- UK inflation rises unexpectedly

- GBP/USD climbs higher

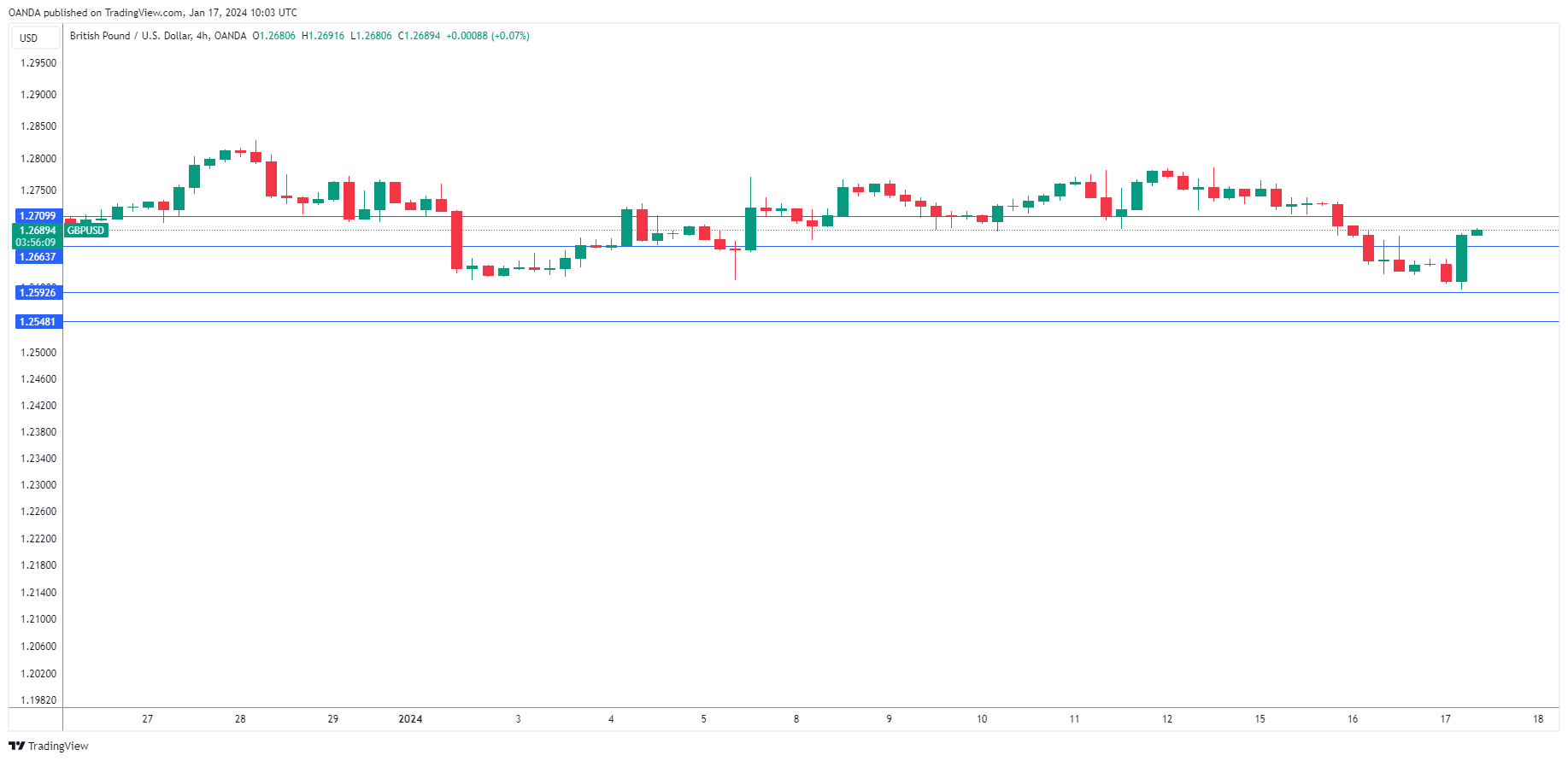

The British pound has edged higher after UK inflation rose unexpectedly in December. In the European session, GBP/USD is trading at 1.2694, up 0.47%.

UK Inflation Rises to 3.9%

UK inflation has a tendency to surprise the markets and that happened again on Wednesday as December CPI ticked upwards to 4.0% y/y, up from 3.9% in November and above the consensus estimate of 3.8%. The main driver of the upswing was higher alcohol and tobacco prices. Monthly, CPI rose 0.4%, up from -0.2% in November and higher than the consensus estimate of 0.2%.

Core CPI remained unchanged at 5.1% y/y, above the consensus estimate of 4.9%. Monthly, the core rate surged 0.6%, compared to -0.3% in November and above the consensus estimate of 0.4%.

For the Bank of England, the rise in inflation is a nasty surprise, in particular the sharp rise in monthly core CPI. Still, one disappointing inflation report will not lead to the Bank of England changing its monetary policy. Today’s release marked the first time in 10 months that inflation has increased, and the 3.9% gain in November was the lowest in almost two years.

The BoE’s steep rate-tightening cycle has slashed inflation and the BoE will be hoping that the unexpected upswing turns out to be a one-time blip. The BoE has stuck to its policy of ‘higher for longer’, maintaining rates at 5.25% for three straight months. Policymakers are hesitant to lower rates, despite the specter of a recession, as inflation remains twice as high as the BoE’s 2% target.

Interestingly, inflation rose in December in the US, France, Germany and Canada. This is a reminder that inflation doesn’t necessarily fall in a straight line, and there will be some ups and downs over a protracted period. It could also be a sign that high-interest rates have largely run their course and are having a lesser impact on reducing inflation as we get closer to the 2% target.

GBP/USD Technical

- GBP/USD is testing resistance at 1.2664, followed by resistance at 1.2709

- There is support at 1.2592 and 1.2547