The British Pound made some gains today despite the latest UK employment details showing lower than expected wage growth. UK claimant count unexpectedly dropped in May with the unemployment rate holding steady at 4.2%. But average earnings growth was weaker than expected at 2.5% against and expectation of 2.6%.

Attention will now turn to a key vote on the Brexit plan in the House of Commons today. MPs will vote on a series of amendments inserted into the EU Withdrawal Bill by the House of Lords. If the Prime Minister loses the votes, the UK will be required to remain a member of the EU single market and the House of Commons will also gain the power to send the Prime Minister back to negotiations if MPs are not happy with the final deal.

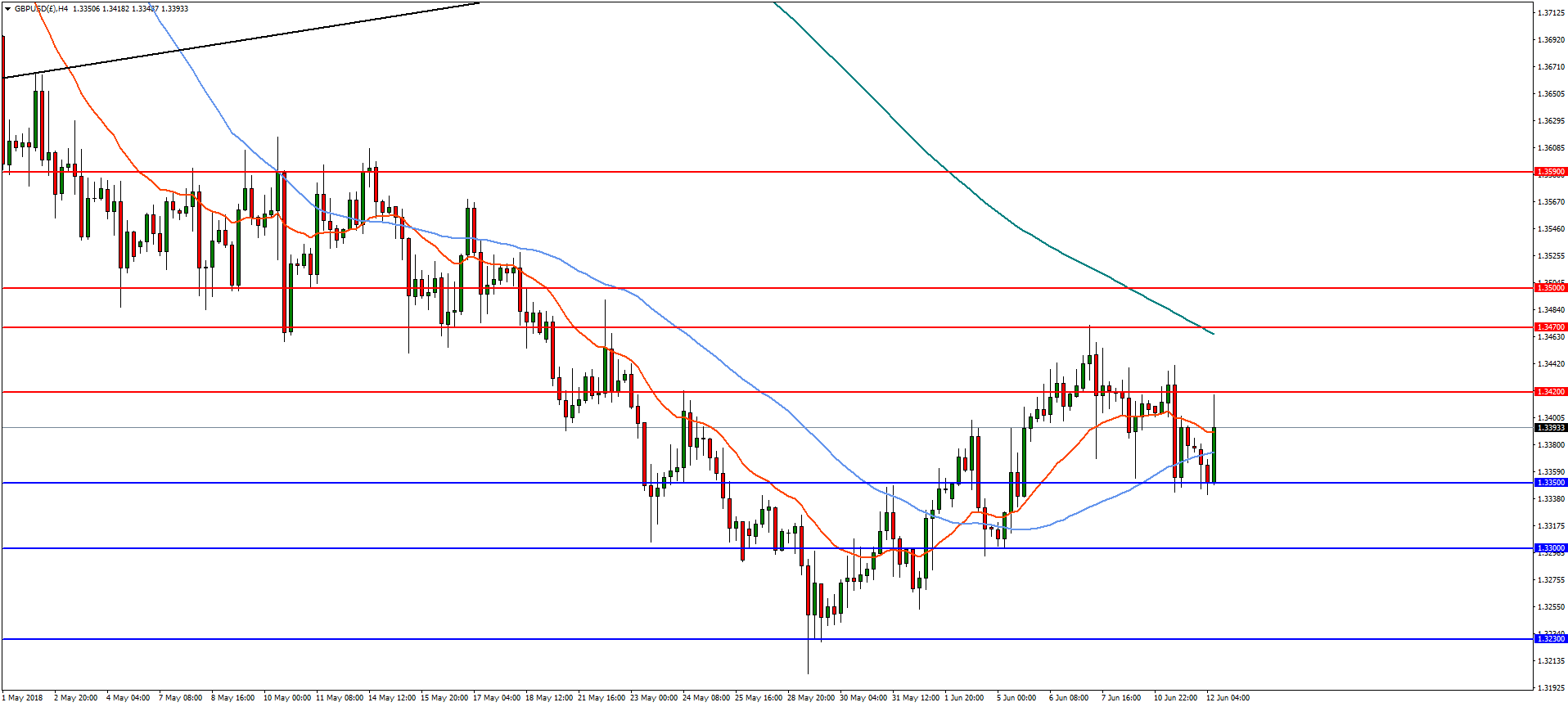

On the 4-hourly chart, GBP/USD is supported at 1.3350 ahead of the Brexit vote. An upside break of 1.3420 is needed to open the way to further bullish progress with resistance at the 23.6% retracement from the April highs at 1.3470. This is followed by resistance at the psychologically important 1.3500 and then 1.3590. However, a drop through support at 1.3350 will see the pair resume the decline towards 1.3300 and the lows at 1.3230.

GBP/JPY

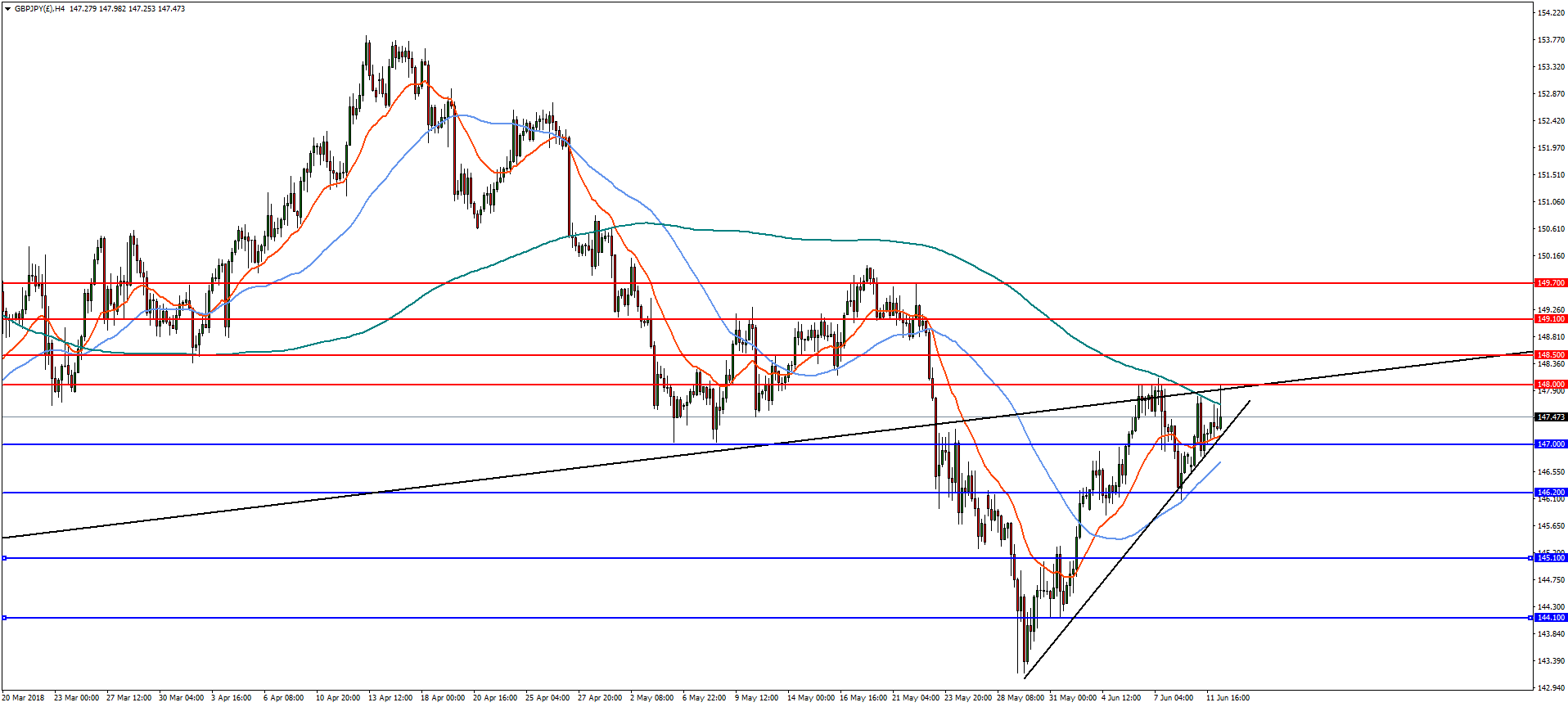

In the 4-hourly timeframe, GBP/JPY has run into resistance at the confluence of the March 2017 trend line and Fibonacci retracement at 148.00 which has capped progress for a number of days. If the pair fails to break above 148.00, a reversal below trend line and horizontal support at 147.00 is possible and this will open the way for declines towards 146.20 and then 145.10. An upside break of 148.00 is needed for a bullish move towards resistance at 148.50 and then 149.10.