GBP/USD Elliott Wave short-term sequence from 3/01 low (1.3709) ended as a Leading Diagonal structure in Minor wave 1 at 1.4248 high in 5 waves. Down from there, the pair is correcting that cycle in Minor wave 2 pullback in 3, 7 or 11 swings before it resumes the upside. So far pair is showing 3 swings back from the peak, which we are labeling as a Zigzag correction. Where Minute wave ((a)) ended with internal distribution of 5 waves at 1.4065 low and Minute wave ((b)) bounce ended in 3 swings at 1.4199 high.

Below from there, Minute wave ((c)) remain in progress with internal distribution of another 5 waves. Where Minutte wave (i) of ((c)) ended at 1.4133, Minutte wave (ii) of ((c)) ended at 1.4181. Then Minutte wave (iii) of ((c)) ended at 1.4059 and Minutte wave (iv) of ((c)) ended at 1.4095. And below from there, Minutte wave (v) of ((c)) remain in progress which has managed to reach the 100%-123.6% ext area of ((a))-((b)) already at 1.4018-1.3975 area. And soon as far as a pivot from 3/01 low (1.3709) remains intact pair is expected to resume the upside once again. We don’t like selling the pair into a proposed pullback and expect buyers to appear again at 1.4018-1.3975 for 3 wave bounce at least.

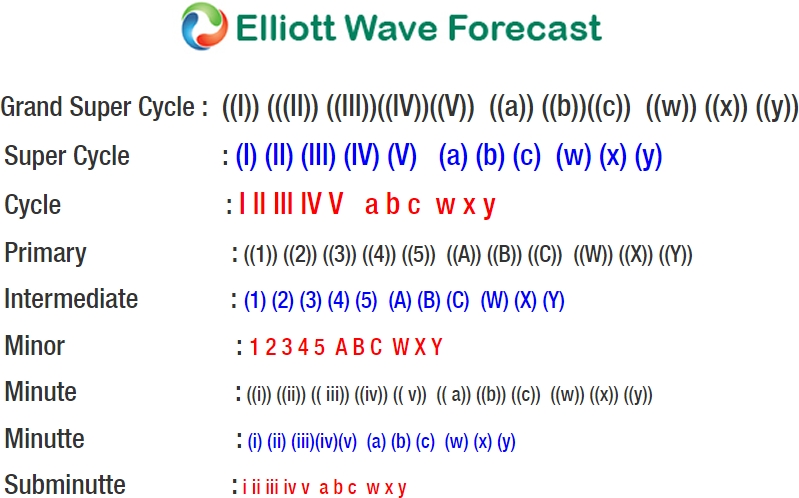

GBP/USD Elliott Wave 1 Hour Chart