The British Pound came down off the highs this morning after the latest economic data releases. UK’s Manufacturing Production contracted at a monthly 0.2% in February against an expectation of an expansion of 0.2%. Industrial Production expanded 0.1% versus an expectation of 0.4%. Additionally, the UK’s trade balance report was released, showing that the deficit shrunk to £10.20 billion, beating expectations. This set of mixed data caused Cable (GBP/USD) to ease off highs at the 1.42 handle. U.S. inflation figures and FOMC minutes out later today will be the catalyst for further moves.

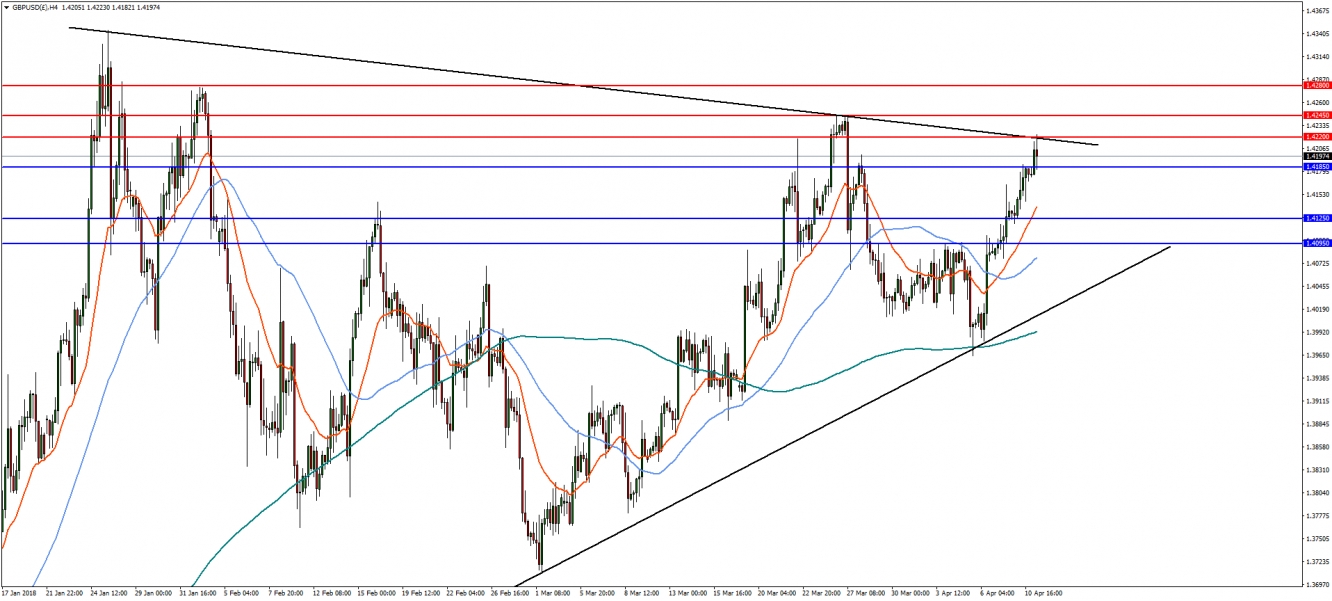

GBP/USD

On the 4-hourly chart, the GBP/USD rally is testing the January resistance trend line near 1.4220. If this level is broken, the pair could make further gains to resistance at 1.4245 and then 1.4280. However, a bearish reversal and break of 1.4185 will see downside resistance at the 38.2% retracement level of 1.4125, followed by the 50% retracement and horizontal support at 1.4095.

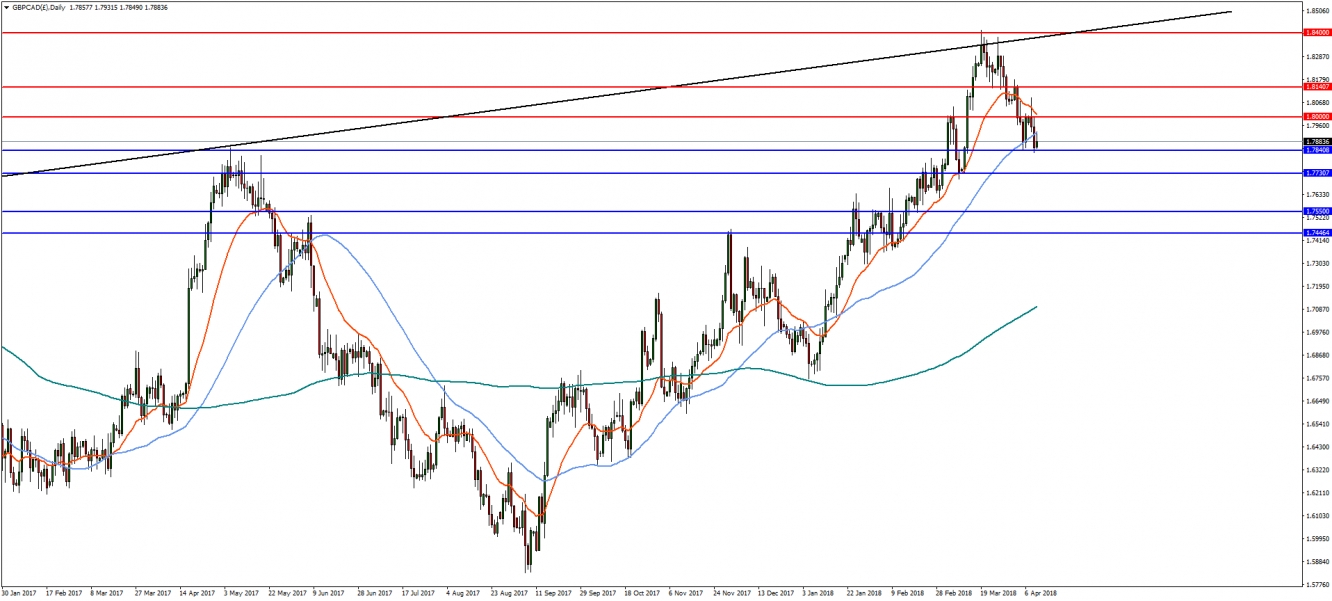

In the daily timeframe, GBP/CAD has reversed from the August 2015 resistance trend line at 1.84. The pair is now testing the 23.6% retracement and horizontal support at 1.7840. If this support holds, a break above 1.80 will likely see a continuation of the bullish trend to resistance at 1.8140 and then the highs at 1.84. On the flip-side, a break of support at 1.7840 will open the way to further declines towards 1.7730 and then 1.7550.