Reuters reports GM Lowers Outlook for U.S. 2017 New Vehicle Sales, but not by enough in my estimation.

General Motors Co (NYSE:GM) now expects U.S. new vehicle sales in 2017 will be in the “low 17 million” unit range, reflecting a widespread expectation that the industry is headed for a moderate downturn, a top executive said on Monday.

“The market is definitely slowing … it’s something we are going to monitor month to month,” Chief Financial Officer Chuck Stevens told analysts on a conference call. “Pricing is more challenging.”

U.S. new vehicle sales hit a record of 17.55 million units in 2016 after a boom that began in 2010. A glut of nearly-new used vehicles is expected to undermine sales this year. Major automakers have reported sales declines for the past three months.

GM had previously announced it expected 2017 new vehicle sales in the “mid-17 million” unit range. Stevens told analysts that sales could fall by 200,000 to 300,000 units this year but that the automaker had “somewhat insulated” itself from a downturn by reducing fleet sales, which lower vehicles’ residual values.

“We are going to remain disciplined from a go-to market perspective,” Stevens said.

He reiterated the company’s target to bring U.S. inventories of its vehicles down to 70 days’ supply by December from 110 days in June.

Reduced Consumer Sales, Reduced Fleet Sales, Reduced Inventories

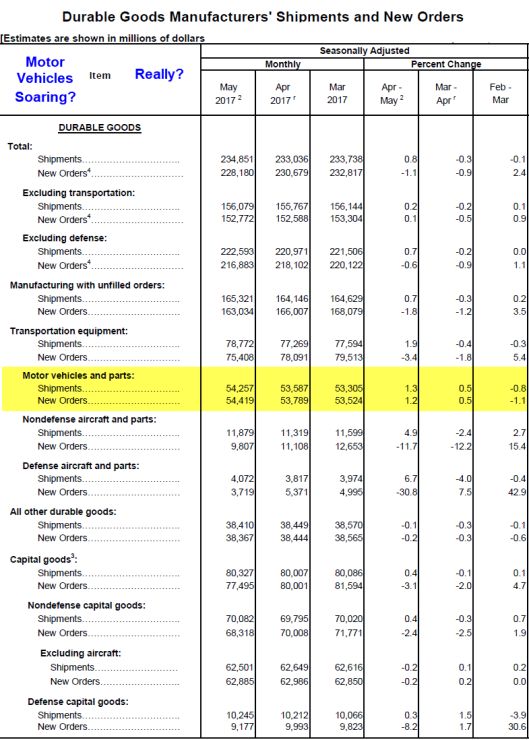

If sales are down, then reducing inventory-to-sales ratios will require even less production. Durable goods reports do not show that happening.

Questionable Details

This morning I posted Durable Goods: Another Bad Report, Diving Into Questionable Details.

Shipments were supposedly up a total of 1.8% in April-May period. New Orders were supposedly up 1.7% in the same timeframe.

Let’s match this up with auto sales.

- June 1: Motor Vehicle Sales Flat, Hope Turns to Second Half: What About Fleet Sales? Incentives?

- May 2: Auto Sales Puke Again: Year-Over-Year Totals: GM -6%, Ford -7.2%, Toyota -4.4%, Fiat-Chrysler -7.0%

- April 3: Auto Sales Final Numbers: Down 5.7%, Two-Year Low; Don’t Worry, It’s Just a Plateau!

This morning I asked: “Are the auto manufacturers planning a big June and July? If so, why? Revisions anyone?”

This afternoon we see GM is not planning a big June or July. I suppose one could happen anyway, but then what about the guidance?

And what about GM’s comment “Pricing is more challenging”? What will that do to the value of inventories on dealer lots?