- UK growth expected to rebound in August

- Fed members more dovish due to the increase in US yields

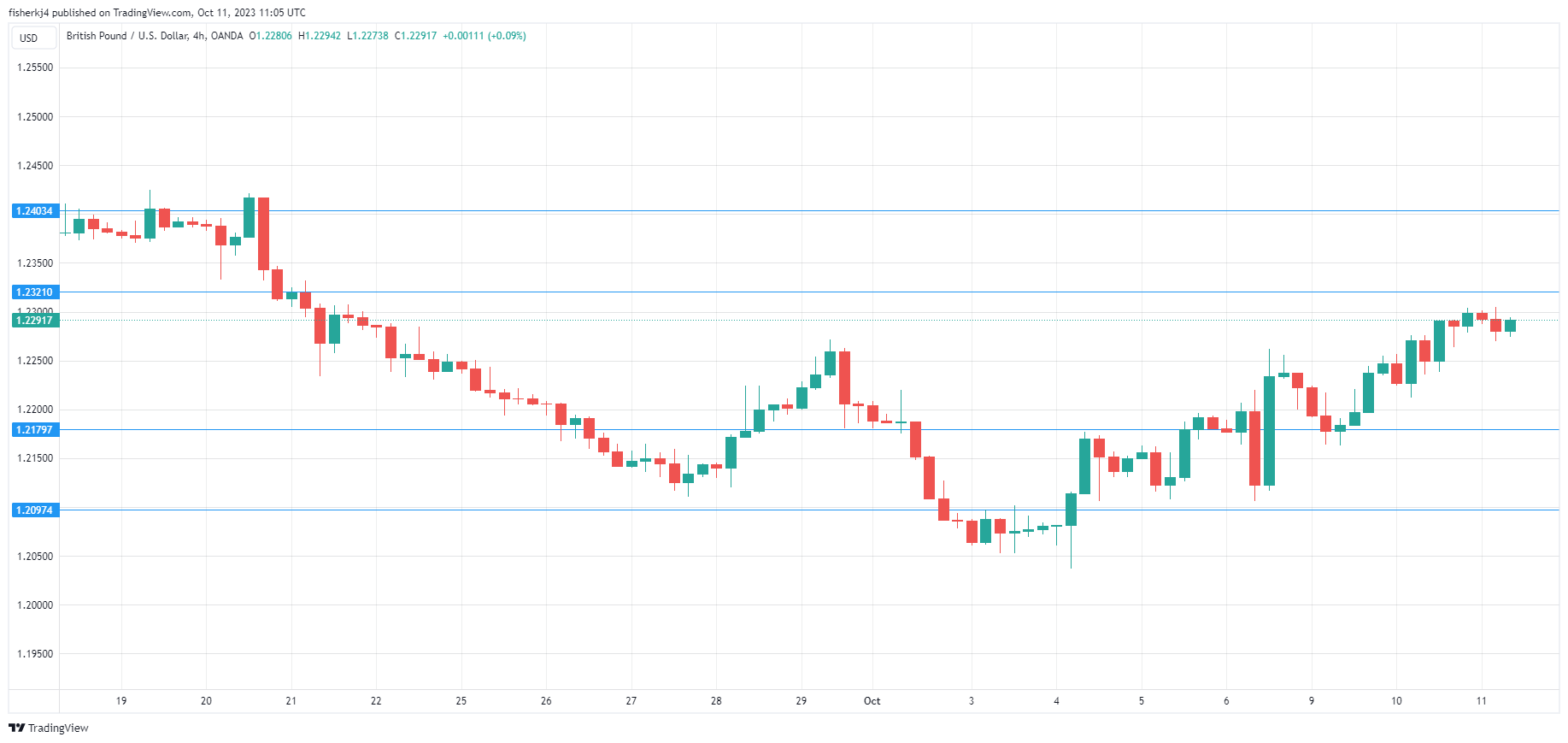

- 1.2179 and 1.2097 are providing support

- 1.2321 is a weak resistance line. Above, there is resistance at 1.2403

The British pound is calm on Wednesday. In the European session, GBP/USD is trading at 1.2297, up 0.10%.

The UK economy has been struggling and GDP declined by 0.5% m/m in July. The markets are expecting a rebound on Wednesday, with GDP projected to rise by 0.2% m/m in August. For the three months to August, GDP is expected to increase by 0.3%, up from 0.2% in the previous release.

The IMF report on Tuesday didn’t bring much cheer, with the report stating that the Bank of England would need to maintain elevated interest rates into 2024 due to weak growth and sticky inflation. The same day, the BoE’s Financial Policy Committee also said that rates would have to “stay high for a long time”, warning that would put pressure on households.

The Federal Reserve has kept to a hawkish script, trying to convince the markets that the tightening cycle may not be over. That message has changed in recent days, as the Fed has become more dovish. The reason? US Treasury yields have been rising sharply, with 10-year yields hitting a 16-year high on Tuesday. The spike in yields has made borrowing costs more expensive and could act as a brake on the economy and push inflation lower without Fed intervention.

Atlanta Fed President Raphael Bostic said on Tuesday that the Fed didn’t need to raise rates anymore in order to push inflation back to the Fed’s 2% target. Bostic is considered a dove, but he has support for this position. Dallas Fed President Lorie Logan and San Francisco Fed President Mary Daly both stated that the increase in Treasury yields could mean less need for the Fed to raise rates in the current tightening cycle.