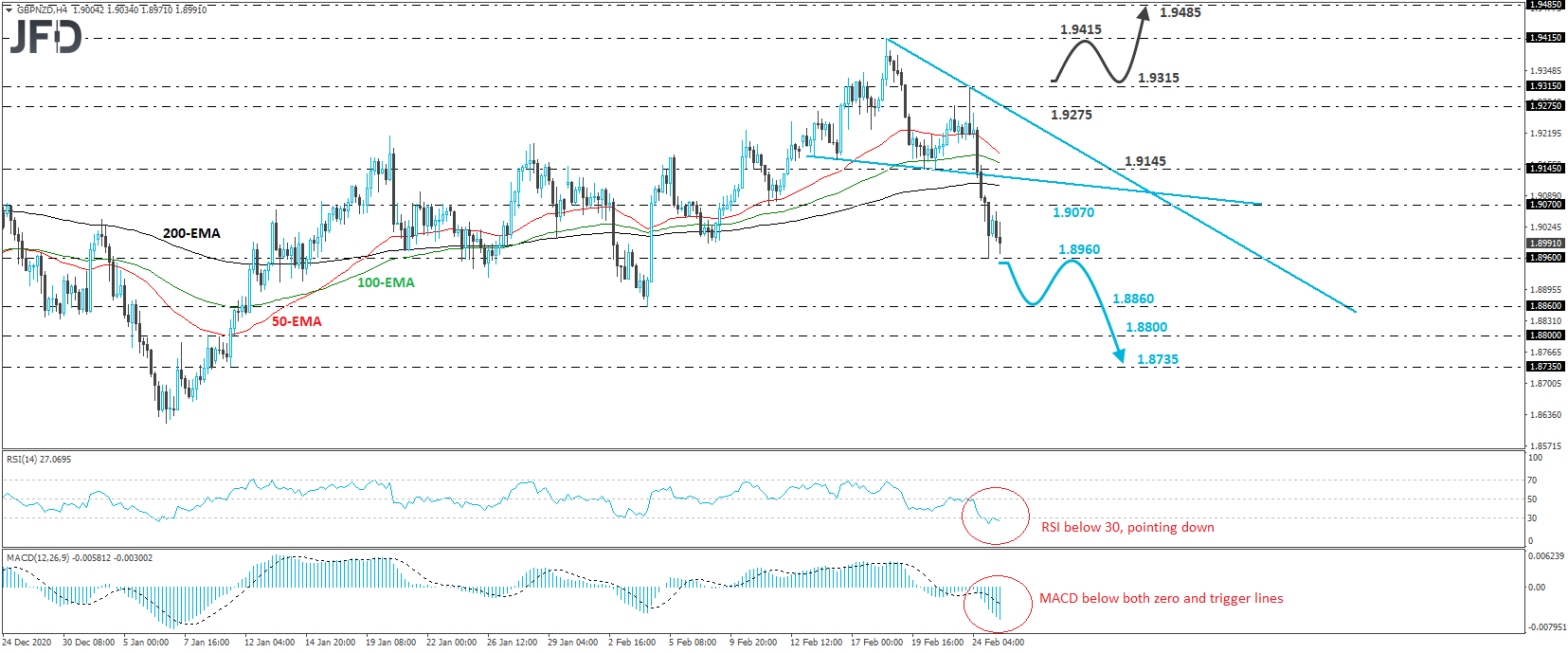

GBP/NZD tumbled on Wednesday, breaking below the neckline of a “Head and Shoulders” formation, thereby completing a short-term bearish reversal. The rate also fell below the low of Feb. 11, at 1.9070, to eventually hit support at 1.8960. In our view, the completion of the H&S pattern paints a negative near-term outlook.

A break below yesterday’s low of 1.8960 could encourage the bears to target the 1.8860 territory, defined as a support by the low of Feb. 4, the break of which may extend the slide towards the 1.8800 zone, marked by the inside swing high of Jan. 8. If that level is not able to stop the slide either, then its break may pave the way towards the low of Jan. 11, at 1.8735.

Taking a look at our short-term oscillators, we see that the RSI, already below 30, has turned down again, while the MACD lies below both its zero and trigger lines, pointing south as well. Both indicators detect strong downside speed and corroborate our view for further declines in this exchange rate.

Now, in order to abandon the bearish case and start examining whether the bulls have gained the upper hand, we would like to see a strong recovery above yesterday’s high. This would also take the rate above the tentative downside resistance line drawn from the high of Feb. 18, and may initially aim that high, which is at 1.9415. A break higher may see scope for extensions towards the peak of Nov. 10, at 1.9485.