- Unemployment rate fell to 4.2%, with a decrease in both short-term and long-term unemployment.

- UK wage growth slowed to its lowest level in two years, yet surpassed market expectations.

- Despite positive jobs data, BoE policymakers warn of potential inflation rebound in H2 2024, supported by a slight increase in grocery inflation.

- Cable edged higher but key resistance levels up ahead.

Cable (GBP/USD) has continued to edge higher this morning following the UK jobs report. The data was mixed with unemployment improving substantially while pay growth hit its lowest level in two years.

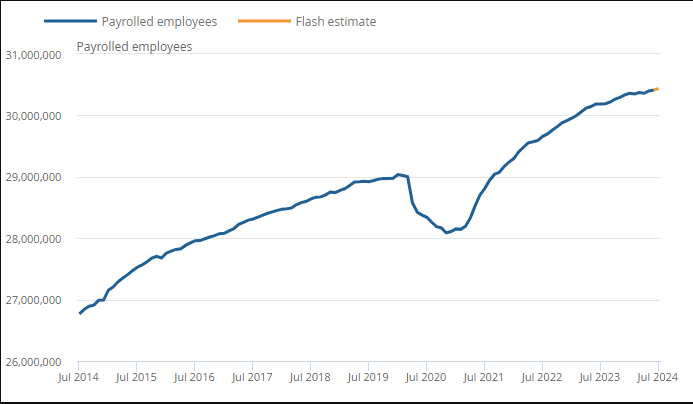

According to the Office of National Statistics (ONS), preliminary data for July 2024 shows a 0.8% increase in payrolled employees compared to July 2023, translating to an additional 252,000 workers.

The health and social work sector saw the most significant annual growth, adding 163,000 employees.

In the UK, regular pay excluding bonuses increased by 5.4% year-on-year, reaching GBP 645 per week in the three months leading up to June 2024.

This marks the smallest rise since August 2022, down from a 5.8% increase in the previous three months, yet surpassing market expectations of 4.6%.

Wage growth slowed in both the private sector (5.2% vs. 5.6%) and the public sector (6.0% vs. 6.4%). The finance and business services sector experienced the highest annual regular wage growth rates at 6.2%, followed by manufacturing at 6.0% and services at 5.5%.

When adjusted for inflation, real-term wage growth for regular pay excluding bonuses slightly decreased to 2.4% from 2.5%.

The surprise came from the unemployment rate which fell to 4.2% with estimates of a 4.5% print. The number of unemployed individuals fell by 51,000, reaching a total of 1.44 million, primarily due to declines among those unemployed for up to 6 months, bringing the figure below last year’s levels.

Furthermore, the number of people unemployed for over 6 months and up to 12 months, as well as those unemployed for over 12 months, also decreased but remained higher than last year’s estimates.

Concurrently, the number of employed individuals rose by 97,000 to 33.1 million, mainly driven by an increase in part-time employees and self-employed workers, partially offset by a reduction in full-time employees.

In the three months leading up to June 2024, the number of employed individuals in the United Kingdom rose by 97,000, marking the second consecutive period of growth following a 19,000 increase in the previous three months.

This period also saw the highest job creation rate since the three months ending in November 2023, primarily due to an uptick in part-time employees and self-employed workers.

Conversely, the number of full-time employees declined during the latest quarter.

Source: ONS

The Bank of England (BoE) Policymakers Issue Inflation Warning

Despite the generally positive jobs report, BoE Policymaker Catherine Mann reiterated her concerns about a potential rebound in inflation during the second half of 2024. This echoes the sentiments expressed by Governor Bailey at the latest BoE MPC meeting.

Both Mann and Bailey’s comments were supported this morning as industry data showed grocery inflation rising for the first time since March 2023.

According to market researcher Kanta, annual grocery inflation was 1.8% for the four weeks ending August 4, compared to 1.6% in the previous four-week period.

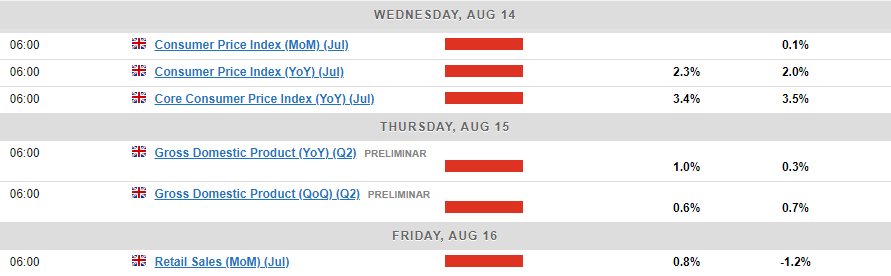

UK inflation data is expected tomorrow, and the recent rise in inflation may not yet be reflected in the figures. However, there is cause for concern.

Despite various improving metrics in the UK, such as household savings, citizens remain cautious about the outlook for the next six months.

Technical Analysis

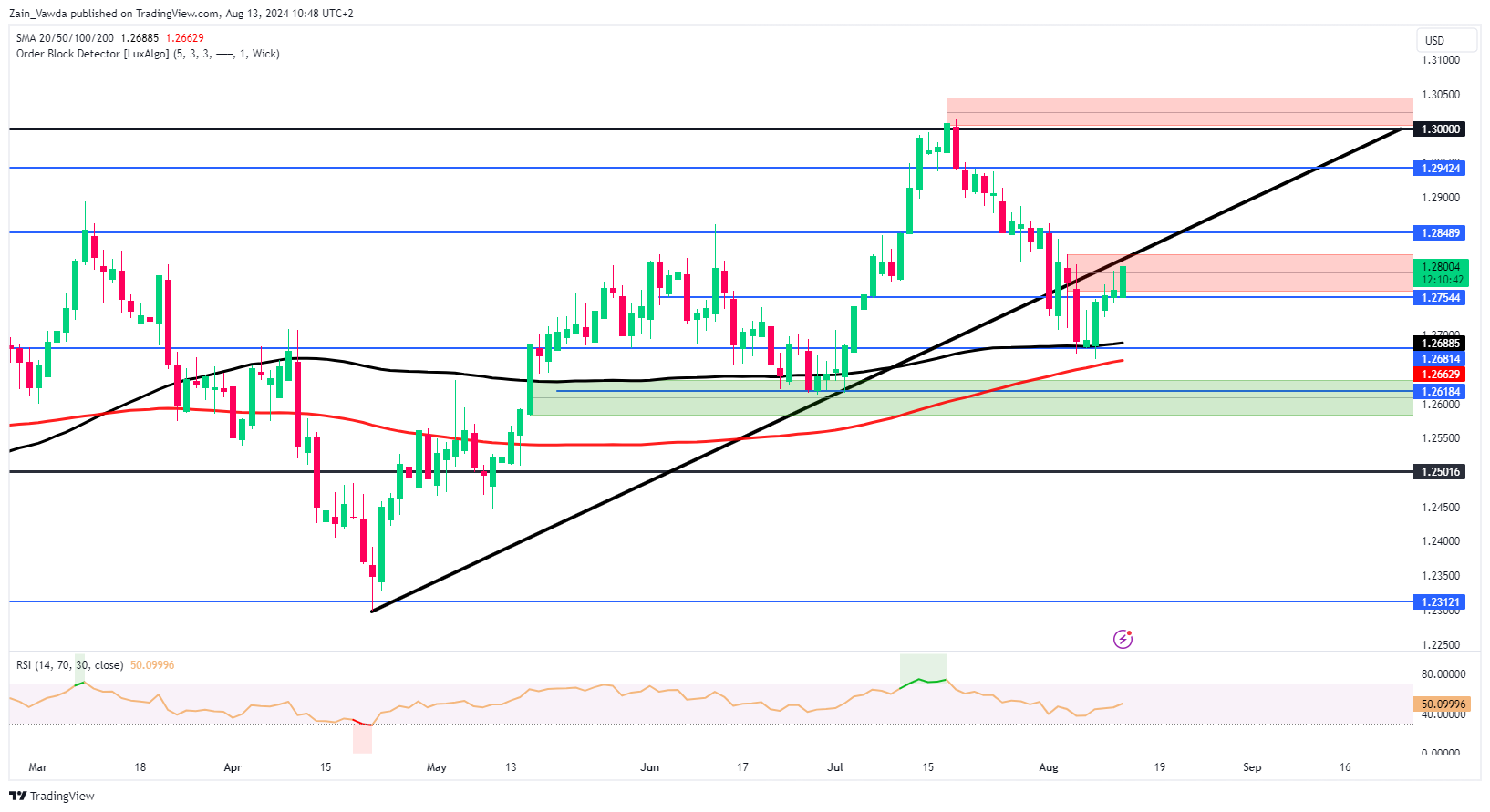

From a technical standpoint, GBP/USD has risen since last Thursday’s low of approximately 1.2665.

Observing the daily chart, the overall trend is still bullish, with a daily candle close below the 1.2618 support level required to signal a structural change.

After breaking the ascending trendline, GBP/USD is now retesting this level, where there is resistance around the 1.2800 mark.

A move upward will encounter resistance at 1.2850 and 1.2950. Conversely, any downward movement will find immediate support at 1.2750, followed by significant confluence and support around the 1.2690-1.2660 range.

GBP/USD Chart, August 13, 2024

Source: TradingView

Support

- 1.2750

- 1.2690

- 1.2600

Resistance

- 1.2850

- 1.2950

- 1.3000

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.