GBP/USD Key Points

- Both the UK (2.2% y/y) and US (2.9% y/y) CPI reports came in a tick below expectations

- Readers risk behind the curve by focusing on a storyline (inflation) that the market has moved on from in favor of the more relevant narrative (growth/employment)!

- Traders may view any near-term GBP/USD dips toward the 50-day EMA near 1.2800 as buying opportunities.

There’s an interesting change afoot for US data watchers: As fears about a coordinated global slowdown rise, the importance of inflation data is fading slightly as traders shift their focus more to employment and consumer data. In other words, traders believe that a re-acceleration of inflation is no longer the biggest risk to the global economy.

This morning’s data underscores that point. Both the UK (2.2% y/y) and US (2.9% y/y) CPI reports came in a tick below expectations, but the evidence of additional disinflation toward the BOE and Fed’s respective targets has not led to as big of a market reaction as it would have a few months ago.

Instead, traders may be more focused on e.g. tomorrow’s US Retail Sales report and Friday’s UK Retail Sales reports for evidence on how the consumer is doing.

As a general point, any time the market’s focus is shifting, there is opportunity for quick-thinking traders to position themselves for the next narrative – don’t be caught behind the curve focusing on a storyline (inflation) that the market has moved on from in favor of the more relevant narrative (growth/employment)!

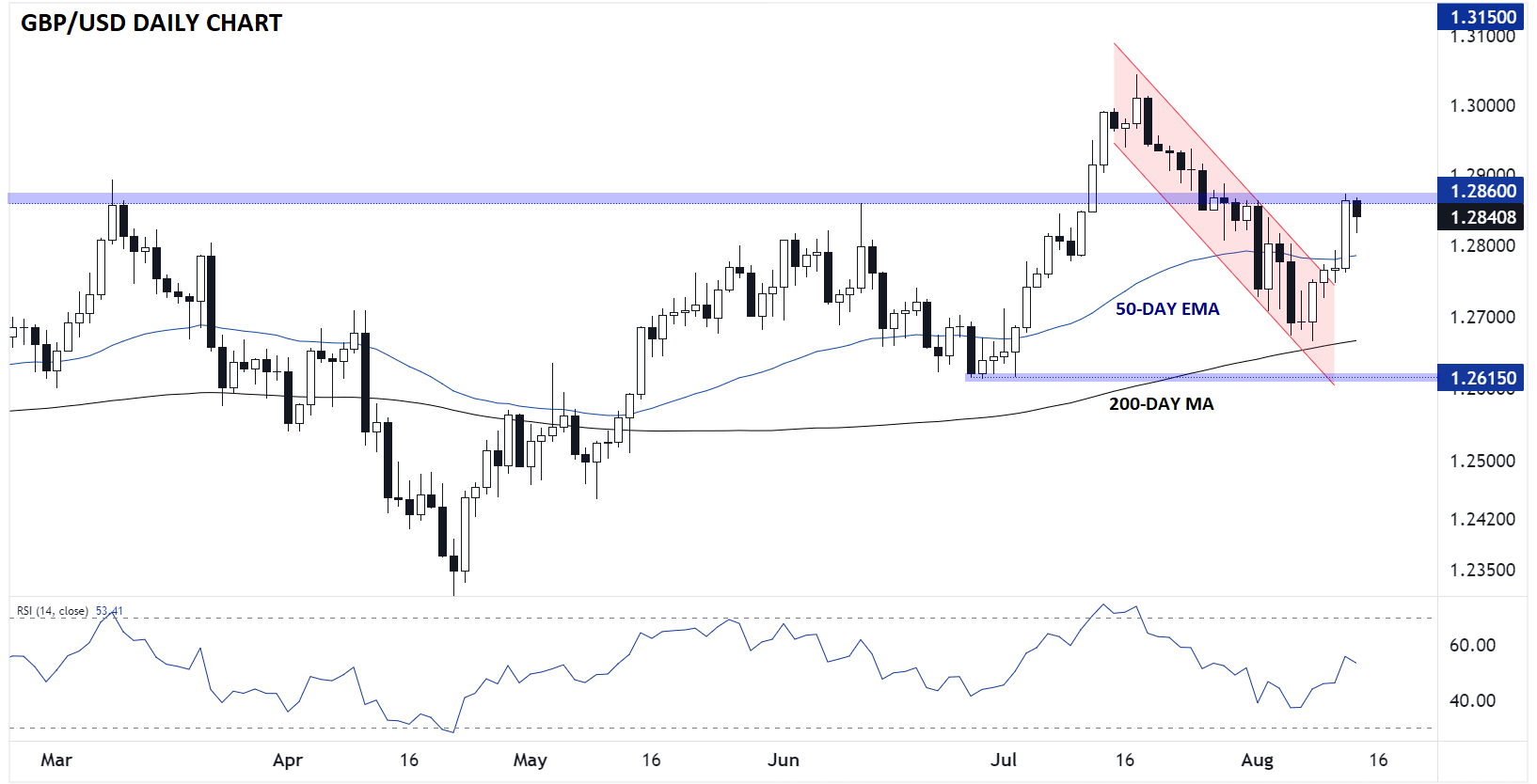

British Pound Technical Analysis – GBP/USD Daily Chart

Source: TradingView, StoneX

Looking at the daily chart, GBP/USD is testing a key resistance level near 1.2860. This level capped rallies in Cable in March and June, and as of writing, is serving as an area of selling pressure in today’s trade. From a broader view, GBP/USD remains in a long-term uptrend with the exchange rate above both the 200- and 50-day MAs, which are themselves trending higher.

Traders may therefore view any near-term dips toward the 50-day EMA near 1.2800 as buying opportunities. Ultimately, a break above the 1.2860 level could open the door for a continuation toward the 1.30 handle