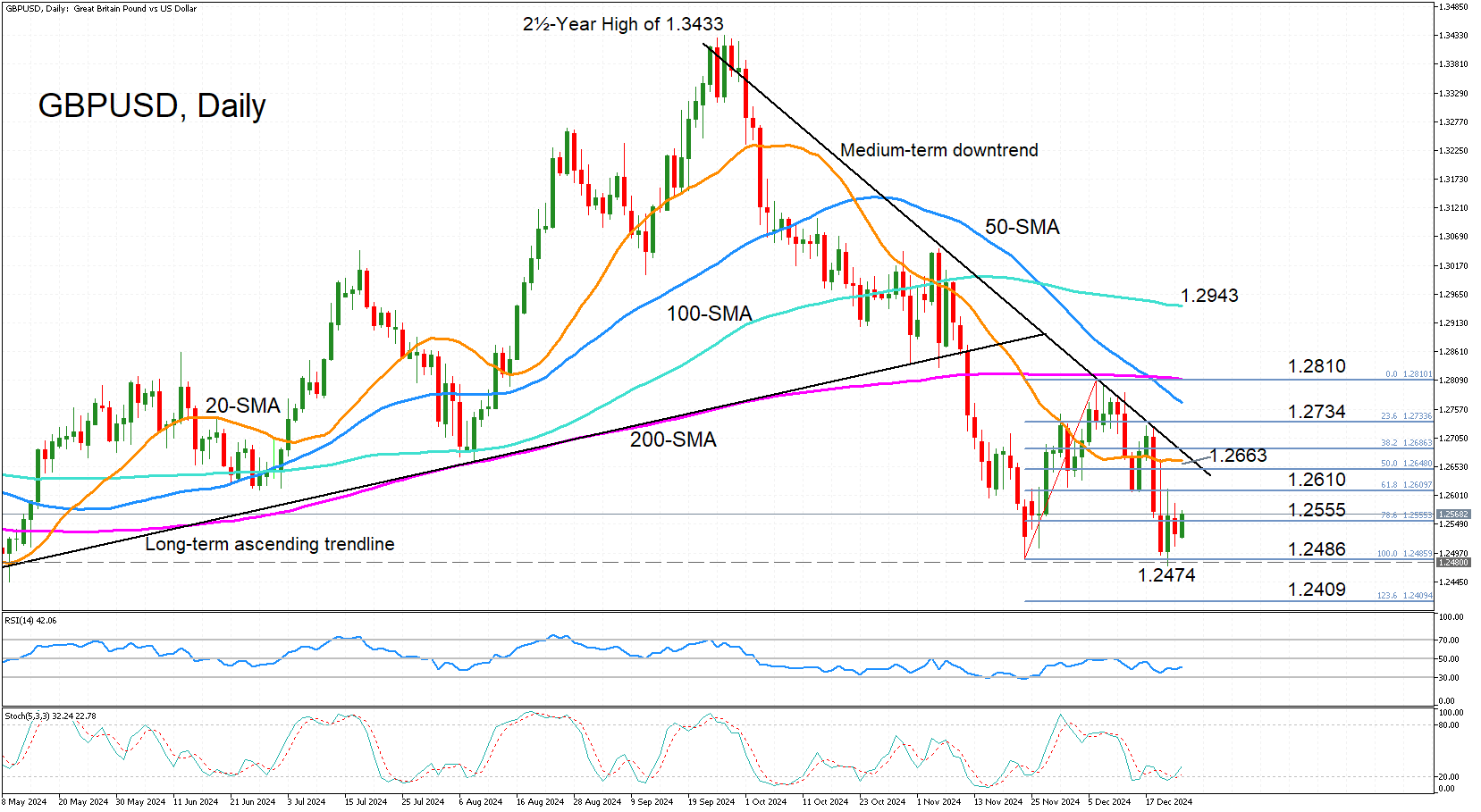

GBP/USD has managed to hold above the 1.2500 mark this week following last week’s post-Fed tumble that pulled the pair to the lowest since May, hitting 1.2474. The slide reinforced the medium-term downtrend line as a strong resistance wall, but now the bulls face additional barriers.

Any recovery attempt would first need to overcome the 61.8% Fibonacci retracement of the November-December upleg at 1.2610 and then battle the 20-day simple moving average (SMA) at 1.2663 before cracking the descending trendline.

However, a successful break above it would strengthen the short-term bullish bias, while switching the bearish outlook in the medium term to a more neutral one. It would also clear the path towards the December peak of 1.2810, which is where the 200-day SMA is currently converging.

In the bigger picture, the bulls would ideally need to aim for the 100-day SMA at 1.2943 as well for the long-term uptrend to stand any chance of being restored.

But given the weak positive momentum, further downside cannot be ruled out in the near term. The RSI is only slightly pointing upwards and remains below 50, while the stochastic oscillator has some way to go before reaching neutral levels.

Should the bears retake control, the 1.2480 support area is likely to be tested again before attention turns to the 1.2400 handle that lies slightly below the 123.6% Fibonacci extension.

To sum up, there is a greater possibility of GBP/USD resuming its medium-term downtrend than reviving its long-term uptrend over the next few sessions.