GBP/USD felt heavily after Euro Stoxx 50 futures surged a couple of days ago and were influenced by a global fear of China slowdown and PBOC yuan devaluation. Also, BOE is still holding off from rate hikes and we have some clues that the hike could come at the end of the year. BOE's governor Carney's unwillingness to share any more details about recent events and a possible rate hike led to a strong sell off of GBP/USD pair.

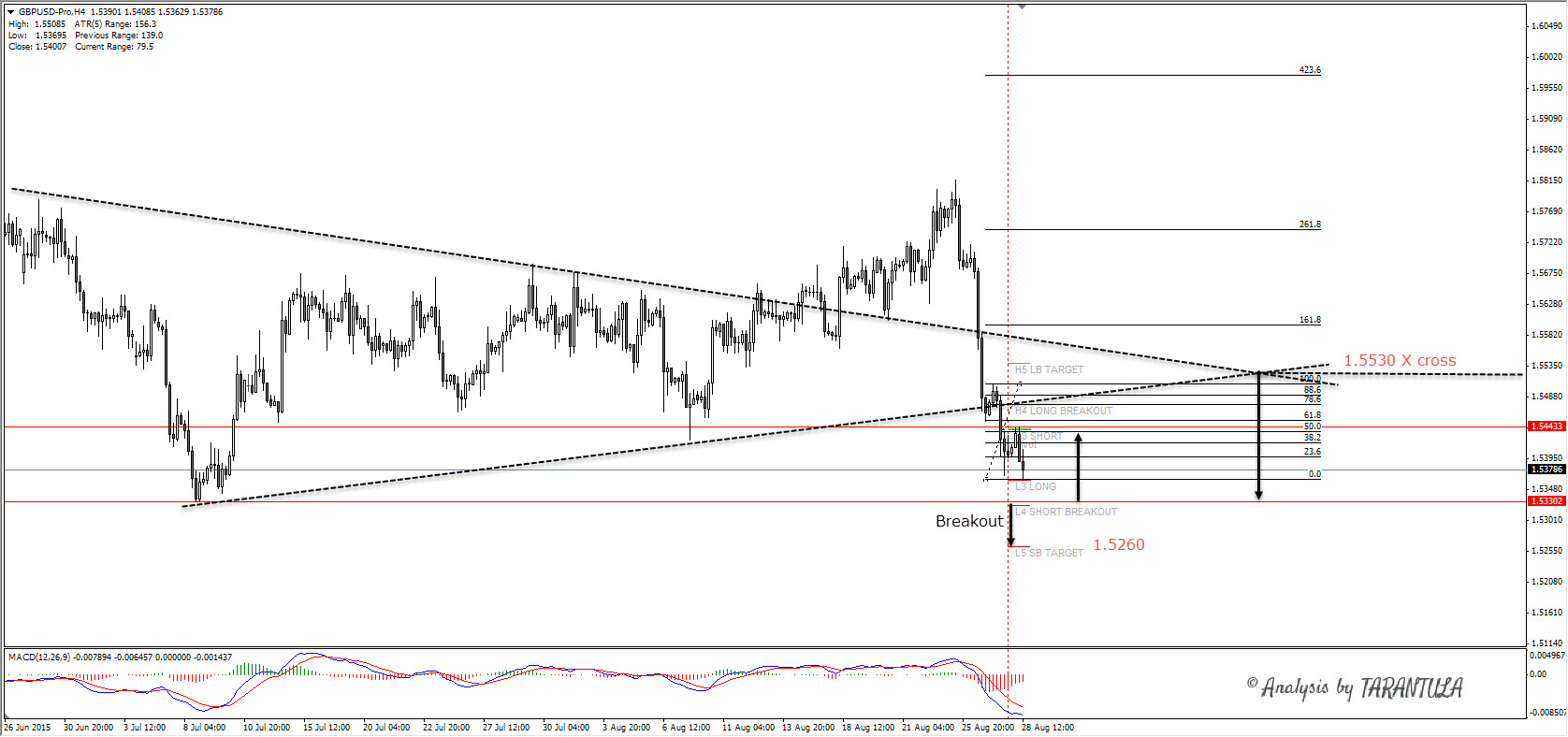

Technically the pair sold off 1.5800-20 zone, but even I am a bit surprised at the huge GBP/USD weakness in the recent days. 1.5530 level shows the X Cross- the intersection of trend lines. X cross usually finds strong confluence with other price factors; this time it is H5 camarilla pivot. 1.5530 is a strong point for taking short trades. Interim resistance is 1.5445 zone, as we can see H3 camarilla and double top confluence. Interim support lies at 1.5360 and if that level is broken, the price should accelerate to 1.5330. Notice that 1.5330 is previous double bottom and when you are reading price action, you should always take HISTORICAL price action into account. Historical buyers lie at 1.5330 and in the context of historical vs now moment buyers, we could see bounce from that spot. If 1.5330 is lost, 1.5260 is next.