- GBP/USD gains as U.S. policy uncertainty drives capital flows

- Yield spreads and volatility correlations support further upside

- Key resistance between 1.3000-1.3045 could limit gains.

- U.S. inflation looms as key indicator on U.S. economic performance

Summary

GBP/USD is pushing higher as improving European growth prospects and U.S. policy uncertainty drive capital flows toward the pound. A narrowing U.S. yield advantage, recession fears, and rising expectations for European fiscal support have all helped fuel the move. Correlation analysis suggests these factors are playing a key role, but with major U.S. inflation data about to provide a guide on U.S. economic strength, will it validate Tuesday's bullish move?

Chaos Beneficiary?

GBP/USD is not only benefitting from brighter prospects for economic growth in Europe from increased fiscal spending and a potential end to the Ukraine war, but also policy uncertainty in the United States which has sparked renewed recession fears and contributed to a noticeable underperformance across U.S. markets.

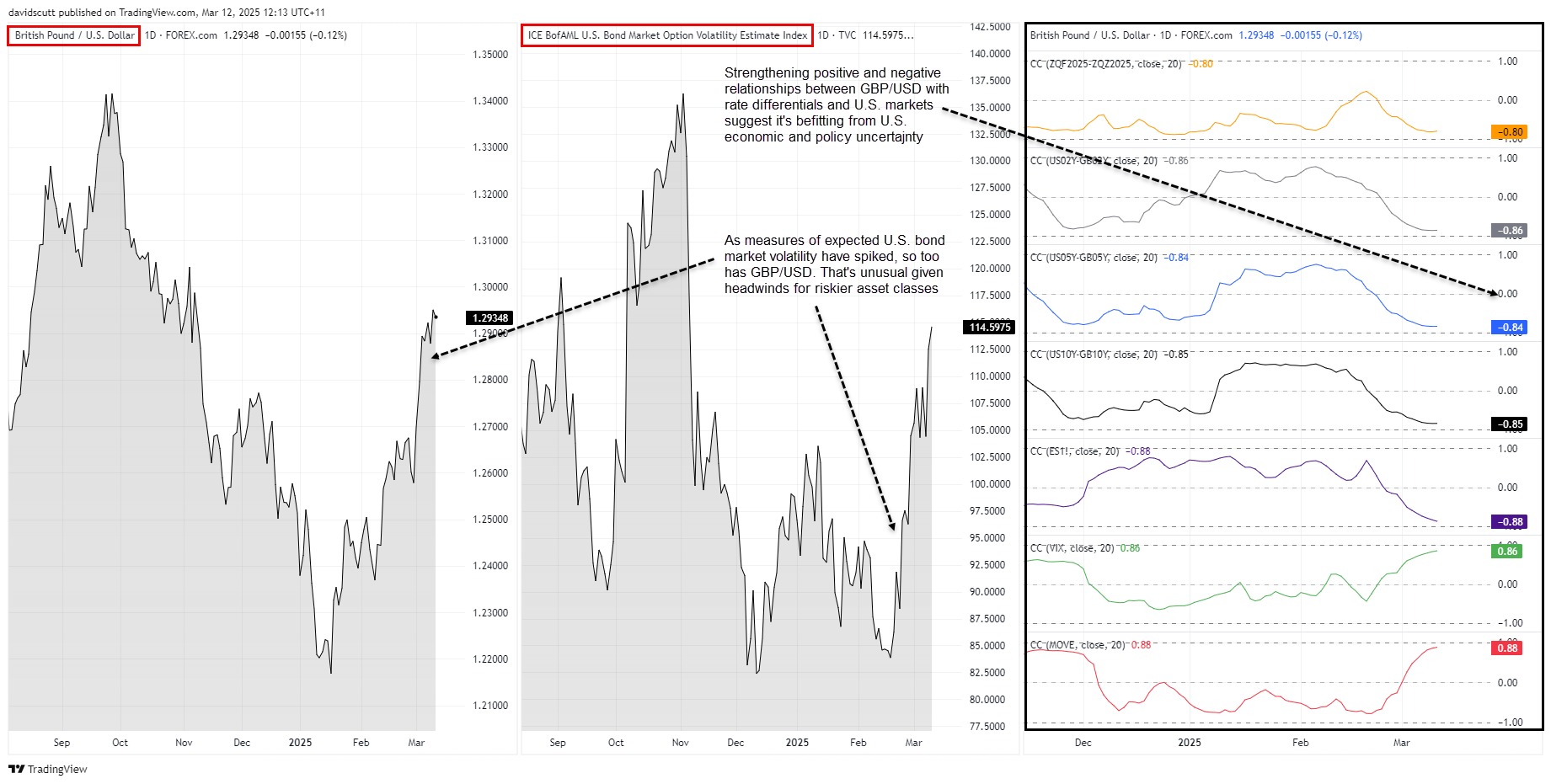

The correlation analysis below backs this up, with increasingly strong relationships between yield differentials, expected U.S. equity and bond market volatility, along with the performance of U.S. S&P 500 futures over the past month.

Source: TradingView

GBP/USD’s correlation coefficient with US 10-Year-UK 10-Year yield differentials over US 2-year-UK 2-year (grey), US 5-year-UK 5-year (blue), and 10-year tenors (black) has strengthened to between -0.84 and -0.86, suggesting that as the U.S. yield advantage has dwindled, cable has tended to push higher. Fitting with those scores, the correlation with futures pricing for Fed rate cuts in 2025 in yellow sits at -0.8.

Pointing to possible capital flows from U.S. markets to the U.K., the relationship with US S&P 500 futures (purple) has strengthened to -0.88, while that with volatility measures such as the VIX (green) and MOVE (the U.S. bond market equivalent, in red) stands at 0.86 and 0.88 respectively.

Put simply, as U.S. recession fears have surged on increased policy uncertainty, it seems to be benefitting GBP/USD. That suggests that until that uncertainty is resolved, it may prove increasingly difficult for the US dollar to find traction unless it drags the rest of the global economy into some form of downturn.

U.S. Economic Health in Focus

While much uncertainty stems from the erratic nature of U.S. trade policy since Donald Trump took office, along with measures to cut government waste through Elon Musk’s DOGE team, unless we receive an abrupt change of tack from the U.S. government, traders will have to assess the impact on the U.S. economy—and implications for markets—using increasingly volatile data releases.

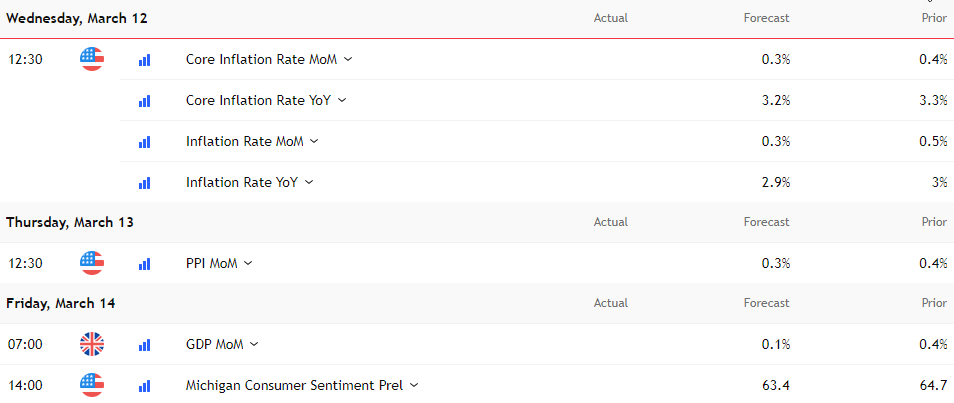

The key events remaining this week are shown below, with focus later Wednesday on the U.S. consumer price inflation report for February.

Source: TradingView

The core rate is important, but given uncertainty on how much tariffs on Chinese imports introduced early in the month will impact goods prices, it may cloud the overall signal. Instead, core services inflation excluding shelter costs may be of more importance given the links to underlying economic strength. That’s the real area of concern right now.

As such, rather than being deemed a positive for riskier assets, signs of softness may amplify economic concerns. Thursday’s PPI report will also be important given the quicker pass-through of tariffs on input prices for businesses, with other releases coming across as very secondary in nature.

GBP/USD Settles into New Range

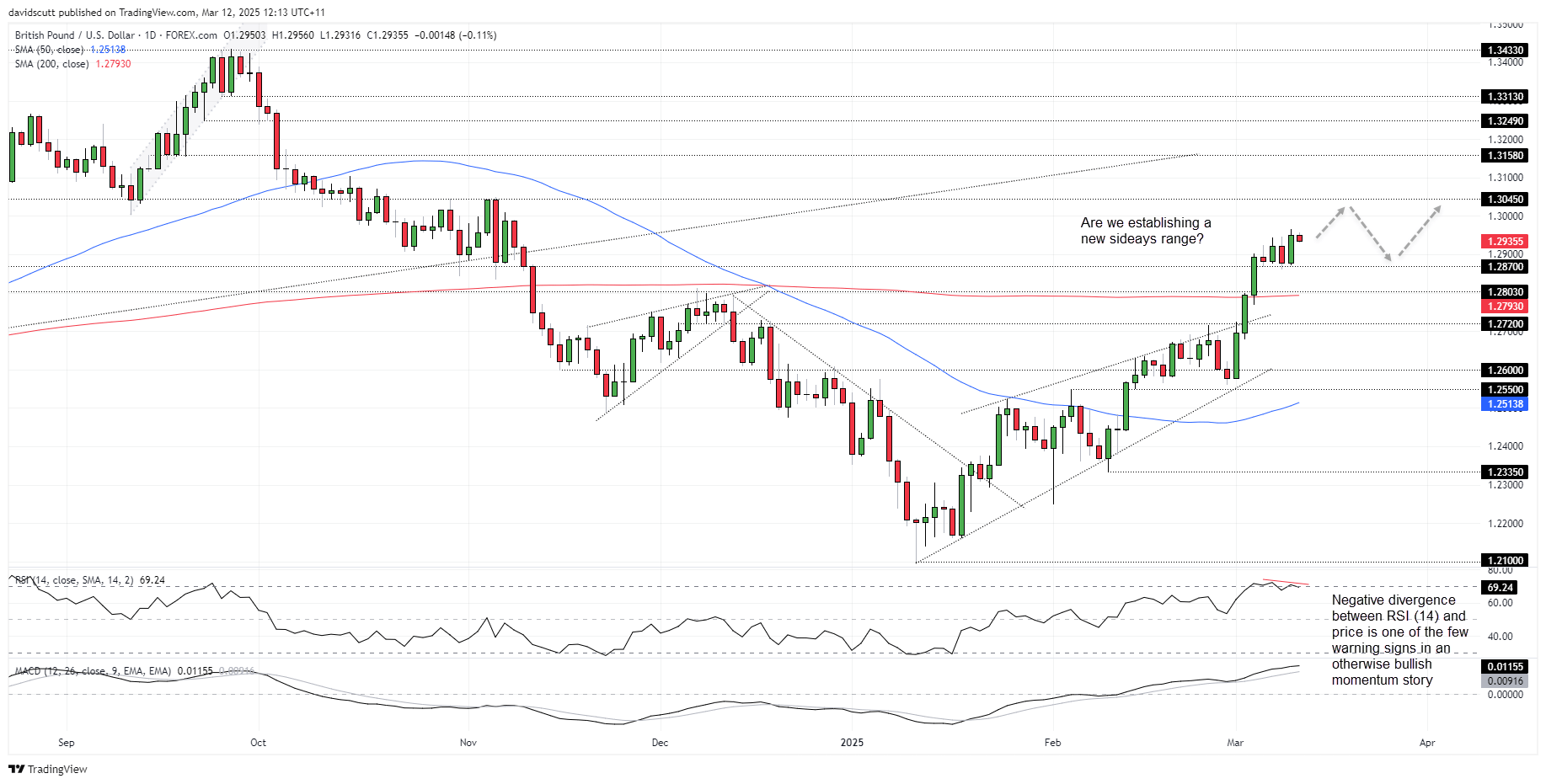

Source: TradingView

GBP/USD looks to be settling into a new sideways range following the bullish move through several key levels over the past month, including the 200-day moving average.

While the bullish price action is mirrored by momentum indicators like RSI (14) and MACD, negative divergence between RSI and price warns the signal triggered by Tuesday’s bullish engulfing candle may not be entirely trustworthy.

Support is found at 1.2870, 1.2803, the 200DMA, and 1.2720. Resistance may be encountered around Tuesday’s high of 1.2970, although a more important zone is found from 1.3000 up to 1.3045.