It is prudent to examine the strength of the GBP/USD in the lead up to two very important inflation data reports. First is the US inflation data due on Wednesday. And second is the UK’s inflation data. The annual US inflation rate to January 2023 is expected to fall to about 6.2% from 6.5% in December of 2022, and in doing so, will continue the decline of consumer prices for a seventh straight month.

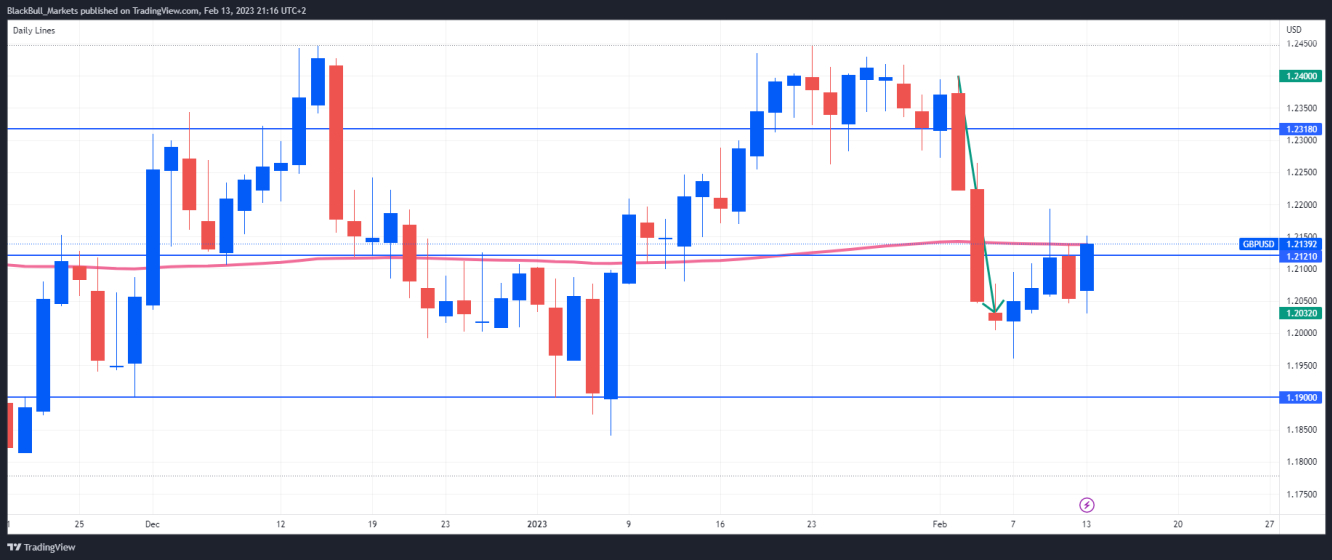

However, a smaller than expected decline in the US inflation data might shake a little more bulls off the GBP/USD frontline after it dropped from 1.2400 to below 1.2030 last week, its weakest level since January 6 and breaking through its upward trendline. The decline in UK inflation is expected to fall from 10.55 to 10.2%, but it has been beating expectations and falling more than forecast in its previous 2 releases, so another beat might be on the cards and putting the GBP back on the front foot.

GBP/USD attempted to bounce back last Thursday after establishing support at 1.2015 but failed to close above the 200-EMA. This failed move meant the GBP/USD ended the week with a big red candle, engulfing the previous bullish candle that tried to move past the 200-EMA. The rejection at the 200-EMA means there is resistance at around 1.2121, which could be considered a lower high in the downtrend.

Stronger-than-expected US inflation or weaker-than-expected UK inflation could see GBP/USD breaking below 1.2018, with 1.1900 a potential target for the downward move. On the opposite side of the trade, GBP/USD may rise to 1.2189 or even 1.2318 from a swing perspective. Look for a closing above the 200-EMA and the 1.2121 resistance area for this to happen.