GBP/USD Rises After Trump’s U-Turn and Ahead of US CPI

GBP/USD is rising for a third straight day as the US dollar weakened amid rank trade confusion surrounding U.S. trade policy

President Trump announced a 90-day pause on reciprocal tariffs for most countries but increased tariffs on China to 125%. The move produced a full-blown trade war that keeps risks elevated.

Universal trade tariffs also remain in place. However, risk sentiment has improved considerably, helping the pound higher. Global stock markets are also rising amid a relief rally.

The market is reassessing the outlook for UK interest rates, with Bank of England rate cut expectations being scaled back. The markets are pricing in 66 basis points of easing down from 79 basis points yesterday.

Meanwhile, UK GDP data is due tomorrow and is expected to show that the UK economy grew by 0.1% Month over Month in February after contracting -0.1 % month over month.

The USD is under pressure as the dust settles on Trump’s shock announcement, which stunned the markers. Perhaps you turn factor relief Riley into risk assets, helping the dollar briefly lift from session lows yesterday. However, selling has resumed given that a trade war with China and universal 10% tariffs could still hurt the US economy.

Attention now turns to US CPI data, which is due out later today and is expected to show that inflation is at 2.6% year on year, down from 2.8%. Core inflation is expected to ease to 3%, down from 3.1%.

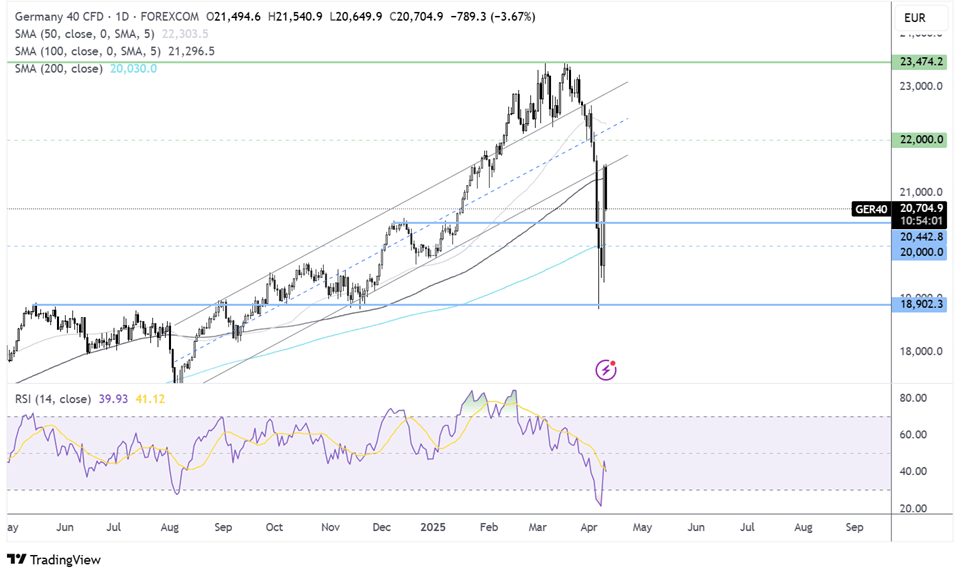

GBP/USD Forecast – Technical Analysis

GBP/USD ran into resistance at 1.32 and rebounded lower to support at 1.2725, the 50 SMA, before recovering above the 200 SMA towards 1.29. Should the recovery extend above here, 1.30 comes into focus.

Support is seen at the 200 SMA at 1.28. Below here, sellers could gain momentum towards 1.2775 and the 100 SMA at 1.2640.

DAX Rebounds as Risk Assets Recover but Gains Could Be Capped

Donald Trump's surprise 90-day pause in reciprocal tariffs has helped the market rebound. His announcement left investors shocked, marking extreme shifts in the market mood. U.S. stock indices closed 10% higher after Trump reacted to the market pain.

A sell-off in U.S. government debt appeared to be a tipping point for Trump. This was likely part of the reasons that prompted him to walk back reciprocal tariffs - you don’t mess with the bond market. However, Trump wasn’t so generous with China, instead lifting tariffs on the world’s second-largest economy to 125%.

While the relief rally is in full swing. US futures are falling as caution is expected to prevail. Tariffs on cars and steel and aluminium still exist, as do universal tariffs of 10%, Meanwhile, the China-US trade war is escalating further. These measures will still likely slow the US economy, although a recession could be avoided.

Whilst we were no longer looking at the doomsday scenario, but we were looking at yesterday. There is still much uncertainty which could see gains capped from here.

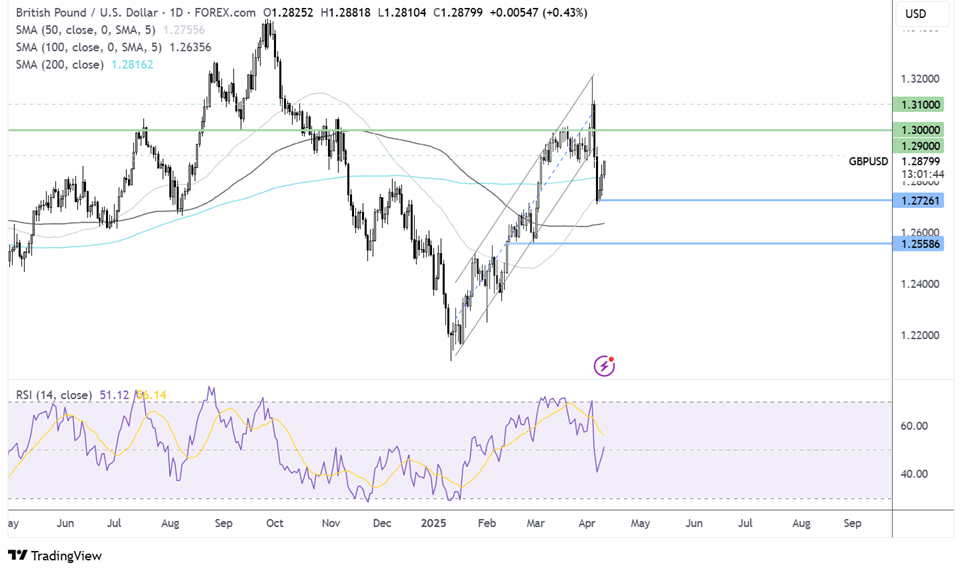

DAX Forecast – Technical Analysis

The DAX fell to a low of 18,800, the May 2024 high and November 2024 low before rebounding sharply, helped by the RSI recovering from deeply oversold conditions. The recovery saw the price rise above the 200 SMA and 20,500 to a peak of 21,500, the rising trendline resistance, negating the downtrend. The price has eased lower back below the 100 SMA at 21,300.

Buyers will look to extend the recovery towards 22,000. Support can be seen at 20,500, the round number, and the 200 SMA.