GBP/USD pair is down to 1.2892 on Thursday. Selling intensified on the 18th of July. Since then, GBP has remained under pressure, although it is making attempts to stabilise.

Statistics released earlier showed that UK private sector activity improved in July. PMI data indicated that activity in the services sector expanded slightly, while in the industrial segment, it was the highest since February 2022.

The data aligned with forecasts and confirmed the positive sentiment in industrial production after Labour's convincing election victory.

The market is watching the situation with the Bank of England interest rate. The probability of a rate reduction at the August meeting is at most 40%. The UK regulator holds a neutral view of the monetary policy structure and is unlikely to make decisions that could have a mixed effect.

Overall, GBP remains under pressure from the US Dollar, which is receiving support from various sides.

GBP/USD Technical Analysis

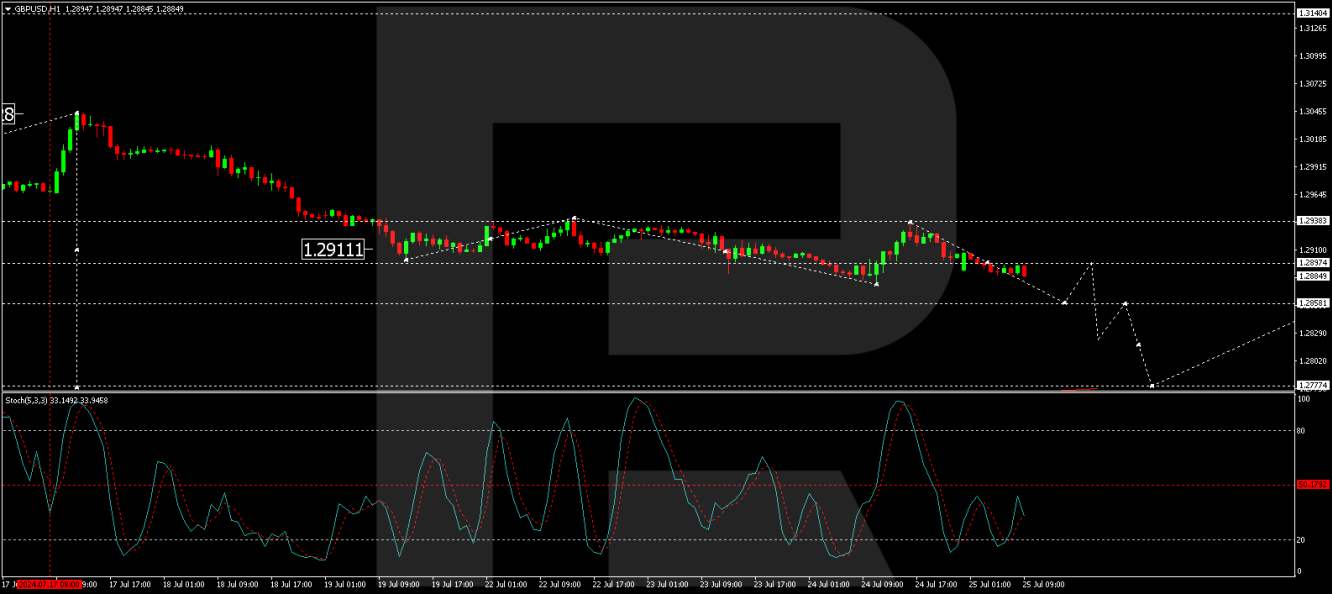

On the H4 chart of GBP/USD, the market has formed a consolidation range around the 1.2911 level. Today, the market broke out of this range downwards. The potential for a downside wave to 1.2777 is almost open. The target is the first one. After reaching this level, we will consider the probability of correction to 1.2911 (test from below). Technically, this scenario is confirmed by the MACD indicator. Its signal line is above the zero mark and is directed strictly downwards.

On the H1 chart of GBP/USD, a correction wave to the level of 1.2937 is performed. Today, the structure of decrease to the level of 1.2858 is formed. After working off this level, we will consider the probability of a growth link to the level of 1.2897. At this point, the correction potential will be exhausted. After the correction is over, we will consider the beginning of a new wave of decline to 1.2824 with the prospect of trend continuation to the level of 1.2777. Technically, this scenario is confirmed by the Stochastic oscillator. Its signal line is under the level of 50 and continues to decline to the level of 20.

Disclaimer: Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.