The US midterm elections have come and passed and with the results coming in broadly as expected (Democrats taking control of the House, Republicans retaining the Senate), we’ve seen minimal reaction in the FX market. In fact, the US Dollar Index is currently changing hands at 96.00…within a few pips of where it was when the first votes started trickling in (though there’s been a bit of volatility in both directions in the interim).

When it comes to cable, traders have already shifted their focus back to UK politics. After meeting with Cabinet ministers yesterday, PM Theresa May relayed her concerns to EU President Tusk earlier Wednesday. According to Reuters sources, the UK and EU are hoping for a breakthrough by Friday, which would allow the two parties to provide an update by Friday and still hold a summit by the end of the month. In other words, high-level negotiations are continuing as the clock approaches midnight, but it remains to be seen whether a workable agreement can be reached in time.

Back Up

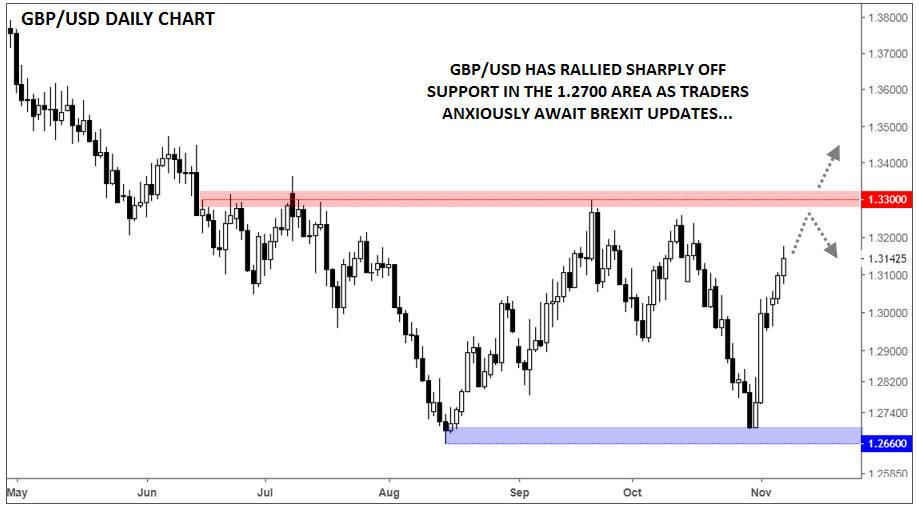

While the headlines remain mixed, traders have taken a decidedly more optimistic tone from this time last week. GBP/USD tested previous support in the 1.2660-1.2700 area midway through last week before bouncing back sharply on Thursday. The pair has built on its gains since then, rising every day this week to trade in the mid-1.3100s as of writing.

Moving forward, the 4-month resistance area around 1.3300 is likely to cap rates until/unless a Brexit deal is reached in the coming days, so bearish traders may look to consider entering short trades if rates approach that level. Meanwhile, a break through that barrier on positive Brexit news could target 1.3470 or even up toward 1.3600 in time.

Source: TradingView, FOREX.com

Cheers