FX Week In Review

USD

A strong week for the Dollar, but not for the reasons we expected, the market had priced in the Fed rise and good economic data, it was the ECB that pushed the Dollar higher with the EUR/USD down 1.3% down to 1.1606, leading the push in the DXY to 94.79 up by 1.3%

EUR

We have talked on the EUR, a bad week! Down on the EXY to 116.2

GBP

Mixed again for the Pound, a bit of a stuck record (apart from Cable obviously) Nothing will seem to bring it to life, Brexit and Politics keeping it in a muddle.

YEN

We mostly traded sideways this week with no real data or major developments.

The Week Ahead

Central Banks dominated last week, with the expected 25bps rise out of the Fed, but the ECB caught the markets of guard, we like a surprise in the markets as they lead to some good technical set ups.

They announced the drawdown of QE by the end of 2018 and a cut in the growth forecasts, which could have been anticipated, but the real shock was the explicit commitment not hike rates before the first half of 2109 was done, a very dovish stance and the EUR behaved accordingly.

Trump also announcing further tariffs on the Chinese, 20% on over $50bn worth of products, will escalate the trade war, with China’s response expected soon. Plus giving rise to Chinese media mocking President Trump with ‘wise men build bridges, fools build walls’ jibe.

We expect some continued volatility, as the market still digests the Fed and ECB positions, the Dollar is also back at a great technical resistance level. Data wise we have more Central Bank goodness from the UK, Switzerland.

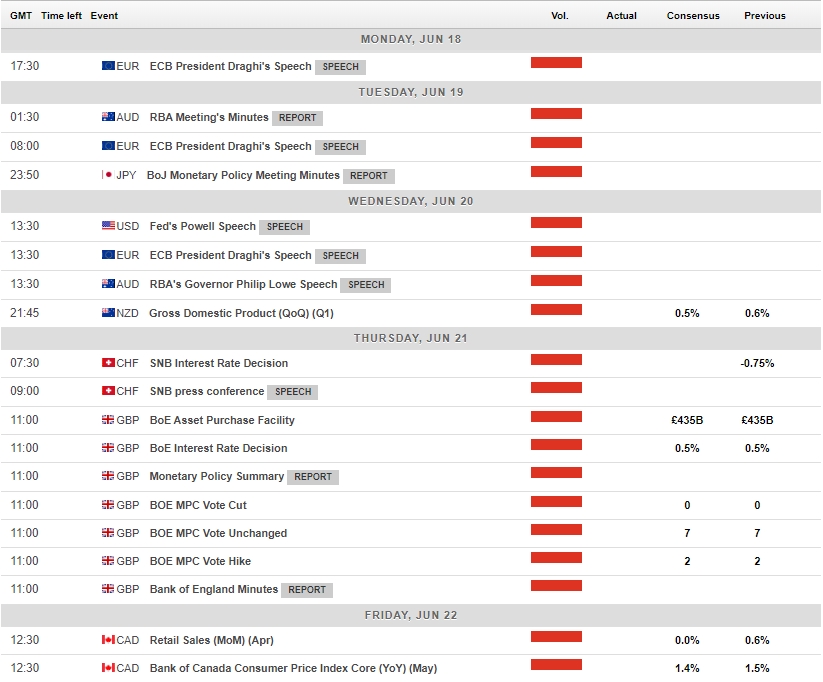

Major Data Releases

Currency Pairs to Watch

We will be interested in the USD, EUR this week. We will be looking at the ’trade of the week’ and the EUR/USD, GBP/USD, and USD/JPY.

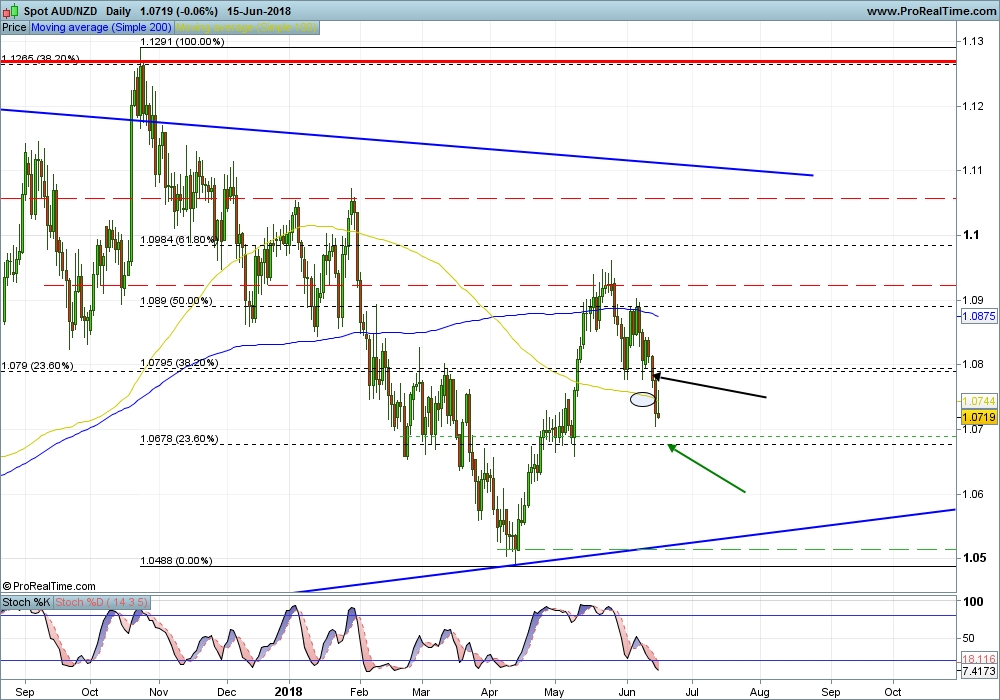

Trade of the Week

So, last week we looked at the AUD/NZD, ‘we will look for a break of 1.079, to retest the 100 day MA’ which was hit, with a low of 1.0704. On its way to the second target of 1.069:

So today we will be looking at the GBP/USD, we are being careful as the Pound is very reactionary to all the Brexit votes in the Commons. Plus, any comments from the EU or the UK government. But if we dial down the trade size and keep sensible stops, there is a good trade set up.

We see the down trend from the 17th April, we also see how structured the market is, as the fall at the end of the week respected the recent low of 1.3205. (6 pips away) The recent rise was held by the 23.6% fib and then as mentioned we had the fall.

If this does not turn into a double bottom, we may see a break of 1.3205 and we will look for 1.3079 area to be hit. As this is better support for cable to make a rally from. So, we will look this week for a break of 1.3205 with a target of 1.3100/1.3080 area.

Happy Trading!