The British Pounddeclined this morning after a major survey showed that British services slowed sharply to the slowest rate since the EU referendum in June 2016. The Purchasing Managers’ Index (PMI) was reported to be worse-than-expected at 51.7, from February’s reading of 54.5. This was attributed to unusually bad weather conditions and weak consumer demand. The services sector accounts for more than 80% of UK GDP so the Bank of England may have to take this into consideration when it meets next month to discuss interest rates.

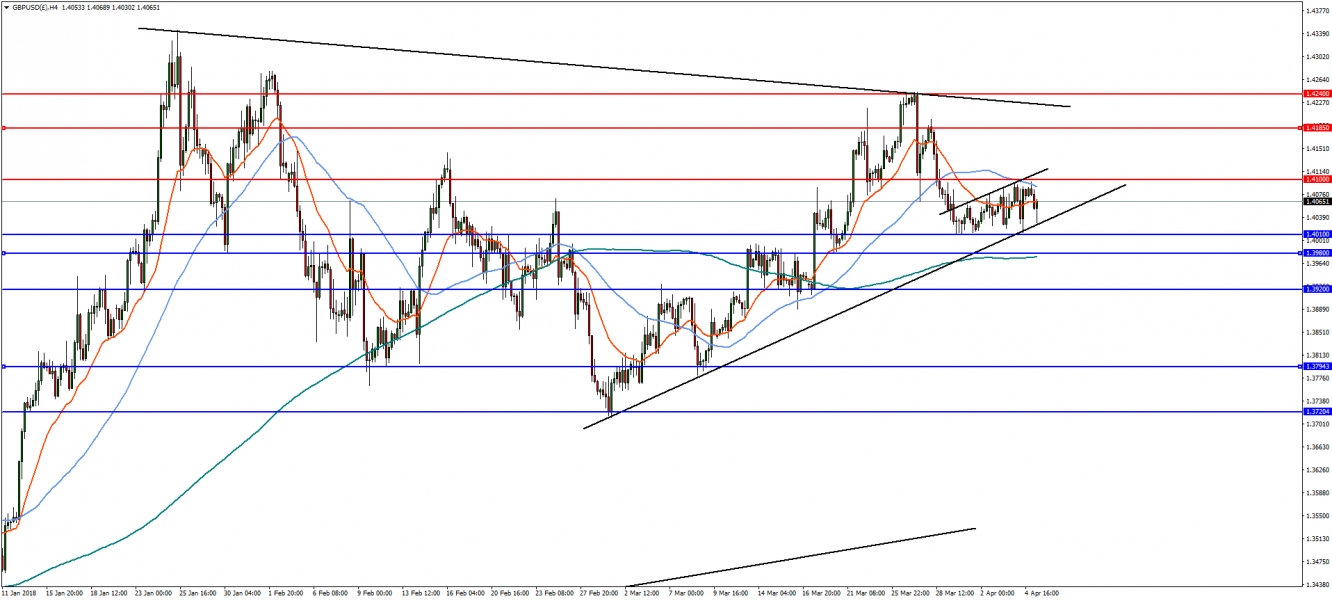

GBP/USD

On the 4-hourly chart, GBP/USD is testing the February trend line near 1.4010. If this level is broken, the pair could decline further towards support at 1.3980 and then the 61.8% retracement at 1.3920. However, a bullish reversal and break of the important 1.41 level will see upside resistance at 1.4185, before reaching for the highs at 1.4240.

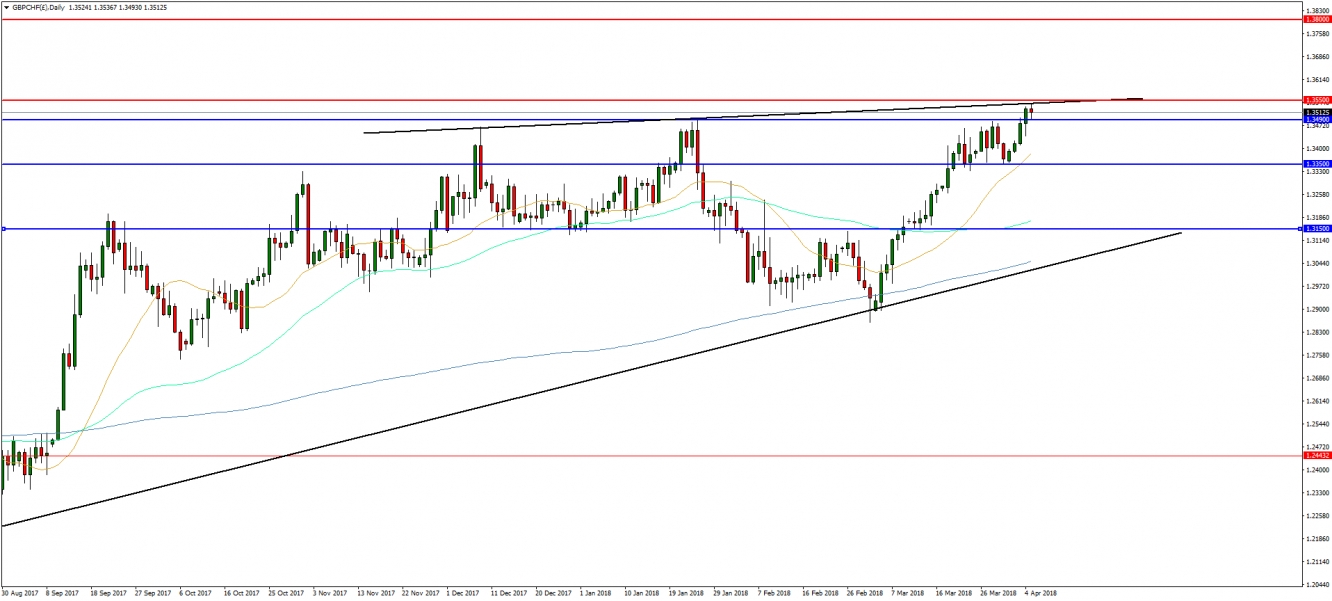

Sterling has today broken to new highs against the Swiss Franc (CHF), reaching levels not seen since the Brexit vote. The GBP/CHF pair has been rising during March despite the CHF being a traditional safe-haven currency during times of equity market turmoil.

On the daily chart, GBP/CHF broke the December highs at 1.3490, however, the pair is now facing trend line resistance at 1.3550. If this level is broken, there is thin resistance overhead, with the 1.380 handle being a possible target. On the flip-side, a reversal will find support at 1.3490 and then 1.3350 before a test of the rising support trend line near 1.3150.