The services purchasing managers’ index (PMI) this morning showed that Britain’s services sector struggled to recover in April from a sharp slowdown in March. The April services PMI was reported at 52.8 versus 51.7 in March, with an expectation of 53.5. Businesses were hurt by weaker demand from consumers due to higher than expected inflation and by corporate clients limiting spend due to the economic outlook. The disappointing services data adds to expectations that the Bank of England Monetary Policy Committee (MPC) will not hike interest rates next week.

Cable (GBP/USD) is trading above support at 1.3550, as the market awaits a key economic data from the U.S. including the ISM Non-manufacturing PMI report today and then the Non-Farm Employment Change and Average Earnings tomorrow.

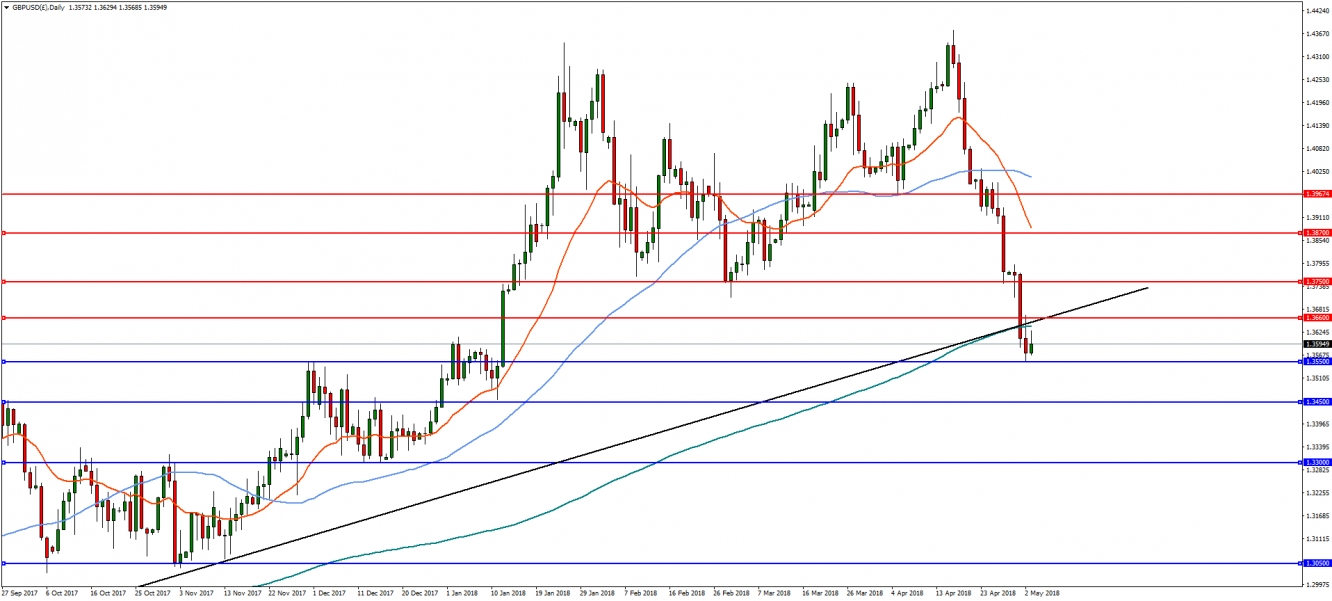

GBP/USD

On the daily chart, GBP/USD has dropped through the August support trend line at 1.3660. If the pair breaks 1.3550, a continuation of the downside move will find support at 1.3450 and then 1.3300. However, a break above 1.3660 will find resistance at the 23.6% retracement at 1.3750. A break of 1.3750 is needed for a bigger bullish move towards the 1.40 handle.

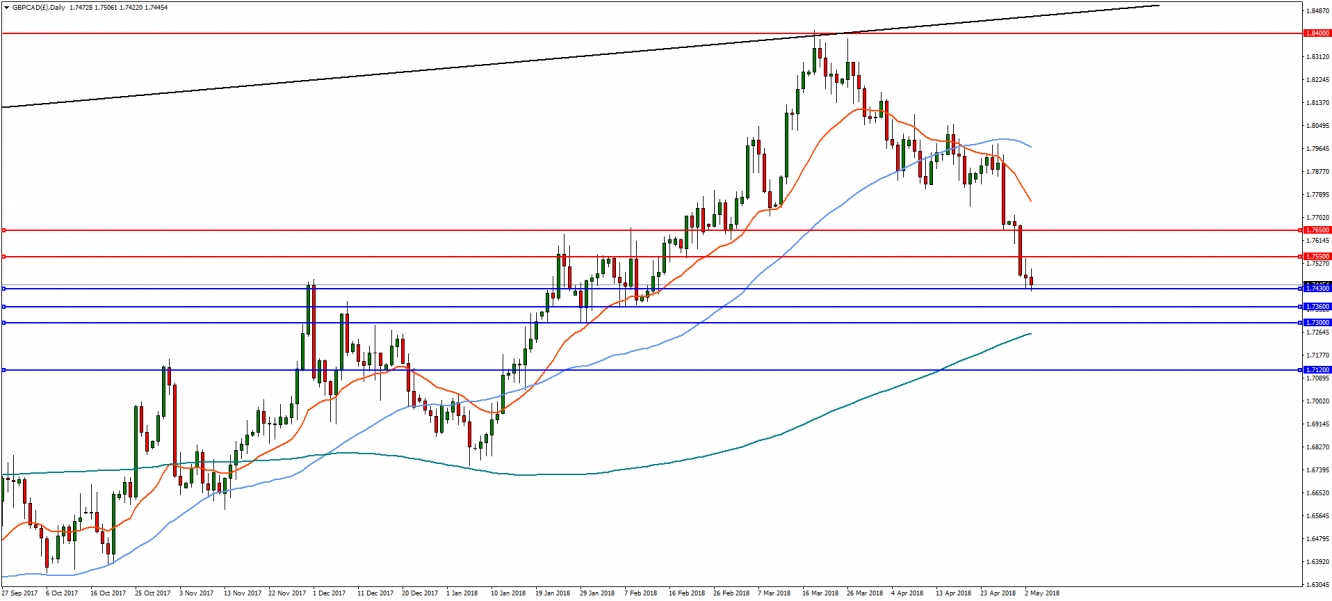

CAD has been one of the stronger currencies over the last week and with the recent weakness in the GBP, the GBP/CAD pair has seen a strong move to the downside. On the daily chart, GBP/CAD is trading at the 38.2% retracement of the move from the lows at 1.5830. A break of the support at 1.7430 could see continued downside towards the 50% retracement at 1.7120, with supports at 1.7360 and 1.7255. On the flip-side, a bullish reversal will find resistance at 1.7550 and then 1.7650.