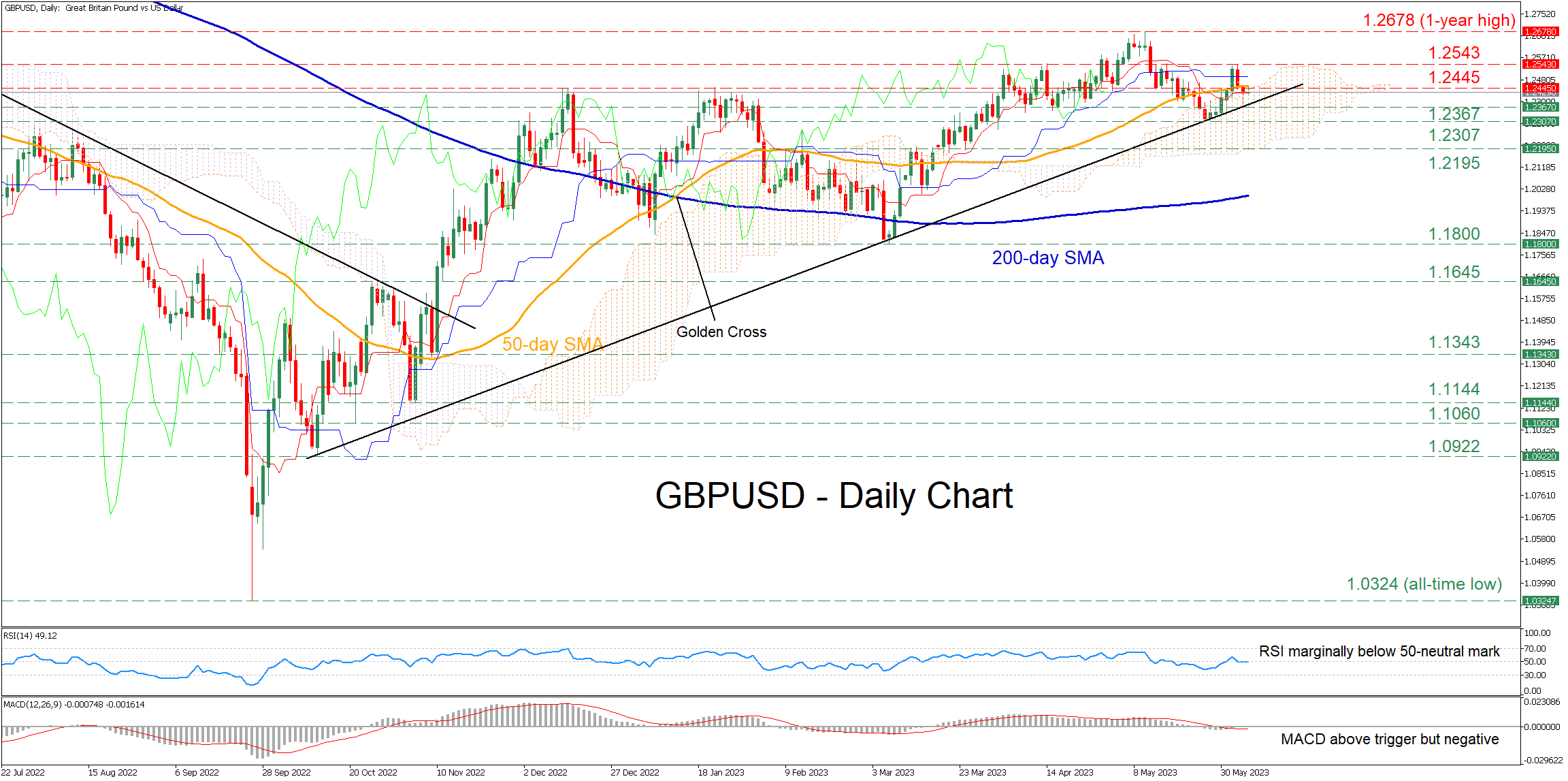

The momentum indicators currently suggest a neutral near-term bias. Specifically, the RSI is hovering around the 50-neutral mark and the MACD remains above its red signal line but in the negative territory.

Should buying pressures intensify, the bulls could initially attempt to overcome the congested technical region around 1.2445. Surpassing that zone, the price might ascend towards the recent resistance of 1.2543, which also provided upside protection in April. A violation of that region may set the stage for the one-year peak of 1.2678.

Alternatively, should the pair reverse lower to extend its short-term pullback towards the key support trendline, 1.2367 could act as the first line of defense. If that barrier fails, the May low of 1.2307 might appear on the radar. Further retreats could then cease at 1.2195, which served both as resistance and support in the past months.

In brief, GBPUSD is currently testing a very important technical region, where a failure to break above it could result in a downside breach of its long-term ascending trendline. Nevertheless, a jump above the fortified territory could enable the bulls to propel the price towards a fresh multi-month peak.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

GBP/USD Battles With Crucial Technical Level

ByXM Group

AuthorTrading Point

Published 06/06/2023, 05:03 AM

GBP/USD Battles With Crucial Technical Level

GBPUSD had been in a downside correction after peaking at the one-year high of 1.2678 on May 10. However, the pair retraced back higher when it found support at the long-term ascending trendline, while it is currently challenging a fortified zone that includes the 50-day simple moving average (SMA), the upper end of the Ichimoku cloud and a historical resistance level near 1.2445.

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.