After surging to a high of $1.3164 in early trade this morning, GBP/USD quickly pared those gains and is currently trading 0.2% lower on the day as it tests support at $1.31

The whipsaw action in sterling came following PMI data and as investors attempt to second guess the BoE ahead of the rate decision next Thursday.

PMI Readings

The data shows that not only is the UK manufacturing sector almost out of contraction, the dominant service sector is firing ahead. The service sector accounts for 80% of economic activity in the UK economy, giving a good indication of its importance.

The composite pmi reading, which is a useful gauge for economic output across the economy, jumped to its highest level in 2 years.

BoE rate cut less likely

The are upbeat readings that show that the UK experience a post-election Boris bounce, an encouraging start to the new year. The reading points to economic growth of 0.2% and has caused investors to scale back expectations that the BoE will cut interest rates when they meet on 30th Brexit.

Profit taking

The pound was unable to sustain gains as profit taking took over. The pound has been one of the strongest performers across the week heading into the PMI’s as investors started to price out the possibility of monetary policy easing by the BoE.

Brexit signed off

Brexit is never far from any pound traders’ thoughts. The Brexit bill was signed off yesterday by the European Commission President Ursula der van Leynes. It will now go to the European Parliament on 29th January for ratification before Brexit next week on 31st January and the start of the all-important trade talks.

Levels to watch:

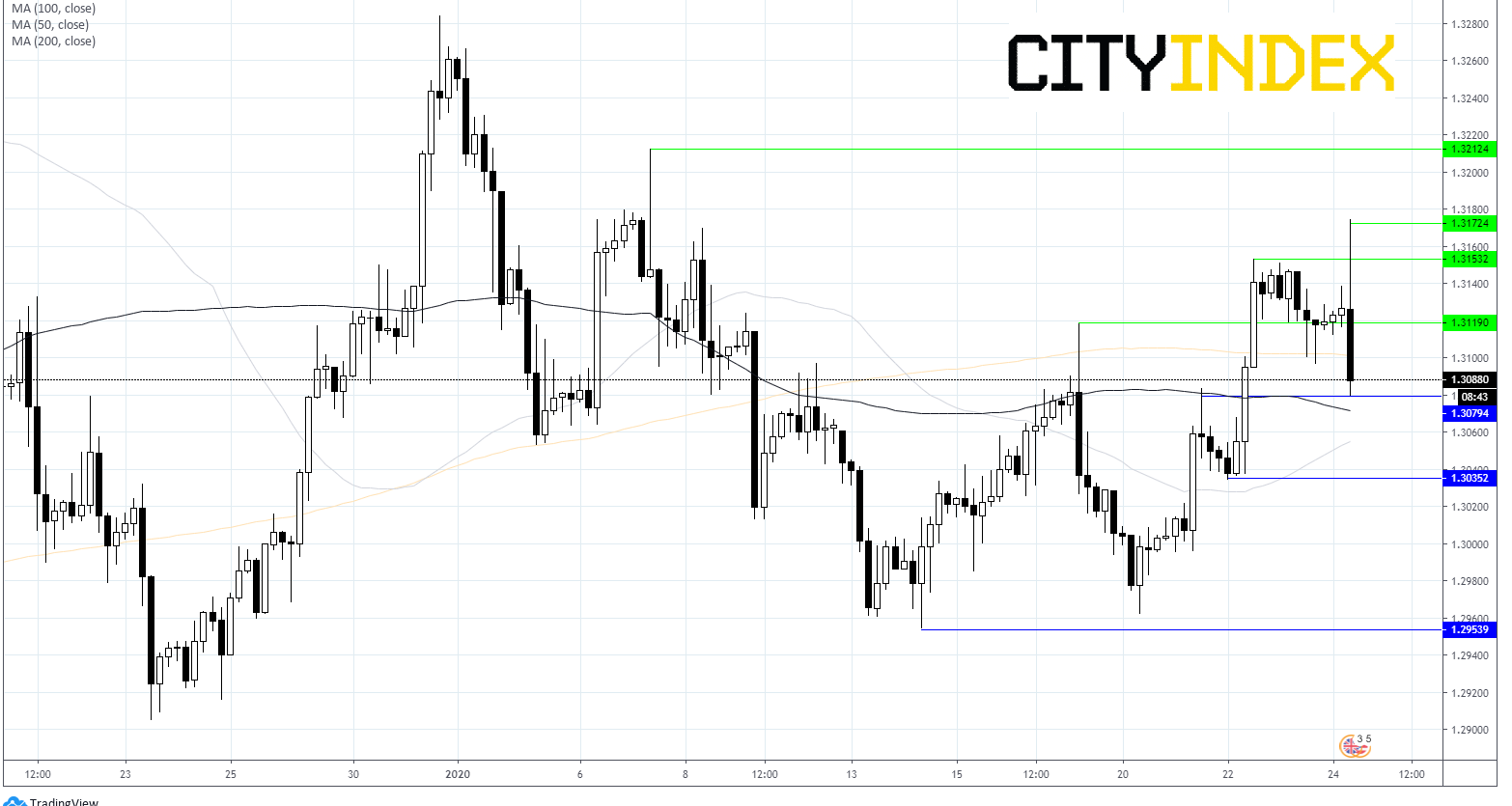

Pound’s sell ff has seen it slip through 200 sma on 4 hour chart. It remains above 100 & 50 sma. Momentum remains to the upside.

Immediate support can be seen at $1.3080 prior to $1.3050 before $1.2950 (Jan low).

Resistance can be seen at $1.3120, prior to $1.3150, $1.3170 (today’s high) before $1.3210 (high 6th Jan).