The British pound has posted slight gains today. In the European session, GBP/USD is trading at 1.2257, up 0.32%.

After a relatively uneventful week for the US dollar, next week could be marked by plenty of action, with a host of key releases on both sides of the pond. The BoE and Federal Reserve are expected to deliver 50 bp hikes, and we’ll get a look at the latest inflation data from both the UK and the US.

Like the Federal Reserve, the BoE has circled inflation as public enemy number one, but Governor Bailey doesn’t have the luxury of a strong economy. With GDP in negative territory and inflation at a staggering 11.1%, the economy may already be experiencing stagflation, but Bailey can ill afford to allow inflation expectations to become more entrenched. Winter is likely a season of discontent, with railroad and other public workers threatening to go on strike as the cost-of-living crisis has hit households hard.

The Federal Reserve will keep a close eye on the US inflation report, which will be released just one day before the Fed’s policy meeting. Inflation has eased over the past several months, but the Fed has been very cautious and is still reluctant to declare that inflation has peaked. The Fed has not looked kindly on market exuberance triggered by soft inflation reports and paraded a stream of Fed members to remind investors that inflation remains unacceptably high and the fight to curb inflation remains far from over.

The markets will get a look at US inflation data later today with the release of the Producer Price Index (PPI). The index is expected to drop to 7.4%, down from 8.0%. A decline in PPI would reinforce expectations that we’ll also see a drop in CPI next week.

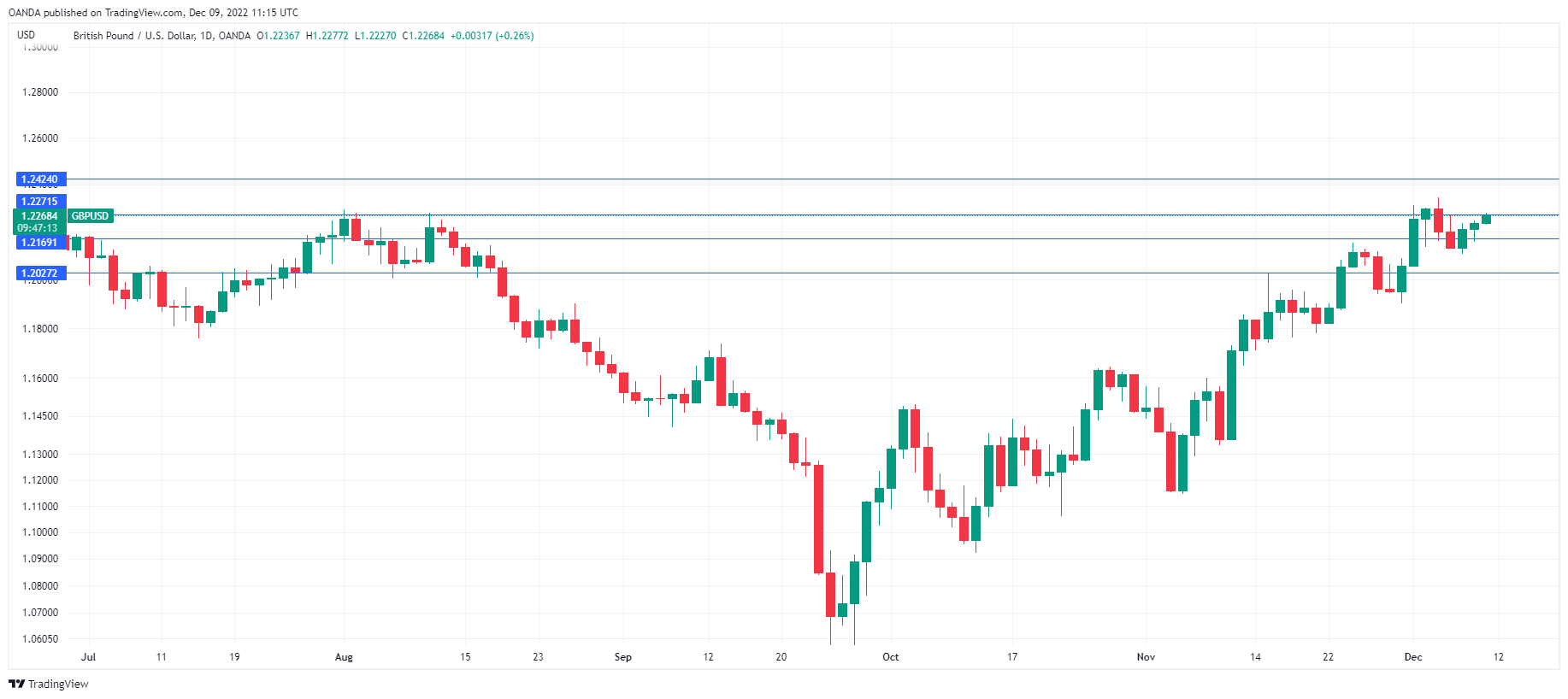

GBP/USD Technical View

- 1.2169 and 1.2027 are the next support levels

- GBP/USD is testing support at 1.2169. Below, there is support at 1.2027