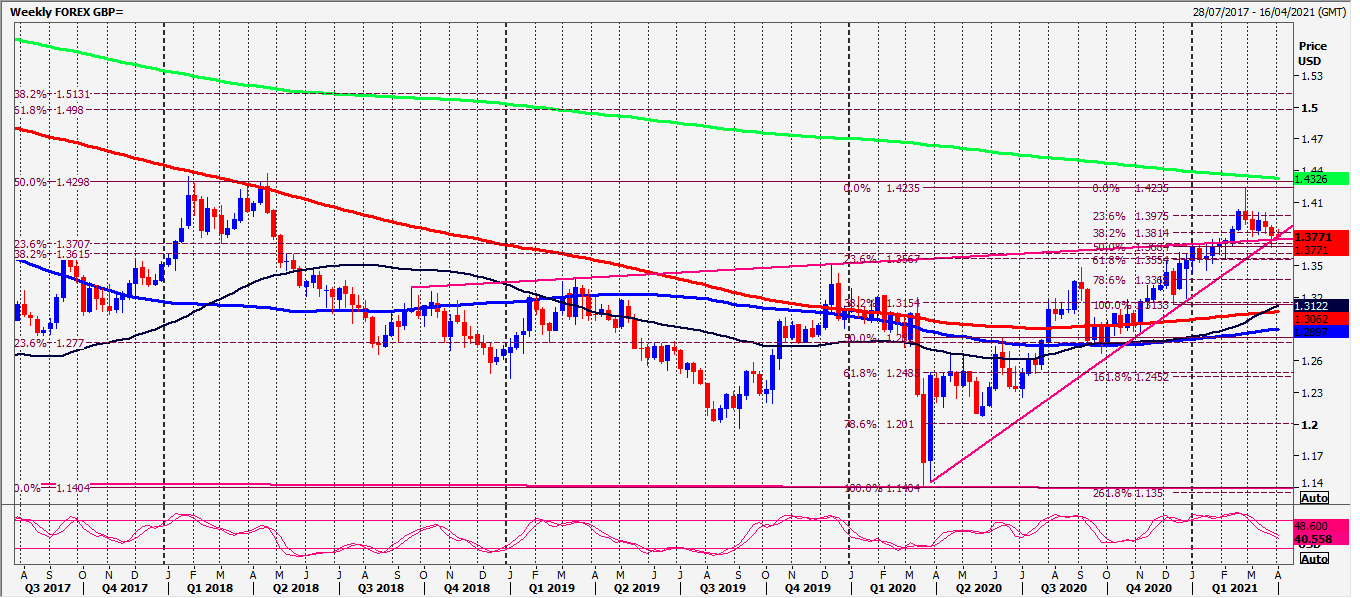

GBP/USD in a sideways consolidation for 3 weeks from 100 month moving average support at 1.4080/60 up to resistance at 1.4220/40. Trade this range while we wait for a breakout.

EUR/GBP dipped 17 pips below first support at 8590/80 before a good recovery to the first target of 8615/25. We topped exactly here.

GBP/NZD longs at 1.9360/20 worked perfectly on the bounce as far as the May high at 1.9770 last week. To bottomed exactly at strong support at 1.9600/1.9580.

Today’s Analysis

GBP/USD sideways as we hold the double top high at 1.4230/40 with a bearish engulfing candle sell signal. Still holding important 100 month moving average support at 1.4080/60. A break lower is a sell signal this week initially targeting 1.4025/15.

Holding very minor support at 1.4150/60 retests key resistance at 1.4220/40. A break above 1.4250 meets strong 200 week moving average resistance at 1.4290/1.4300.

Shorts need stops above 1.4340.

EUR/GBP holding first support at 8590/80 (again yesterday) targets 8615/25 before first resistance at 8644/50. We topped exactly here. Bulls now need a break above 8665 to retest 8712/19.

First support at 8590/80. A break lower to test the May low at 8558.

GBP/NZD has had a great run from that big support at 1.9360/20 to the May high at 1.9770. The pair collapsed from the May high keeping the pair in a sideways range for a dip to 1.9680/70 & 10 pips from strong support at 1.9600/1.9580. Longs here today need stops below 1.9540. A break lower targets 1.6465/55.

Yesterday we bounced to 1.9680. Minor resistance at the May June high at 1.9770/80.

A break higher tests the April high at 1.9820/25.

Disclaimer: No representation or warranty is made as to the accuracy or completeness of this information and opinions expressed may be subject to change without notice. Estimates and projections set forth herein are based on assumptions that may not be correct or otherwise realised. All reports and information are designed for information purposes only and neither the information contained herein nor any opinion expressed is deemed to constitute an offer or invitation to make an offer, to buy or sell any security or any option, futures or other related derivatives.