EUR/CHF: SNB softens guidance on CHF overvaluation

Macroeconomic overview:

The Swiss National Bank left monetary policy unchanged at its quarterly announcement today, in line with expectations. The interest rate on sight deposits remains at -0.75% and the target range for the three-month Swiss Libor unchanged at between -1.25% and -0.25%. However, the main news is that the SNB has tweaked its guidance on the degree of overvaluation of the Swiss franc following the franc’s 5.4% depreciation against the euro – and 3.7% depreciation in trade-weighted terms – since the SNB’s last meeting on 15 June. Instead of the Swiss franc being “significantly overvalued”, the SNB said the recent depreciation is “helping to reduce, to some extent, the significant overvaluation of the currency”, although it cautioned that the franc “remains highly valued, and the situation on the foreign exchange market is still fragile”. The SNB reiterated its willingness to intervene in the fx market.

The SNB has revised up its inflation forecasts across its three-year forecast period, by 0.1pp in each year, entirely due to the recent depreciation of CHF. The SNB now expects inflation of 0.4% yoy in 2017 (previously 0.3%), 0.4% yoy in 2018 (previously 0.3%), and 1.1% yoy in 2019 (previously 1.0%), conditional on the three-month Libor remaining at -0.75% over the forecast period. In August, headline inflation rose 0.2pp to 0.5% yoy, while core inflation edged up 0.1pp to 0.4% yoy.

There was a large downward revision to the SNB’s growth forecast for this year, to a little below 1.0% from 1.5% in June. This reflects the weak end to last year after the Swiss Federal Statistical Office revised down its estimate of growth in the fourth quarter 2016 by 0.4pp to -0.2% qoq, and growth in the first quarter 2017 was just 0.1% qoq. The SNB said the “moderate recovery is continuing”, and is benefiting from stronger global growth.

The SNB will have welcomed the recent depreciation of the Swiss franc, and today it has acknowledged that by slightly softening its guidance on the degree of CHF overvaluation and revising up slightly its inflation forecasts across its three-year forecast horizon. However, it is simply too early for the SNB to talk up the prospects of actually tightening policy. Inflation remains subdued, economic growth is patchy and, hence, the SNB certainly does not want a tightening of financial conditions. Ultimately, given Switzerland is a small, open economy, the SNB is likely to wait for the ECB to move first, and we do not expect the ECB to increase interest rates until 2019.

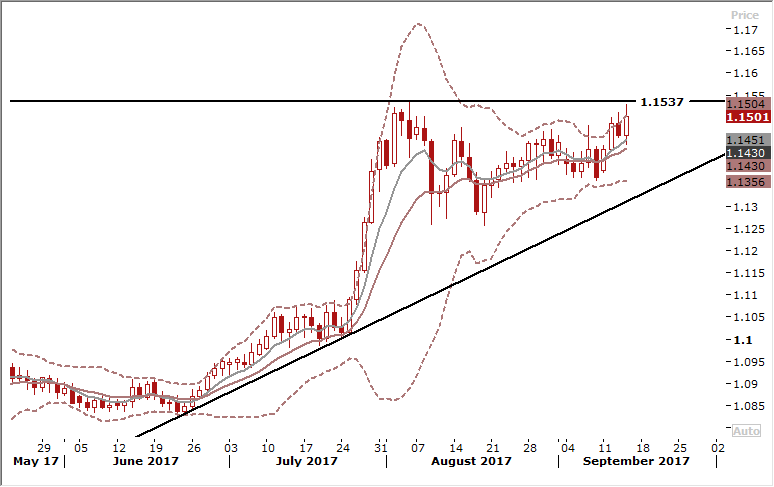

Technical analysis:

Investors shrugged off softer SNB rhetoric on CHF overvaluation and continued to sell franc. The EUR/CHF remains in bullish trend, the nearest resistance level is 1.1537 high on August 4. The EUR/CHF appreciation is likely to strengthen if the above-mentioned level is broken. Short-term moving averages remain positively aligned, which highlights overall bullish structure.

Short-term signal: Stay long at 1.1370 for 1.1610

Long-term outlook: Bullish

GBP/USD: Eyes on BOE decision, U.S. inflation data

Macroeconomic overview: Sterling fell back from a one-year high to trade lower against the dollar on Wednesday as weaker than expected UK wage growth put a brake on bets that the Bank of England could change its interest rate stance due to a surge in inflation.

Wages in the three months to July were 2.1% higher than a year earlier, little changed from previous months' growth rates. But the market had on average forecast a rise of 2.3%.

British inflation has shot past the BoE's 2% target - surging to its highest level in more than five years according to data released this week at 2.9%.

We expect the MPC to vote 7-2 to maintain its current monetary policy stance today, with MPC members Ian McCafferty and Michael Saunders maintaining their dissent in favor of an immediate 25bp increase in the bank rate. Any more defections could push the pound higher.

Today’s US inflation figures will attract plenty of attention together with the BoE decision. We do not think that a US inflation report close to expectations will – by itself – lead to sustainable dollar support. As we have pointed out before, recent USD rallies have tended to be very limited, both in terms of magnitude and in terms of duration. Overall, we see risks as asymmetric: a higher print would be dollar-positive, but marginally and temporarily so, because it would still be difficult to revive rate-hike expectations in a material way. But a negative surprise would constitute the sixth consecutive one and would increase the probability of a dovish Fed next week. Such an outcome would be quite bearish on the dollar.

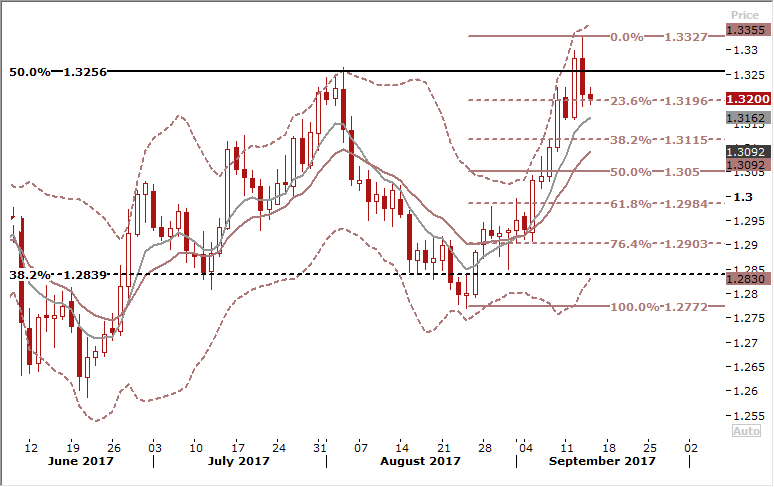

Technical analysis: GBP/USD consolidates above the Wednesday’s 1.3185 low. Further fall to 38.2% fibo of 1.2772-1.3327 rise is likely and could be a good opportunity to open a long position.

Short-term signal: Stay sideways

Long-term outlook: Bullish

AUD/USD rises on upbeat Australian jobs report

Macroeconomic overview: The Australian dollar jumped on Thursday as local jobs data blew past all expectations and helped offset strength in its U.S. counterpart, though there was still scant sign of the inflationary pressure that might push up interest rates.

Data from the Australian Bureau of Statistics showed employment leapt 54.2k, the biggest jump since October 2015 and far above the 15k increase forecast by the market.

Employment was racing at an annual rate of 2.7% in Australia, compared with 1.4% in the United States. Over the past six years, annual U.S. jobs growth has not exceeded 2.3%.

A blockbuster 269k jobs have been created so far this year but the labour force has also expanded by an equally sizable 257k, keeping the jobless rate steady at 5.6%.

Indeed, the participation rate was the highest since September 2012. While that is a sign of greater confidence, it also means more labour supply will restrain wages, which are already growing at a record-low pace. That in turn limits upward pressure on inflation which is stuck below the central bank's 2% to 3% target band.

The Reserve Bank of Australia is confident the momentum in the labour market will continue as economic growth picks up and a measure of business conditions rises to its highest since early 2008. National Australia Bank's survey of more than 400 firms showed its index of business conditions firmed 1 point to +15 in August, triple its long-run average of +5. The survey's employment index surged 4 points to +11, a major turnaround from earlier in the year when it was stuck around 0.

Interbank futures imply around a 30% chance of a hike in the Reserve Bank of Australia's 1.5% cash rate in the next six months.

Today’s Aussie's gains were tempered by some mixed Chinese data as retail sales and industrial production both rose by less than market forecasts.

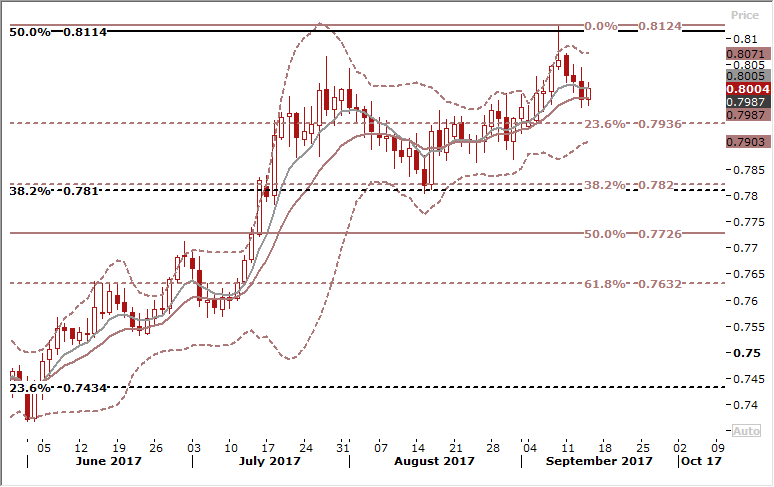

Technical analysis:

The AUD/USD remains in bullish trend, but the pace of appreciation has moderated. The pair is fluctuating between 7- and 14-day exponential moving averages today, which suggest the market is indecisive. A fall to 23.6% fibo of May-September rise at 0.7936 cannot be excluded, but strengthening fundamentals of Australian economy and rising prices of metals support the AUD bulls in the medium term.

Short-term signal: Buy at 0.7955

Long-term outlook: Bullish

Source: GrowthAces.com - your daily forex signals newsletter