GBP/USD

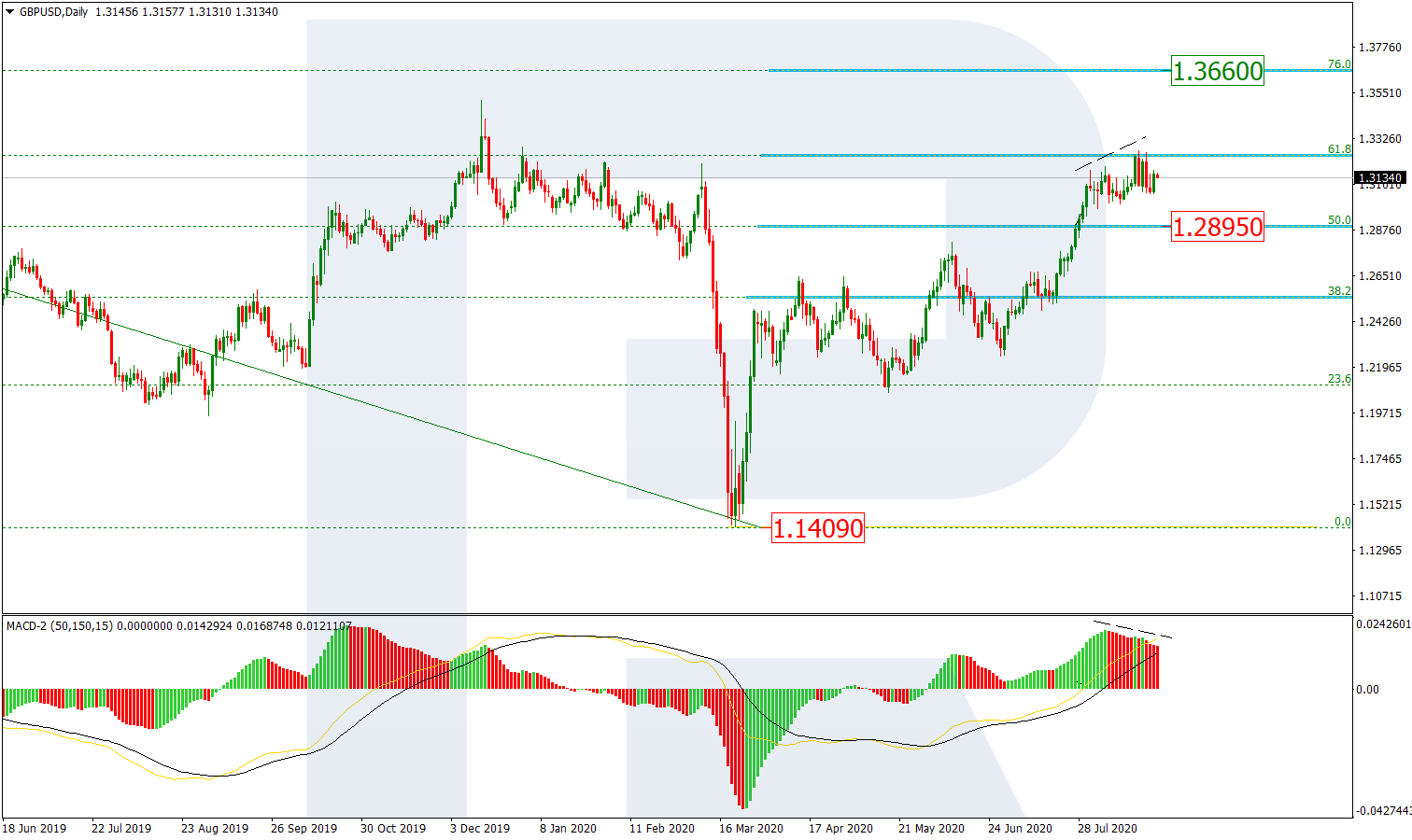

As we can see in the daily chart, GBP/USD has reached a long-term 61.8% Fibonacci while moving within the uptrend. At the same time, the MACD indicator is forming a local divergence, which may hint at a possible pullback. The closest downside target may be the local support at 50.0% Fibonacci (1.2895). After completing the correction, the next rising impulse may be heading towards the long-term 76.0% Fibonacci at 1.3660.

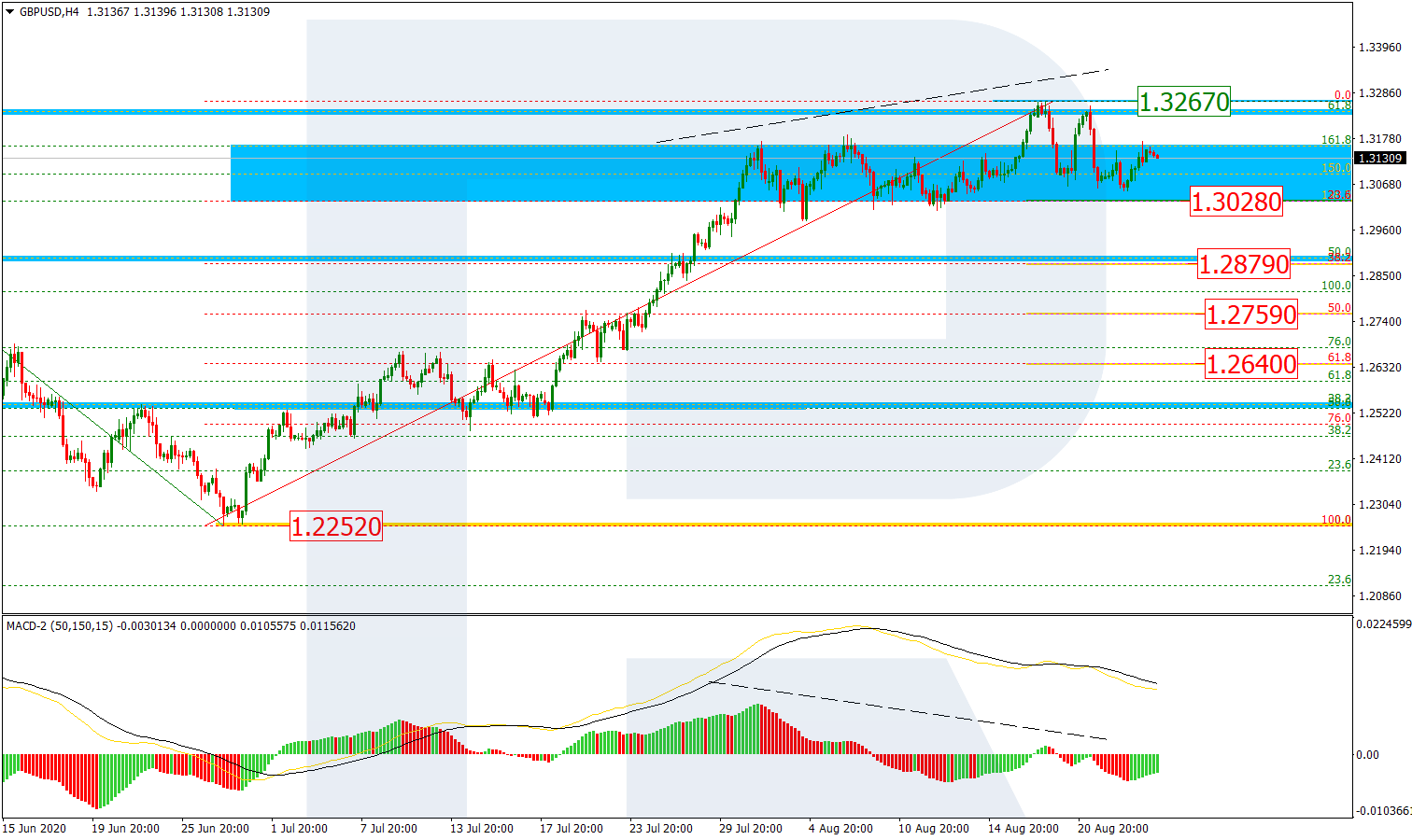

In the H4 chart, the pair has reached the post-correctional extension area between 138.2% and 161.8% Fibonacci. At the same time, the MACD indicator is forming a divergence, which may hint at a new correction. The closest target of this pullback may be 23.6% Fibonacci at 1.3028, while the next ones are 38.2%, 50.0%, and 61.8% Fibonacci at 1.2879, 1.2759, and 1.2640 respectively. However, if the price breaks the high at 1.3267, the instrument may continue the uptrend.

EUR/JPY

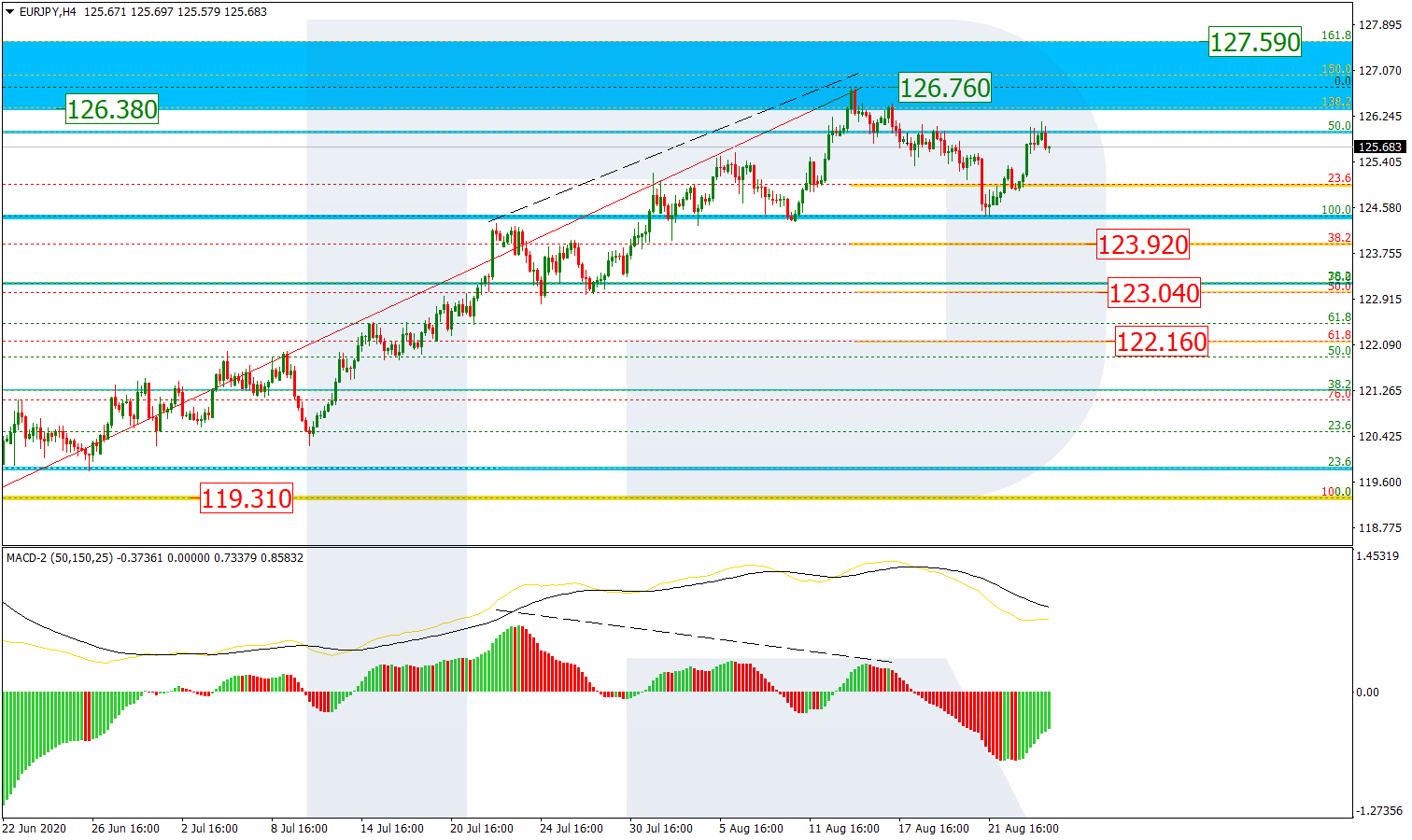

As we can see in the daily chart, EUR/JPY has reached the long-term 50.0% fibo and the post-correctional extension area between 138.2% and 161.8% fibo at 126.38 and 127.57 respectively. such a technical picture may indicate a possible correction in the form of a sideways channel. The next upside target may be the long-term 61.8% fibo at 128.65.

In the H4 chart, after the first descending correctional wave and the divergence, the instrument is forming a local pullback. The first wave has already reached 23.6% Fibonacci and may later continue towards 38.2%, 50.0%, and 61.8% fibo at 123.92, 123.04, and 122.16 respectively. The resistance is the high at 126.76.