- UK inflation falls to 10.1%, higher than expected

- BoE likely to raise rates in May

- Three Fed members will deliver public remarks today

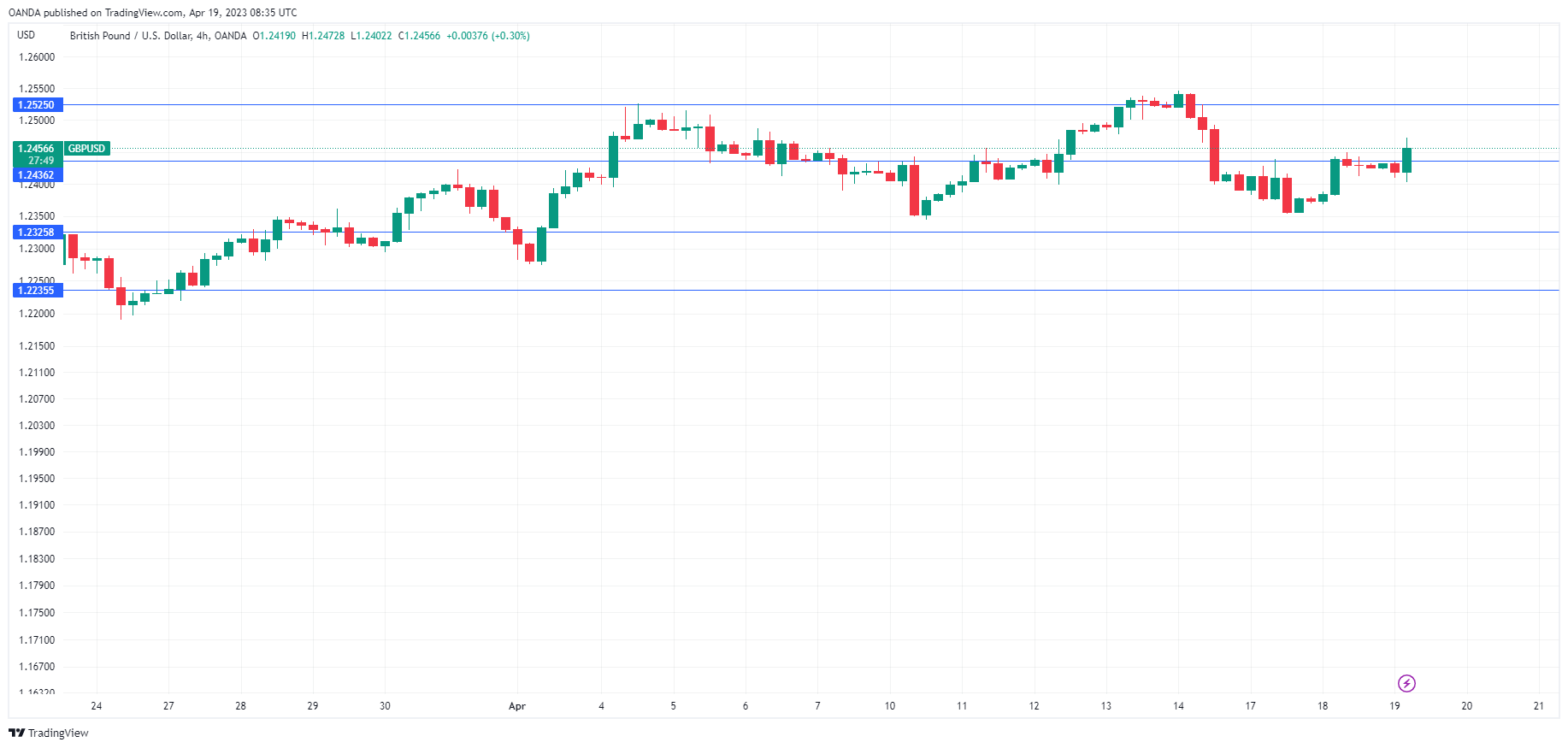

- GBP/USD is testing resistance at 1.2436. The next resistance line is 1.2526

- There is support at 1.2325 and 1.2235

GBP/USD is trading at 1.2445, up 0.16% on the day.

UK inflation stays above 10%

UK inflation remains hot and stubbornly high. In March, headline CPI dropped to 10.1%, down from 10.4% but above the consensus estimate of 9.8%. Inflation is still stuck in double digits, but the silver lining is that inflation has resumed its downswing after unexpectedly rising in February from 10.4% to 10.1%. The core rate remained unchanged at 6.2%, above the estimate of 6.0%. The usual suspects were at play in the headline release, as food and energy costs continue to drive inflationary pressures.

It hasn’t been the best of weeks for the Bank of England. The employment report showed that wage growth remains high and inflation is galloping at a double-digit pace. The BoE has raised rates to 4.25%, but the battle against inflation has been difficult, and it’s unclear if inflation has even peaked. The latest wage and inflation numbers have likely cemented another rate hike at the May meeting, but that’s not good news for a struggling economy.

GDP in February was flat, as widespread strikes and the cost-of-living crisis dampened economic activity. Consumers are struggling with higher taxes, hot inflation and rising interest rates. Inflation remains the central bank’s number one priority and a pause in rates will isn’t likely until the tight labor market, which is causing higher wage growth, cools down.

In the US, there are no tier-1 events on the calendar. Investors will be focussing on Fedspeak, with Fed members Williams, Goolsbee and Mann making public statements. Earlier this week, Williams said that he expects inflation to continue falling and to reach 3.75% by the end of this year and hit the 2% target by 2025.