Investing.com’s stocks of the week

There was a lot happening in early North American trade today with the release of a disappointing GDP that showed the US economy only grew 0.2% in Q1 2015. While that dismal release was widely expected by much of the financial media and despite the 1.0% consensus, the USD couldn’t muster any strength whatsoever as it fell against virtually every other currency on the planet. I say virtually every other currency because there is one in particular that doesn’t seem to be getting the memo, the NZD. Even though the Kiwi trade balance was pretty good last night, and US data has been subpar, the NZD/USD has had trouble overtaking the Triple Top near 0.7740, which could even be classified as a Quadruple Top with this morning’s rejection at that level once again.

As for why the NZD has had so much trouble finding some traction points directly toward the Reserve Bank of New Zealand’s monetary policy decision this afternoon. Once the Federal Reserve gives us their take on the current status of the US economy, the RBNZ will be making their thoughts known merely three hours later. While members of the RBNZ have been dovish heading in to the meeting, there is the possibility that they have been a little too dovish and the RBNZ’s statement will clarify the matter a bit more.

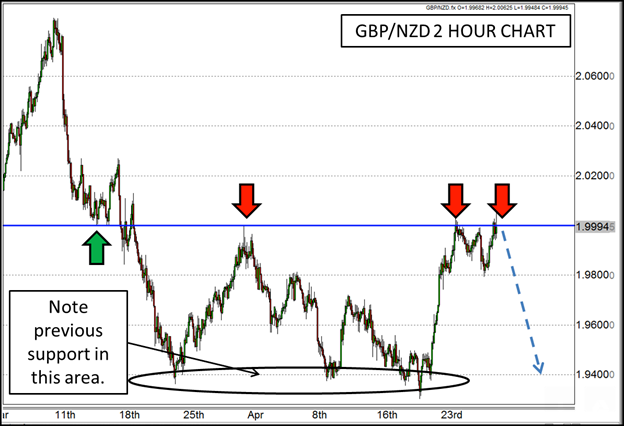

If the RBNZ isn’t as dovish as they have let on heading in to the meeting, the NZD may have some room to grow, particularly against potentially shaky currencies like the GBP. The UK has an election upcoming that could put the GBP in retreat very soon, and the GBP/NZD just happens to be in a technically intriguing area that may create resistance to any further advance. The 2.00 price level in GBP/NZD is not only a nice round number that garners attention, but it has also lived up to its hype by providing both support and resistance consistently over the last couple of months.

If you wanted to avoid the potential crazy volatility surrounding the Fed’s decision this afternoon, the RBNZ may be a potential target. While it may seem crazy to avoid one central bank by seeking out another, the RBNZ’s post-announcement reactions are much less insane than the Fed’s; and with the GBP/NZD, more logical head’s just may rule the afternoon.

Source: www.forex.com

For more intraday analysis and trade ideas, follow me on twitter (@FXexaminer ).