The British Pound eased from post-Brexit highs this morning, after the release of wage data from the Office for National Statistics (ONS). Average earnings growth for the three months to the end of February was reported at 2.8%, less than the expectations for 3%. In further good news for the U.K economy, the ONS also reported unemployment at 4.2%, down from 4.7% last year, and the lowest reading since 1975. The employment rate rose to a record high of 75.4%, as the number of people in jobs rose by 55,000 over the period. The headline wage inflation was softer than expected and attention will now turn to the release of CPI data tomorrow, which will give an indication of real wage growth in the U.K. Although the Bank of England (BOE) may still raise rates at the May meeting, the upcoming data should indicate if more hikes are likely this year.

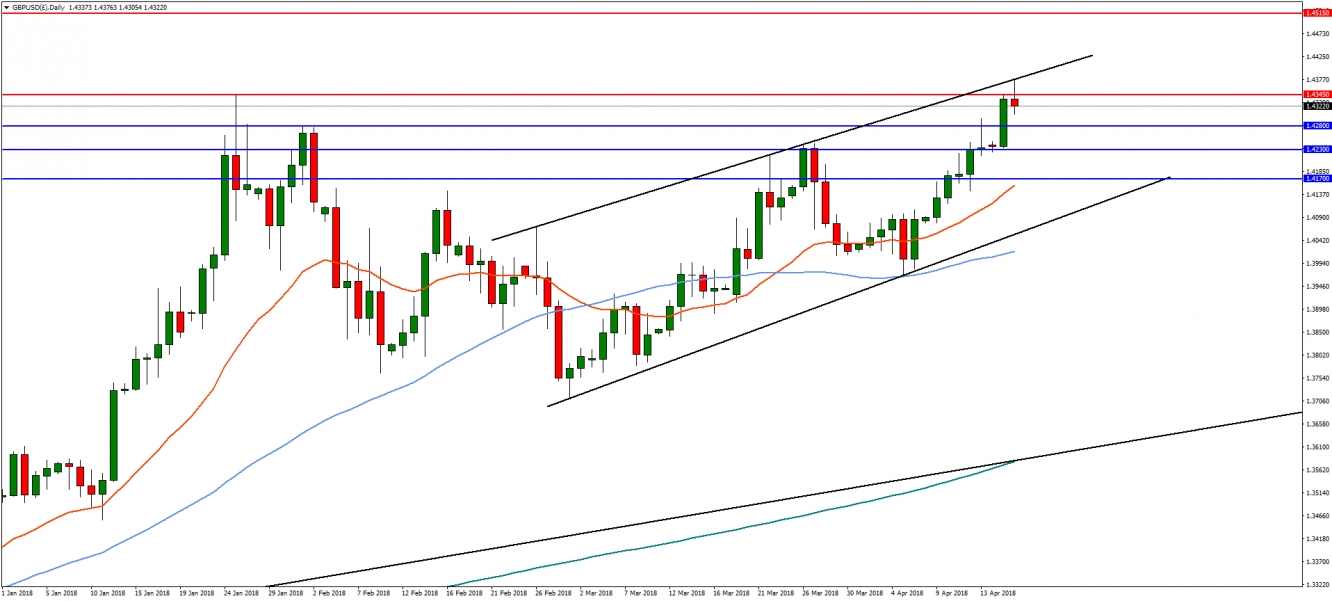

On the daily chart, GBP/USD is capped at the trend line resistance above the January high of 1.4345. A break could open the way to further upside movement towards the March 2016 high of 1.4515. A bearish reversal below near-term support at 1.4280 will see a deeper retracement to further support at 1.4230 and then 1.4170.

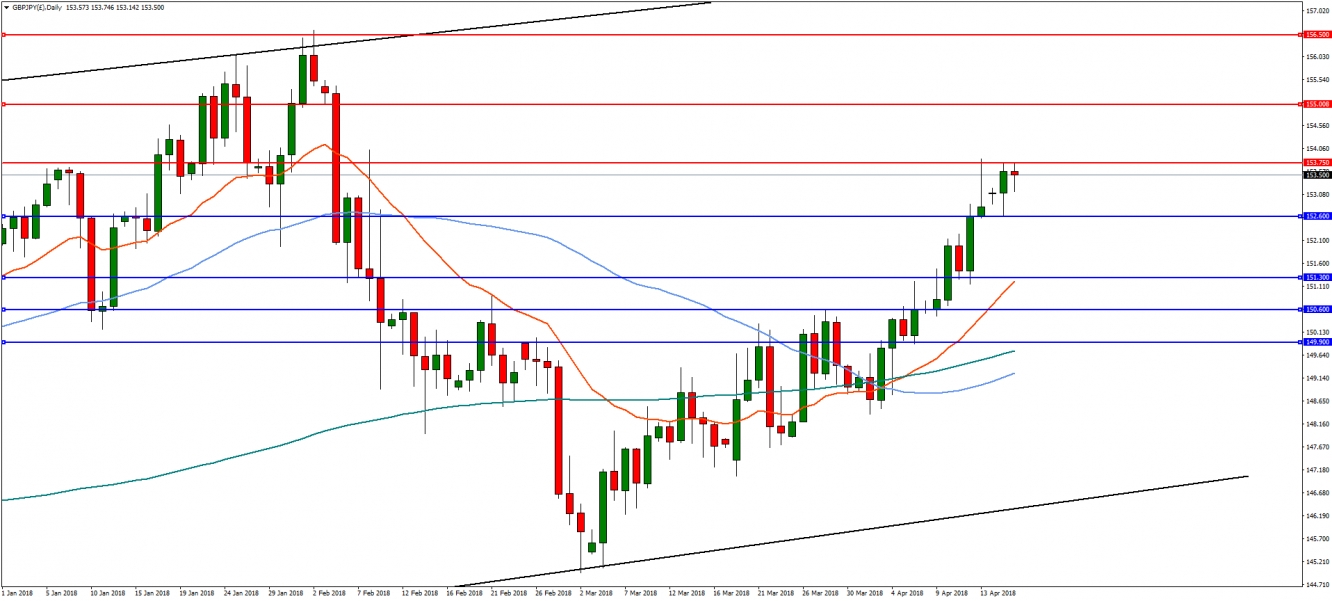

In the daily timeframe, GBP/JPY has run into strong resistance at 153.75, which has held back bullish progress for a number of days. An upside break of 153.75 is needed for a move towards resistance at 155.00 and then 156.50. However, a reversal and break of the 23.6% Fibonacci at 152.60 would open the way for further declines towards supports at 151.30 and then 150.60.