- The Bank of England (BoE) is expected to announce a 25 bps rate cut on February 6, 2025.

- Weak UK Data and ongoing trade war and geopolitical risks pose threat to BoE policy.

- Key levels to watch are 1.2500 (resistance) and 1.2466 (support).

- Governor Bailey comments and press conference are key to future policy hints.

The Bank of England (BoE) is set to announce its latest monetary policy decision soon, in what is shaping up to be one of the most closely watched meetings in recent months. The central bank faces a delicate balancing act as it navigates a mix of economic challenges and opportunities.

The seesaw price action experienced by the British Pound over recent weeks was initially down to uncertainty surrounding Britain’s inflation, interest rate, and fiscal challenges. That is not to downplay the US and its role in the recent uncertainty in global markets.

What is Expected from the Bank of England (BoE)?

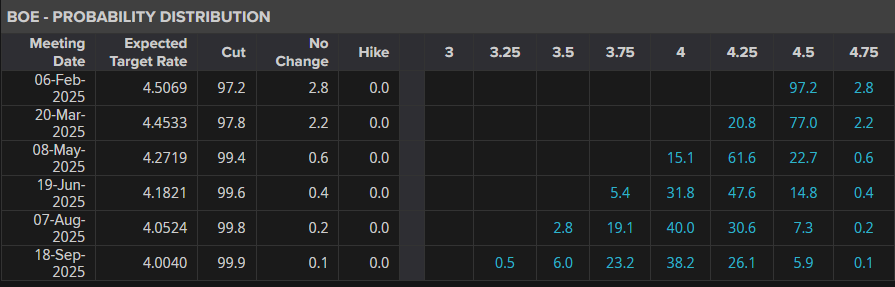

According to LSEG Workspace data, market participants are pricing in a 97% probability of a 25 bps cut today. Such a move would hardly come as a big surprise for anyone following developments in the UK over the past few months.

The bigger question will be whether the outlook moving forward will strike a dovish tone which could see the British Pound surrender some of its recent gains.

I am not sure if such a statement will materialize though, largely on the back of a shaky jobs market and the prospect of lower services inflation.

Source: LSEG

If the BoE delivers a 25 bps cut and discusses any further cuts as being gradual and the number of cuts to be expected in 2025, the market reaction could be relatively muted. A definitive change in stance with any hint regarding speeding up of rate cuts could send the British Pound sliding.

At this stage, market participants are pricing in around 83 bps of cuts through December 2025, however, a dovish message by Governor Bailey could increase markets' expectations of a rate cut every quarter. This would mean 100 bps of cuts in 2025.

UK Data and the Picture it Paints

Inflation in services, a key focus for the BoE, dropped a lot in December. This could be temporary since it might rise back to 5% in January, but overall, it is clearly going down. By the second quarter, it’s expected to fall below 4%, and it’ll look even better once less important categories are excluded.

The jobs market is also showing signs of weakness. Private-sector employment slowly dropped in 2024, and job openings have decreased a lot. While wage growth has been stubborn, surveys suggest it will slow down as the year progresses.

These factors certainly paint a picture that may require further rate cuts. Now of course there is the shadow of a potential trade war which could kick off another round of inflation and play a role in BoE decision-making going forward.

On the geopolitical side, we still do not have a resolution in Russia-Ukraine while President Trump’s call for Gazans to be moved has added a fresh new dimension to the Middle East as well. A further deterioration in these conflicts could lead to sticky inflation rearing its ugly head once more.

Technical Analysis – GBP/USD

From a technical point of view, Cable has staged an impressive recovery this week.

Following a gap lower over the weekend on tariffs being implemented, the British Pound has gained around 300 pips against the greenback, peaking yesterday at 1.25500 before pulling back to trade below the 1.2500 psychological level.

Looking at the daily chart below and as you can see the medium-term descending trendline remains intact thanks to Monday’s swift recovery.

A daily candle close above the 1.2500 handle may embolden bulls but if any move is to take place, it will likely come after the BoE meeting.

GBP/USD Daily Chart, February 6, 2025

Source: TradingView

Dropping down to a H4 and the bullish trend remains intact without a four-hour candle close below the 1.2466 handle.

A close below this handle will result in a change of the four-hour structure and open the door for bears to push price toward support at 1.2400, where the 200-day MA rests.

The possibility of a deeper correction toward 1.2350 may provide a better risk-to-reward opportunity for potential bulls should it materialize. I expect that barring any surprises today, for any moves relating to GBP/USD to remain short-lived.

GBP/USD Daily Chart, February 6, 2025

Source: TradingView

Support

- 1.2466

- 1.2405

- 1.2360

Resistance

- 1.2550

- 1.2750

- 1.2864