- GBP/USD returns to bearish territory after rejection from 1.2500

- A move below 1.2350 could renew downside pressures

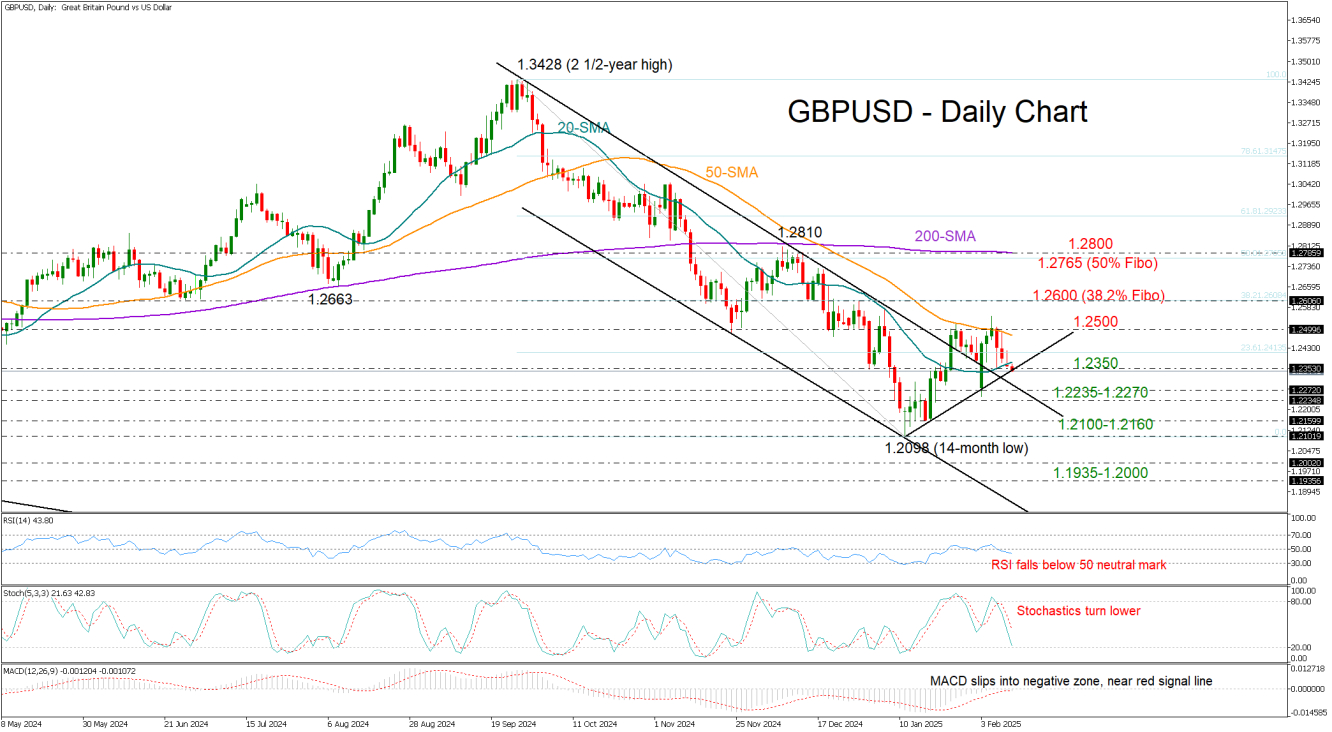

GBP/USD has taken a negative turn again after its strong bullish start to the month failed to break above the 1.2500 resistance and the 50-day simple moving average (SMA). The pair couldn't sustain levels above its 20-day SMA on Monday and is currently seeking support from a short-term trendline at 1.2350. With technical signals leaning to the bearish side, a continuation lower seems more likely as the Fed chief is heading to Capitol Hill for a two-day testimony.

Additional losses could initially pause within the 1.2235-1.2270 constraining zone. If selling interest persists, the price could challenge the bottom of its September-December downtrend at 1.2100-1.2160. Failure to pivot there could spark a decline towards the 1.2000 psychological level, with the 1.1935 territory, last seen in February-March 2023, also coming into sight.

Conversely, if the pair establishes a strong foothold near 1.2350 and climbs back above its 20-day SMA, it may stage another battle between its 50-day SMA and the 1.2500 barrier. A victory there could clear the way towards the 38.2% Fibonacci retracement of the September-December downtrend of 1.2600. A steeper rally could target the 50% Fibonacci level and the 200-day SMA within the 1.2765-1.2800 area.

In summary, GBP/USD is facing a bearish short-term outlook, with sellers waiting for a close below 1.2350 to target lower levels.