Roller-coaster on the USD continues. For the past few weeks, the USD was gaining strength. Then, we had a proper bullish correction and many traders thought that the good times for the USD are gone. New week, starts with the demand for the USD, again.

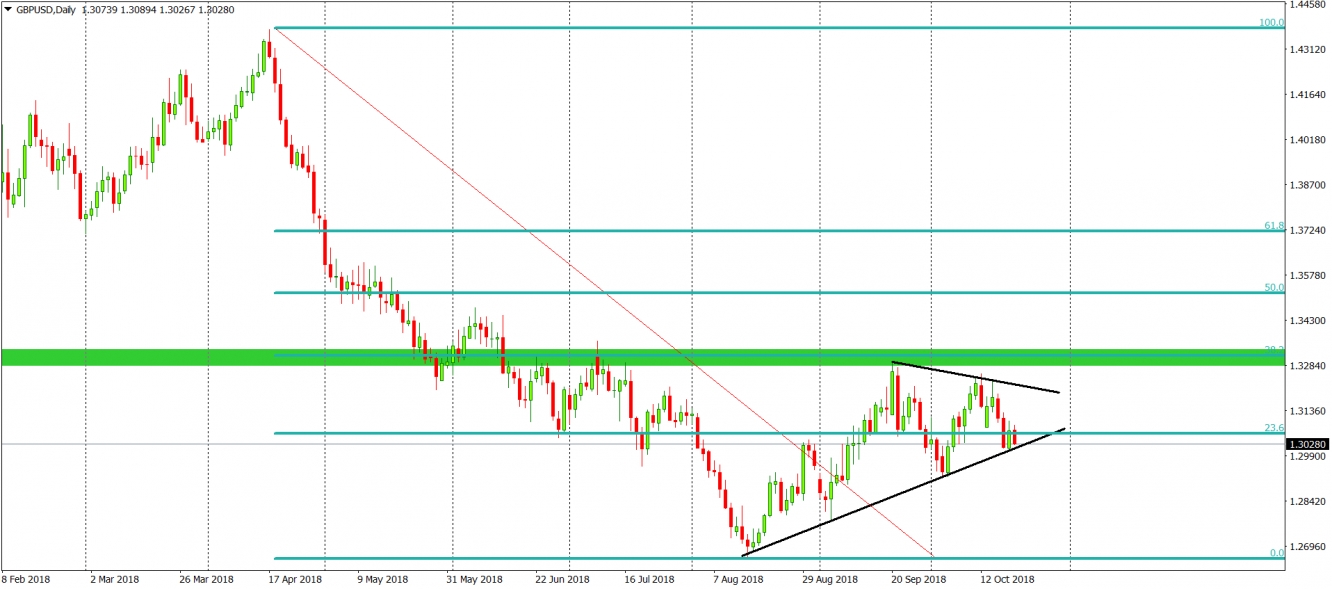

On the Cable we are very close to a major sell signal. Our negative approach comes from the fact, that the price bounced from the 38,2% Fibonacci and created the symmetric triangle pattern (black). In this case, it looks like this is a trend continuation pattern, which should result with the breakout of its lower line. Some may say that the triangle is in the same time a head and shoulders pattern and to be honest with you, we will not argue with that. The proper signal will be triggered, when the price will close a day below the lower black line. Chances for that are quite significant.

In case of the breakout, the target is on the lows from from August. That additionally gives us a great risk to reward ratio. From the practical point of view, the Stop loss can be placed above the daily highs from today, which makes the potential profit three times bigger than the potential loss.