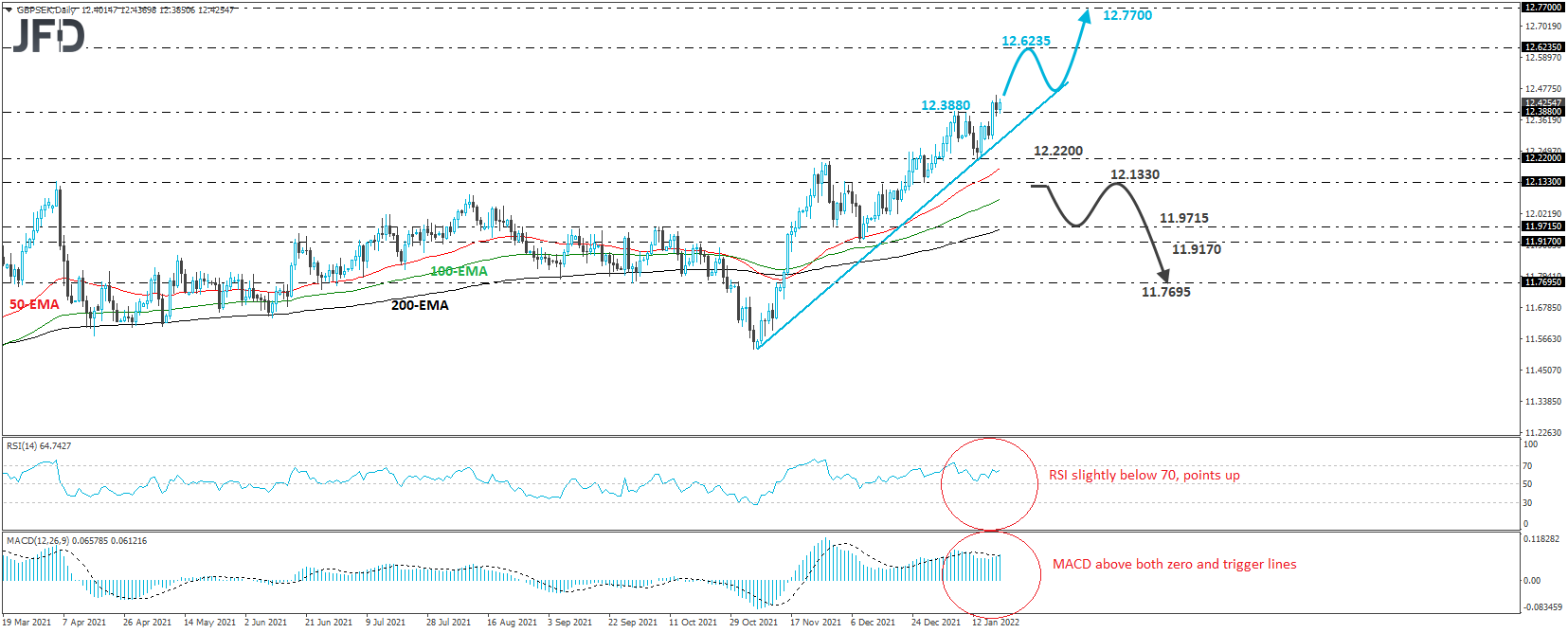

GBP/SEK traded higher on Tuesday, breaking above the 12.3880 barrier, marked by the highs of Jan. 6, 7, and 10. This confirmed a forthcoming higher high on the daily chart, which, combined with the fact that the rate is trading above the upside support line drawn from the low of Nov. 7, paints a positive near-term picture.

The break above 123880 has taken the rate into territories last seen back in April 2020, and we would expect the bulls to take in charge for a while more, perhaps until they challenge the high of Apr. 14 of that year, at 12.6235. If they are unwilling to stop there and decide to break higher, we may see them pushing towards the high of Feb. 19, 2020, at 12.7700.

Looking at our daily oscillators, we see that the RSI stands slightly below its 70 line and points up, while the MACD lies above both its zero and trigger lines. Both indicators detect strong upside speed and support the notion for further advances in this exchange rate.

To start examining the case of a potential bearish reversal, we would like to see a clear break below the 12.1330 zone, marked by the low of Dec. 28. The rate will already be below the upside support line taken from the low of Nov. 7 and may initially slide towards the 11.9715 barrier, or the 11.9170 zone, marked by the lows of Nov. 30 and Dec. 8, respectively. If the bears are willing to dive lower, then we could see extensions towards the 11.7695 zone, marked by the lows of Sept. 7 and 30.