The British pound is steady on Wednesday after sharp losses a day earlier. In the European session, GBP/USD is trading at 1.2632, up 0.11%.

UK Services PMI Expected to Accelerate

UK Services PMI will be released on Thursday. The services sector, which is responsible for most of the economy’s growth, hit a rough patch late last year and posted three straight declines. The PMI managed to claw back into expansion territory in November with a reading of 50.9. The consensus for December is 52.7, which would indicate modest growth.

The UK manufacturing sector remains mired in a depression. December’s Manufacturing PMI eased to 46.2, below the consensus of 46.4 and shy of the November reading of 47.2, which was a seven-month high. Manufacturing production has now declined for ten straight months. The December decline was driven by weaker demand abroad for UK goods and less optimism from manufacturers about business conditions. The weak UK economy and high borrowing costs continue to dampen manufacturing activity.

The Federal Reserve releases the FOMC meeting of the December meeting later today. The meeting was highly significant as the Fed surprised the markets by failing to push back against rate-cut fever. The Fed signaled that it expected to trim rates three times in 2024, a major pivot from the well-worn script of ‘higher for longer’. Still, some Fed members have cautioned the markets from expecting imminent rate cuts and the timing of any rate cuts is unclear. Investors will be looking to the minutes for further details about the Fed’s surprise pivot. The markets are bubbling with confidence that the Fed will slash rates this year and have priced in six rate cuts starting in March.

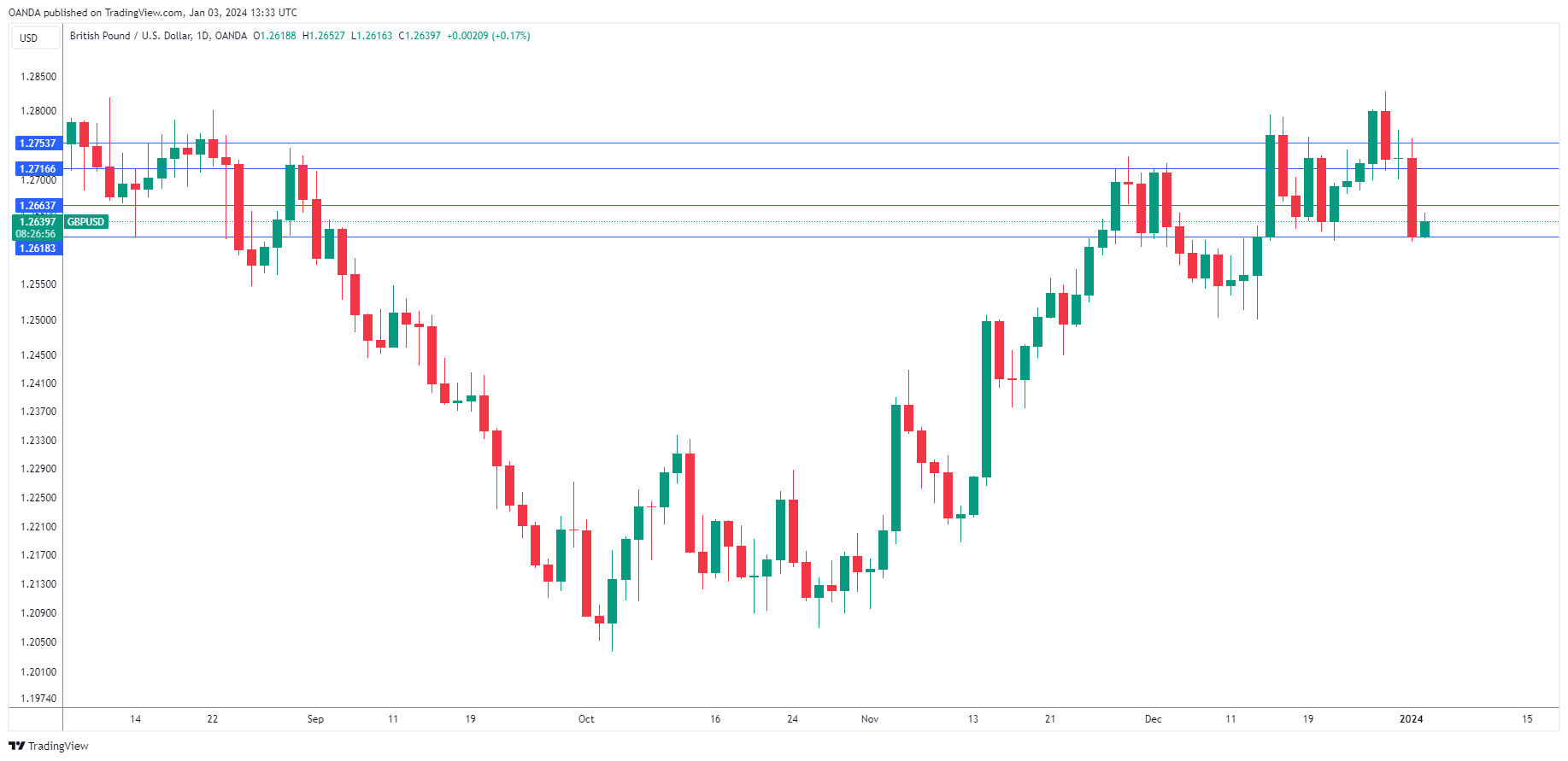

GBP/USD Technical

- There is resistance at 1.2753 and 1.2807

- GBP/USD pushed below support lines at 1.2678 and 1.2624 earlier. Below, there is support at 1.2549